Sample Letter to Remove Repossession from Credit Report: Boost Scores Now!

To remove a repossession from your credit report, write a goodwill letter to your creditor. Explain your situation and request the removal.

A repossession can significantly impact your credit score, making it essential to address it promptly. A goodwill letter is a powerful tool that allows you to communicate directly with your creditor. Explain the circumstances that led to the repossession and demonstrate your commitment to maintaining good financial habits.

Be honest and concise, showing your genuine intent to rectify past mistakes. Creditors may consider your request, especially if you have a history of timely payments. Removing a repossession from your credit report can improve your credit score, enabling better financial opportunities. Always follow up and keep records of your correspondence for future reference.

Credit: www.etsy.com

Introduction To Credit Scores And Repossessions

Credit scores play a crucial role in financial health. They determine your ability to get loans, mortgages, and even jobs. One of the most damaging items on a credit report is a repossession.

Repossession happens when you fail to pay for a financed item, like a car. The lender takes back the item, leaving a negative mark on your credit report. This can significantly lower your credit score.

The Impact Of Repossession On Your Credit Score

A repossession can drop your credit score by 100 points or more. The impact is severe and can last for years. It makes it harder to get approved for new credit. Even if you get approved, you’ll face higher interest rates.

Creditors see repossession as a sign of financial irresponsibility. It shows that you failed to meet your financial obligations. This makes you a risky borrower in their eyes.

Why It’s Important To Address Repossessions

Addressing repossessions is vital for rebuilding your credit score. Ignoring them can make financial recovery more difficult. Removing a repossession can boost your credit score significantly.

Here are some reasons to address repossessions:

- Improve Loan Approval Chances: Better credit scores lead to more loan approvals.

- Lower Interest Rates: Good credit scores mean lower interest rates on loans.

- Better Job Opportunities: Some employers check credit scores before hiring.

- Housing Options: Good credit scores help in getting rental approvals.

Taking steps to remove a repossession is essential. It can lead to better financial opportunities. It also helps in achieving long-term financial stability.

Understanding Your Credit Report

Your credit report is a vital document. It showcases your financial history. Understanding this report helps you maintain good credit health. A clear credit report can improve loan approvals and interest rates.

Components Of A Credit Report

A credit report contains several sections. Each section provides specific information about your credit behavior.

| Component | Description |

|---|---|

| Personal Information | Includes your name, address, and Social Security number. |

| Credit Accounts | Details about your credit cards, loans, and payment history. |

| Credit Inquiries | Records of who has checked your credit report. |

| Public Records | Includes bankruptcies, liens, and judgments. |

| Collections | Accounts sent to collection agencies. |

Identifying Repossession Entries

Repossession entries can harm your credit score. It’s important to spot them on your report.

- Look under the “Credit Accounts” section.

- Check for entries marked as “Repossession” or “Charge-off”.

- Note the date and amount associated with the repossession.

Repossessions usually stay on your report for seven years. Removing them can boost your credit score.

Eligibility For Repossession Removal

Understanding your eligibility for repossession removal is essential. If you face a repossession on your credit report, you might wonder if you can remove it. Knowing your eligibility helps you take the right steps.

Valid Reasons For Disputing A Repossession

Several valid reasons exist for disputing a repossession. First, verify if the repossession is an error. Sometimes, credit reports contain mistakes. If you find an error, you can dispute it.

Another reason could be identity theft. If someone used your identity to get a loan, that repossession isn’t yours. In such cases, you must dispute it.

Consider the statute of limitations. If the repossession is too old, it might no longer affect your credit. The statute of limitations varies by state.

When To Seek Professional Help

Knowing when to seek professional help is vital. If you find errors but don’t know how to dispute them, consult a professional. Credit repair companies specialize in fixing credit report issues.

If you feel overwhelmed, a professional can guide you. They have experience and know the best strategies. They can also communicate with creditors and credit bureaus on your behalf.

For complex cases, professionals offer valuable assistance. They can help you gather evidence and build a strong case.

