Section 604 Dispute Letter: Unlock Credit Success!

A Section 604 Dispute Letter is a formal request to credit bureaus to verify and correct inaccurate information on your credit report. It invokes your rights under the Fair Credit Reporting Act (FCRA).

Disputing inaccuracies on your credit report is crucial for maintaining a healthy credit score. A Section 604 Dispute Letter ensures that credit bureaus investigate and rectify any erroneous data. This letter is a powerful tool to ensure the accuracy of your credit history.

By addressing inaccuracies, you can prevent potential negative impacts on your financial health. A well-crafted dispute letter is clear, concise, and supported by relevant documentation. This approach maximizes the chances of a successful resolution. Always include your personal details, account information, and a detailed explanation of the disputed items.

Credit: www.dochub.com

Introduction To Section 604 Dispute Letters

Understanding your credit report is crucial. Sometimes, errors appear on your report. These errors can affect your financial health. Section 604 Dispute Letters can help you fix these errors. This guide will introduce you to Section 604 Dispute Letters.

The Magic Behind Your Credit Report

Your credit report holds a lot of power. It influences your ability to get loans, credit cards, and even jobs. Credit reports are like report cards. They show your credit history and how you manage debt.

Three major credit bureaus create these reports. They are Equifax, Experian, and TransUnion. These bureaus collect data from various sources. This data includes your payment history, outstanding debts, and more.

Sometimes, mistakes happen. Incorrect information can appear on your credit report. These mistakes can lower your credit score. This is where the magic of Section 604 Dispute Letters comes in.

Why Section 604 Matters

Section 604 of the Fair Credit Reporting Act (FCRA) is important. It gives you the right to dispute incorrect information on your credit report. This section helps you maintain a clean credit history.

When you send a Section 604 Dispute Letter, the credit bureau must investigate your claim. They must verify the accuracy of the disputed information. If they find errors, they must correct them.

Section 604 Dispute Letters empower you. They give you a way to correct mistakes on your credit report. This can improve your credit score and financial health.

| Key Points | Details |

|---|---|

| Credit Report | Shows credit history and debt management |

| Credit Bureaus | Equifax, Experian, TransUnion |

| Section 604 | Right to dispute incorrect information |

Credit: credit-report-dispute-form.pdffiller.com

The Legal Groundwork

Understanding the legal framework behind a Section 604 Dispute Letter is crucial. This knowledge empowers consumers to challenge inaccuracies on their credit reports effectively. Let’s delve into the basics and your rights. Under the Fair Credit Reporting Act, consumers have the right to dispute any inaccurate information on their credit report. This can be done by sending a Section 604 dispute letter to the credit bureau. Additionally, individuals have the right to place an Equifax security freeze on their credit report to prevent unauthorized access and potential identity theft. Understanding these legal provisions is essential for protecting one’s financial well-being.

Fair Credit Reporting Act (FCRA) Basics

The Fair Credit Reporting Act (FCRA) is a federal law. It aims to ensure the accuracy, fairness, and privacy of consumer information. This act governs how credit reporting agencies operate.

Under the FCRA, consumers have specific rights. These rights help protect against misinformation on credit reports. Here are some key points:

- Access to your credit report at least once a year for free.

- Right to dispute incomplete or inaccurate information.

- Credit reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information.

Rights Under Section 604

Section 604 of the FCRA outlines the permissible purposes for accessing a consumer’s credit report. This section ensures that only authorized entities can view your credit information. Here are some scenarios where your credit report can be accessed:

- By creditors when you apply for a loan.

- By landlords when you rent a property.

- By employers, but only with your written consent.

- By insurance companies when you apply for coverage.

It’s essential to know your rights under Section 604. Unauthorized access to your credit report is a violation of the FCRA. If you find errors, you can dispute them using the Section 604 Dispute Letter.

The Section 604 Dispute Letter is a powerful tool. It helps ensure your credit report remains accurate and private. Knowing the legal groundwork can make this process smoother and more effective.

When To Use A Section 604 Dispute Letter

A Section 604 Dispute Letter is a powerful tool for correcting credit report errors. Knowing the right time to use this letter can help you improve your credit score efficiently.

Identifying Errors In Your Report

Review your credit report regularly. Look for inaccuracies such as:

- Incorrect personal information

- Duplicate accounts

- Incorrect account statuses

- Outdated information

If you spot any errors, it’s time to consider a Section 604 Dispute Letter.

Strategic Timing For Disputes

Timing your dispute can increase its effectiveness. Here are some tips:

- Dispute errors before applying for a loan.

- Submit your dispute after a major life change like marriage or moving.

- Avoid holidays when credit bureaus may be understaffed.

Being strategic can help ensure a quicker resolution. Keep an eye on your credit report and act promptly.

