The FCRA Defines a Consumer Report As Unlock Secrets

The FCRA defines a consumer report as any communication of information by a consumer reporting agency. This information evaluates a consumer’s creditworthiness, character, or general reputation.

The Fair Credit Reporting Act (FCRA) is a federal law that governs the collection, dissemination, and use of consumer information. It aims to ensure fairness, accuracy, and privacy of personal data. Consumer reports play a crucial role in various financial decisions, including credit, insurance, and employment.

They contain details about an individual’s credit history, public records, and other personal information. Accurate consumer reports help lenders, insurers, and employers make informed decisions. Understanding the definition and purpose of consumer reports helps consumers protect their rights and maintain good financial standing.

Credit: www.onesourcebackground.com

Introduction To The FCRA and Consumer Reports

The Fair Credit Reporting Act (FCRA) is a crucial law in the United States. It helps protect consumer information. Understanding the FCRA is essential for both businesses and consumers. It ensures accuracy and privacy in credit reporting.

Initial Glimpse Into The Fcra

The FCRA was enacted in 1970. Its main goal is to ensure fairness in reporting. It sets guidelines for collecting and using consumer information. The FCRA affects various entities, including credit bureaus and data furnishers.

Consumers have rights under the FCRA. They can access their credit reports. They can dispute incorrect information. They can also know who has accessed their report.

What Qualifies As A Consumer Report?

A consumer report is any information about a person’s creditworthiness. It includes their credit standing, credit capacity, character, and reputation. The report can also cover personal characteristics and lifestyle.

These reports are used for various purposes. They help in making decisions about credit, employment, insurance, and renting. They contain detailed and sensitive information about individuals.

Type of Information | Details |

|---|---|

Creditworthiness | Credit scores, payment history |

Credit Standing | Current debts, credit limits |

Character | Employment history, criminal records |

Personal Characteristics | Age, marital status |

Consumer reports are vital for making informed decisions. They must be accurate and up-to-date. The FCRA ensures that these reports are reliable and secure.

Types Of Consumer Reports Under The Fcra

The Fair Credit Reporting Act (FCRA) defines various types of consumer reports. These reports help businesses and employers make informed decisions. Each type of report serves a specific purpose.

Credit Reports And Scores

Credit reports contain detailed information about a consumer’s credit history. They include data on loans, credit cards, and payment histories. Lenders use this information to assess creditworthiness.

Credit scores are numerical representations of a consumer’s credit risk. Scores range from 300 to 850. Higher scores indicate better creditworthiness. Various factors impact your credit score:

Payment history

Credit utilization

Length of credit history

Types of credit accounts

Recent credit inquiries

Credit reports and scores are crucial for loan approvals. They affect interest rates and credit limits.

Background Checks And Employment History

Background checks provide comprehensive information about a person’s history. Employers often use them during the hiring process. These checks include:

Criminal records

Employment history

Educational qualifications

Credit history

Driving records

Employment history checks verify past job titles and durations. They confirm the accuracy of resumes and job applications. This process ensures trustworthy hiring practices.

Background checks help maintain a safe workplace. They protect both employers and employees.

Legal Protections For Consumers

The Fair Credit Reporting Act (FCRA) provides various legal protections for consumers. These protections help to ensure the accuracy, fairness, and privacy of information in consumer reports. Let’s explore your rights and limitations under this act.

Rights To Access And Dispute Information

The FCRA grants you the right to access your credit report. You can request a free copy of your report from each major credit bureau annually. This allows you to check for any errors or inaccuracies.

If you find any mistakes, you have the right to dispute them. You can contact the credit bureau and the company that provided the information. They must investigate your claim within 30 days.

Here is how you can dispute errors:

Contact the credit bureau with a written dispute.

Provide copies of documents that support your claim.

Wait for the bureau to investigate and respond.

Limits On Who Can Access Your Report

Not everyone can access your credit report. The FCRA places strict limits on access. Only those with a valid reason can view your report.

Here are some examples of who can access your report:

Creditors considering your credit application.

Landlords evaluating your rental application.

Employers with your written consent.

- Insurance companies assess

your risk.

These restrictions help to protect your privacy and ensure that your information is not misused.

Credit: www.consumerfinance.gov

Impact Of Consumer Reports On Individuals

Consumer reports play a vital role in many aspects of our lives. These reports affect our financial decisions, job opportunities, and even where we live. Understanding the impact of consumer reports is crucial for every individual.

Influence On Credit And Loans

Consumer reports significantly impact credit and loan applications. Lenders use these reports to assess creditworthiness. A high score can result in better interest rates. Conversely, a low score may lead to loan denials or higher interest rates.