Credit: www.lexingtonlaw.com

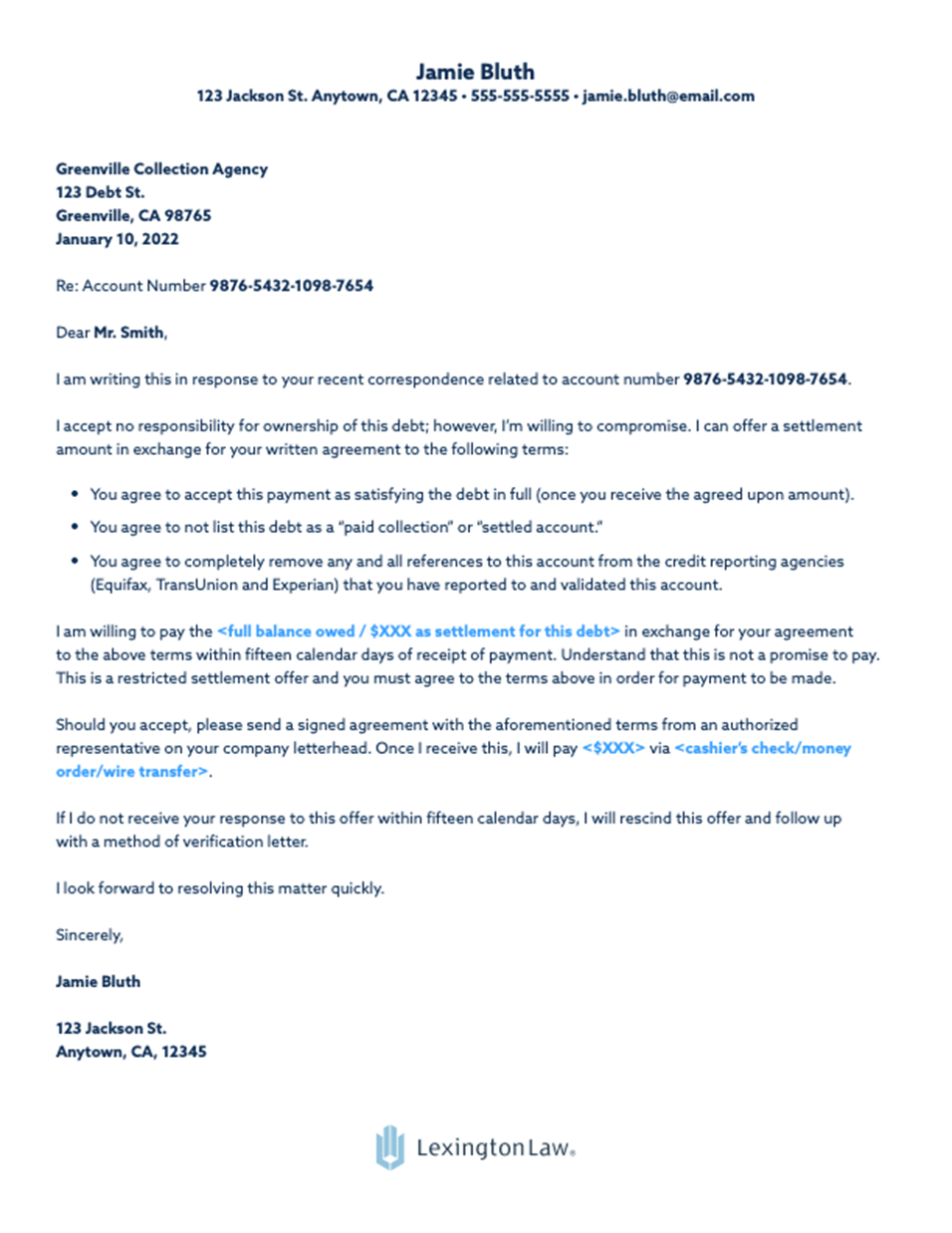

Crafting Your Removal Letter

Writing a letter to remove a repossession from your credit report can feel daunting. By following a structured approach, you can create a compelling case. Here’s how to craft an effective removal letter.

Essential Elements Of An Effective Letter

An effective removal letter should include key components. These elements will strengthen your request:

- Personal Information: Include your full name, address, and contact details.

- Account Details: Mention the account number and lender’s name.

- Explanation: Clearly state the reason for the repossession.

- Supporting Evidence: Attach relevant documents to support your case.

- Polite Tone: Keep the tone respectful and professional.

- Request for Removal: Explicitly ask for the removal of the repossession.