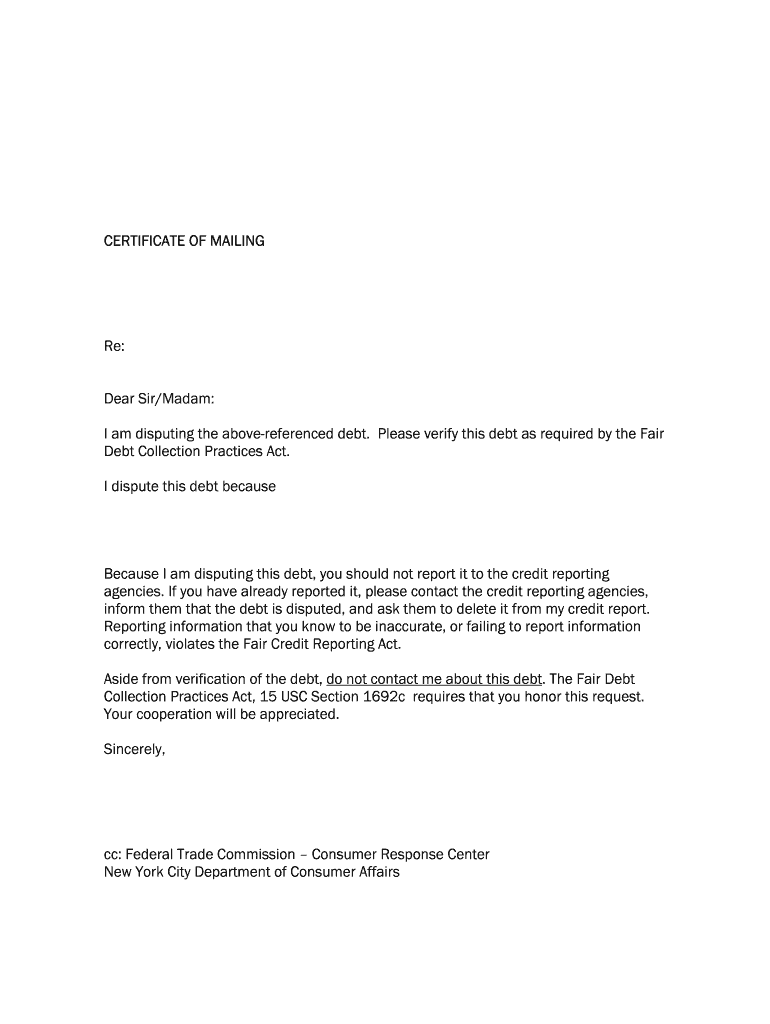

Crafting Your Dispute Letter

Crafting a Section 604 dispute letter can seem tricky. But, with the right approach, you can make it effective. This section will guide you through the process of writing a compelling dispute letter.

Key Components Of An Effective Letter

Your dispute letter needs to be clear and concise. Include the following key components:

- Personal Information: Your name, address, and contact details.

- Account Information: Details of the account you’re disputing.

- Reason for Dispute: Clear explanation of why the information is incorrect.

- Supporting Evidence: Attach copies of documents that support your claim.

- Request for Action: Specify what you want the credit bureau to do.

Ensure you include all these elements to make your dispute letter effective.

Sample Language And Templates

Here is some sample language you can use in your dispute letter:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Credit Bureau Name]

[Address]

[City, State, ZIP Code]

Dear Sir/Madam,

I am writing to dispute the following information in my file. I have enclosed copies of supporting documents. Please remove or correct the disputed items as soon as possible.

The items I dispute are:

1. [Account Name/Number]: Incorrect balance shown. Enclosed is a statement showing the correct balance.

2. [Account Name/Number]: This account is not mine. Attached is a copy of my ID.

I appreciate your prompt attention to this matter.

Sincerely,

[Your Name]

Feel free to adjust the sample language to fit your specific situation. Using a clear and polite tone will help your case.

The Dispute Process

The Section 604 Dispute Letter process can help correct errors on your credit report. This process involves several steps to ensure accuracy. Let’s explore how you can submit your dispute and what happens after you send the letter.

Submitting Your Dispute

Start by collecting all necessary documents. These include copies of your credit report, any proof supporting your claim, and the completed Section 604 Dispute Letter. Ensure all information is clear and accurate.

Next, mail your dispute package to the credit bureau. Use certified mail with a return receipt request. This way, you have proof of your submission. The credit bureau will then have 30 days to investigate your dispute.

What Happens After You Send The Letter?

The credit bureau reviews the information you provided. They will contact the creditor or entity reporting the disputed information. The creditor must then verify the accuracy of the reported item.

If the information cannot be verified, it must be removed from your credit report. The credit bureau will send you the results of the investigation. This typically includes an updated credit report and a summary of their findings.

If your dispute is successful, your credit report will reflect the corrected information. If not, you have the right to add a statement of dispute to your credit report. This allows future creditors to see your side of the story.

Credit: www.scribd.com

Potential Outcomes And Next Steps

After sending a Section 604 Dispute Letter, you need to know the potential outcomes. Understanding the next steps will help you stay prepared.

Best And Worst-case Scenarios

There are two main outcomes you can expect:

- Best-case scenario: The disputed item gets removed.

- Worst-case scenario: The disputed item remains on your report.

If the item is removed, your credit score may improve. This is a positive outcome. If the item stays, you may need to take further steps.

Following Up On Your Dispute

After submitting your dispute, follow up diligently. Here are some steps you can take:

- Wait for the credit bureau’s response, which can take up to 30 days.