Credit Card Approvals: Issuers check your report before approving a card.

Loan Interest Rates: Better scores often mean lower interest rates.

Loan Amount: Higher scores can increase the amount you can borrow.

Implications For Employment And Housing

Employers and landlords often review consumer reports. These reports help them gauge reliability and trustworthiness. A good report can open doors to job offers and rental approvals. On the other hand, a poor report can close these opportunities.

Aspect | Impact |

|---|---|

Employment | Good reports can lead to job offers. |

Housing | Landlords may approve rentals based on your report. |

Secrets Behind Credit Reporting Agencies

Credit reporting agencies hold vast amounts of personal information. They collect, store, and sell this data. But how do they manage this process? Let’s dive into the secrets behind these agencies.

How Agencies Collect And Process Data

Credit reporting agencies gather data from various sources. These sources include banks, credit card companies, and lenders. They also obtain information from public records.

Agencies use advanced algorithms to process this data. They compile it into detailed credit reports. These reports include credit scores, payment histories, and outstanding debts.

Data accuracy is crucial. Credit agencies verify the information with creditors. They ensure that all details are up-to-date and correct.

The Business Of Selling Consumer Information

Credit reporting agencies sell consumer information to various businesses. These businesses use the data for credit checks and lending decisions.

Agencies also sell data to employers. Employers check credit reports before hiring. Landlords use credit reports to screen tenants.

Here’s a table showing who buys consumer data and why: BuyerPurposeBanksAssess loan applicationsEmployersEvaluate potential hiresLandlordsScreen tenants Insurance companies determine policy rates

Selling consumer information is a lucrative business. Agencies make billions annually. They charge fees for access to detailed reports.

Consumers need to be aware of these practices. Knowing how data is used can help protect personal information.

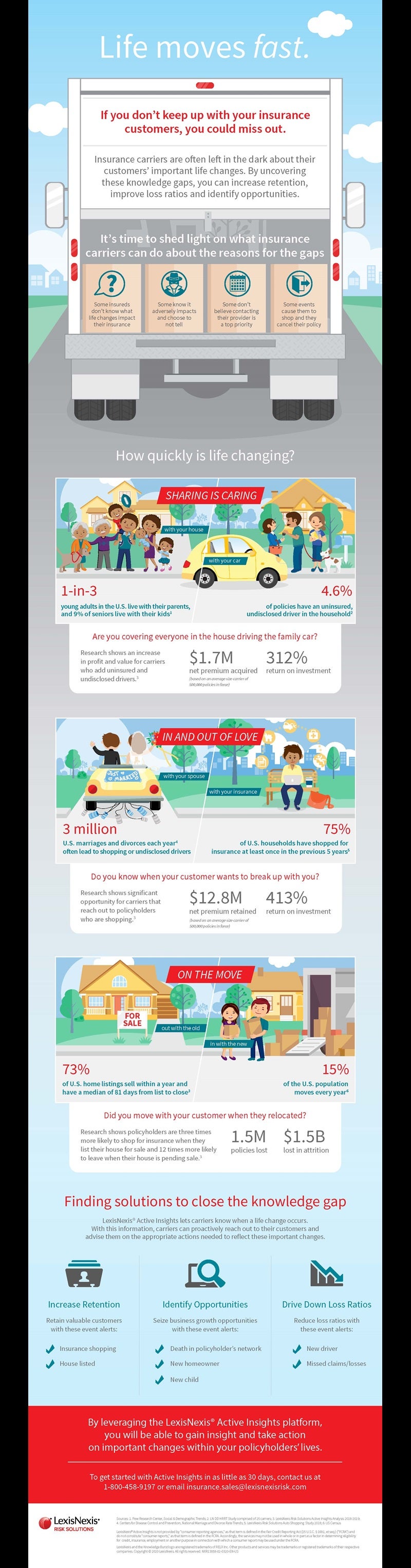

Credit: risk.lexisnexis.com

Navigating Errors And Inaccuracies

It’s crucial to check your consumer report for errors. Mistakes in your report can harm your credit score. This can impact your ability to get loans or a mortgage. Knowing how to fix these errors is vital.

Steps To Correct A Consumer Report

Obtain a Copy: Request a copy of your consumer report.

Identify Errors: Check for incorrect or outdated information.

Gather Evidence: Collect documents to support your claim.

Contact Agencies: Write to credit bureaus detailing the errors.

Follow Up: Ensure the bureaus correct the mistakes.

Errors can include incorrect personal details or wrong account information. Make sure you review all sections of your report.