- Check your updated credit report for any changes.

- Contact the credit bureau if you don’t receive a response.

- Gather additional evidence if the dispute is not resolved in your favor.

Keeping track of your dispute process is crucial. Maintain all records and correspondence.

| Action | Timeframe |

|---|---|

| Wait for a response | Up to 30 days |

| Check credit report | After 30 days |

| Contact credit bureau | If no response |

Tips For Success

Are you ready to tackle errors on your credit report with a Section 604 Dispute Letter? Success hinges on a few key strategies. Let’s dive into some essential tips for success. First, be sure to clearly identify the errors you are disputing in your letter. This can include incorrect personal information, accounts that do not belong to you, or outdated negative information. It’s important to be specific and provide any supporting documentation to strengthen your case. Additionally, familiarize yourself with the consumer report definition as outlined by the Fair Credit Reporting Act, which defines what information can be included in a credit report and how it should be handled. Understanding this definition can help you identify any inaccuracies in your report and effectively dispute them.

Maintaining Patience And Persistence

Credit disputes may take time. Be patient and stay consistent. Sometimes, it takes several attempts to resolve an issue. You might need to follow up multiple times. Do not get discouraged if the results are not immediate.

Stay persistent. Keep pushing until the errors are corrected. Your efforts will pay off with improved credit scores. Always remember, that consistency is key in this process.

Keeping Detailed Records

Document every step you take. This includes letters sent, responses received, and any related communication. Keeping records helps track progress and provides evidence if needed.

| Action | Details |

|---|---|

| Letters Sent | Record date, recipient, and content |

| Responses Received | Note date and response details |

| Follow-up Actions | Track dates and actions taken |

Use a spreadsheet or a notebook to maintain these records. This practice ensures you have a clear history of the dispute process.

Ensuring Accuracy And Completeness

Make sure your dispute letters are accurate and complete. Double-check all information before sending. Include your name, account number, and a detailed description of the error.

- Include copies of supporting documents.

- Use clear and concise language.

- Proofread for any mistakes.

Accuracy is vital for a successful dispute. Incorrect or incomplete information can delay the process.

Beyond Section 604: Building Your Credit

Improving your credit isn’t just about fixing errors with a Section 604 dispute letter. It’s about building strong credit habits and using smart tools. Here are some tips to help you build a healthy credit profile.

Healthy Credit Habits

Adopting healthy credit habits is crucial for a solid credit score. Start by paying your bills on time. Late payments can hurt your credit score.

- Set up automatic payments to ensure timely bill payments.

- Keep your credit card balances low. High balances can be harmful.

- Aim to use less than 30% of your credit limit.

It’s also wise to avoid applying for too many credit cards at once. Each application results in a hard inquiry, which can lower your score.

| Healthy Habit | Benefit |

|---|---|

| Paying on time | Improves payment history |

| Keeping balances low | Reduces credit utilization |

| Limiting credit applications | Prevents hard inquiries |

Using Credit Monitoring Tools

Credit monitoring tools help you keep track of your credit activity. These tools alert you to changes in your credit report. This allows you to spot potential issues early.

- Sign up for a credit monitoring service.

- Check your credit report regularly.

- Dispute any errors you find immediately.

Some credit monitoring tools offer tips on improving your credit score. They also provide identity theft protection, adding an extra layer of security.

Using these tools helps you stay informed and proactive about your credit health.

Can Sending a Section 604 Dispute Letter Help in Removing a Judgement from My Credit Report?

If you have a judgment on your credit report, you can send a Section 604 dispute letter to the credit bureaus. In this letter, you can request them to investigate the accuracy of the judgment. Following these clear steps for credit report can help in removing the judgment from your credit report.

How Can Credit Karma Support Help with a Section 604 Dispute Letter?

A Section 604 dispute letter helps challenge inaccuracies on a credit report, improving financial standing. Utilizing credit karma tollfree support can simplify this process by offering guidance on drafting an effective dispute letter and ensuring proper submission. Expert assistance helps navigate complexities, increasing the chances of a successful resolution for credit discrepancies.

Frequently Asked Questions

What Is Section 604 Dispute Letter?

A Section 604 dispute letter challenges errors on your credit report. It requests credit bureaus to verify the information. If unverifiable, the data must be removed. This helps improve your credit score.

What Is The Best Reason To Put When Disputing A Collection?

The best reason to dispute a collection is inaccurate information. Errors in account details or reporting can support your claim.

What Is A 609 Dispute Letter?

A 609 dispute letter challenges errors on your credit report. It requests verification of disputed items from credit bureaus.

How Do I Remove Collections From My Credit Report Letter?

To remove collections, write a dispute letter to the credit bureau. Include account details and reasons for removal. Attach supporting documents.

What Is A Section 604 Dispute Letter?

A Section 604 Dispute Letter is used to challenge inaccurate credit report information.

Conclusion

Crafting a Section 604 dispute letter can significantly improve your credit report. Ensure you include accurate, relevant details. Tailor the letter to your specific situation for the best results. Remember, persistence pays off in maintaining a healthy credit score. Start your journey to a better financial future today.