Legal Recourse For Wrongful Information

If the credit bureaus do not correct the errors, you have options:

File a Complaint: Submit a complaint to the Consumer Financial Protection Bureau (CFPB).

Seek Legal Advice: Consult with a lawyer who specializes in consumer rights.

Consider Small Claims Court: You can file a claim if the damages are significant.

Incorrect information can lead to denied loans and higher interest rates. Legal action ensures that your credit report is accurate and fair.

Preventative Measures To Protect Your Report

Protecting your consumer report is crucial. The FCRA defines a consumer report as any information that affects your creditworthiness. By taking preventative measures, you can safeguard your credit and personal information. One way to protect your consumer report is to regularly monitor your credit report for any suspicious activity. Another important step is to avoid sharing your personal information with untrusted sources. By following these credit protection tips, you can help ensure that your consumer report remains secure and your credit remains protected.

Monitoring Your Credit Regularly

Regular credit monitoring helps you spot errors and signs of identity theft. Use free annual credit reports to keep an eye on your credit. Services like Credit Karma or Experian provide regular updates.

Check for unfamiliar accounts.

Look for incorrect personal information.

Spot any suspicious activities.

Best Practices For Data Privacy

Data privacy is key to protecting your consumer report. Follow best practices to keep your information safe.

Use strong passwords: Combine letters, numbers, and symbols.

Enable two-factor authentication: Adds an extra layer of security.

Be cautious with personal information: Avoid sharing sensitive info online.

Shred sensitive documents: Prevent identity theft by properly disposing of documents.

The Future Of Consumer Reporting

The future of consumer reporting is evolving rapidly. Technological advancements and new laws are shaping the landscape. Consumers and businesses alike are feeling the impact. Let’s dive into what lies ahead.

Advancements In Data Security And Privacy

Data security is more critical than ever. Advancements in encryption and blockchain technology are making data safer. Companies are using AI and machine learning to detect fraud. These technologies help to protect sensitive information.

Encryption methods are getting stronger. Multi-factor authentication is becoming standard. This adds an extra layer of security. Consumers can feel safer knowing their data is protected.

Technology | Benefit |

|---|---|

Encryption | Protects data from unauthorized access |

Blockchain | Ensures data integrity and transparency |

AI and Machine Learning | Detects and prevents fraud |

Multi-factor Authentication | Adds an extra layer of security |

Legislative Changes And Consumer Advocacy

New laws are changing how companies handle data. The General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are key examples. These laws give consumers more control over their data.

Consumer advocacy groups are also playing a big role. They are pushing for more transparency. They want companies to be clear about how they use data. This is leading to better practices and more trust.

Legislation and advocacy are working hand in hand. This partnership is making consumer reporting more ethical and secure.

GDPR – gives EU citizens control over personal data

CCPA – Offers California residents new privacy rights

Consumer Advocacy – Promotes transparency and ethical practices

How Do Credit Reporting Agencies Ensure Accuracy in Consumer Reports?

Credit reporting agencies follow strict guidelines to ensure accuracy in consumer reports by verifying data from creditors, investigating disputes, and updating records regularly. Consumers can request corrections by reaching out through credit reporting agencies contact details, enabling them to challenge errors and maintain fair credit profiles. Accurate reporting helps ensure financial integrity.

Frequently Asked Questions

What Must Be Disclosed By A Consumer Credit Reporting Agency Under The FCRA?

A consumer credit reporting agency must disclose all information in the consumer’s file, their credit score, and the sources of the information. They must also provide a list of parties who accessed the report in the past year.

What Is A Consumer Credit Report?

A consumer credit report details your credit history. It includes personal information, credit accounts, and payment history. Lenders use it to assess creditworthiness.

What Is The General Fcra Investigative Consumer Report?

An FCRA investigative consumer report includes information on a person’s character, reputation, and lifestyle gathered through personal interviews.

What Does A Fcra Report Show?

An FCRA report shows credit history, including loans, credit cards, payment history, and public records like bankruptcies. It also includes personal information and inquiries.

What Is A Consumer Report?

A consumer report is a detailed file containing an individual’s credit and personal information.

Conclusion

Understanding the FCRA’s definition of a consumer report is crucial. It ensures accurate and fair credit reporting. Compliance with these regulations protects both consumers and businesses. Stay informed and ensure your practices align with the FCRA. This knowledge fosters trust and promotes fair financial practices in the marketplace. Understanding the FCRA’s definition of a consumer report also includes knowing the requirements for removing late payments from credit reports. By familiarizing yourself with these regulations, you can ensure that your credit reporting practices are in line with the law. This not only protects consumers from inaccuracies on their credit reports but also promotes fairness and transparency within the financial industry.