- Signature: Sign the letter to authenticate it.

Personalizing Your Case

Personalizing your letter can make a significant impact. Tailor the content to reflect your unique situation:

- Share Your Story: Briefly explain the circumstances that led to the repossession.

- Express Regret: Show remorse for the event.

- Highlight Improvements: Mention any positive changes in your financial habits.

- Commit to Future Payments: Assure the lender of your commitment to timely payments.

By adding a personal touch, you show genuine intent to rectify the situation.

Sample Letter Breakdown

A well-crafted letter can help remove repossession from your credit report. This section will break down the letter into three parts. Follow the format to improve your chances of success. In the first part of the letter, start by stating your intention to have the repossession removed from your credit report. Provide any relevant details, such as the reason for the repossession or any extenuating circumstances. In the second part, explain how the repossession is impacting your credit score and financial well-being. Finally, in the third part, offer a proposed solution, such as making a payment or entering into a repayment plan, to demonstrate your commitment to improving your credit score. By following this format, you can increase your chances of success in having the repossession removed from your credit report and ultimately improve your credit score.

Introduction And Purpose

Start your letter with a clear introduction. Mention your purpose right away. Use the following points:

- Your full name and address

- Current date

- Credit bureau’s name and address

- A brief statement of your request

For example:

John Doe 123 Main St. Anytown, USA 12345 October 1, 2023 Experian P.O. Box 4500 Allen, TX 75013 Subject: Request for Repossession Removal

Detailing The Dispute

Next, detail the specific repossession you are disputing. Include the following:

- The account number

- The date of the repossession

- A brief explanation of why it’s an error

For example:

I am writing to dispute the repossession on my credit report. The account number is 12345678, and the repossession date is June 1, 2022. I believe this is an error because I was not late on payments.

Requesting Removal Or Correction

Finally, state clearly what you want the credit bureau to do. You can request:

- Complete removal of the repossession

- Correction of any inaccuracies

Be polite and firm in your request. For example:

Please investigate this matter and remove the incorrect repossession. I appreciate your prompt attention to this issue.

End your letter with a polite closing. Provide your contact information for follow-up:

Sincerely, John Doe Phone: (123) 456-7890 Email: johndoe@example.com

Steps After Sending The Letter

Sending a letter to remove repossession from your credit report is an important step. But, the journey doesn’t end there. You must follow through with additional actions to ensure success.

Follow-up Communications

After sending your letter, wait for a response. Credit bureaus typically respond within 30 days. If you don’t hear back, follow up with them. Use email or phone for quicker communication. Always remain polite and professional in your follow-ups.

Keep records of all communications. This includes dates, times, and names of representatives. Documentation is key in case you need to escalate the matter. If the response is not satisfactory, consider escalating to higher authorities.

Monitoring Your Credit Report For Changes

Once you send the letter, start monitoring your credit report. Check for changes regularly. You can get a free credit report from major bureaus. Look for any updates regarding the repossession.

If you see changes, ensure they reflect accurately. Sometimes errors can occur. If errors are found, dispute them promptly. Use the credit bureau’s online dispute process for faster resolution.

Below is a table summarizing the steps:

| Step | Description |

|---|---|

| Send Letter | Mail the letter to the credit bureau. |

| Wait for Response | Wait up to 30 days for a response. |

| Follow-Up | Contact the bureau if no response within 30 days. |

| Monitor Credit Report | Check your credit report for changes. |

| Dispute Errors | Dispute any inaccuracies found. |

These steps are crucial for successfully removing a repossession. Follow them diligently to improve your credit report.

Dealing With Rejection

Facing a denial when trying to remove a repossession from your credit report can be disheartening. Yet, understanding why your request was rejected is crucial. It equips you with the knowledge to take the next steps effectively.

Understanding Reasons For Denial

There are several reasons why your request might be denied. Knowing these reasons can help you plan your next move.

| Reason | Explanation |

|---|---|

| Incomplete Documentation | Ensure all necessary documents were submitted. |

| Incorrect Information | Double-check the details you provided. |

| Insufficient Evidence | Gather more supporting evidence. |

| Credit Bureau Error | Errors can occur; verify with the credit bureau. |

Next Steps: Re-dispute Or Legal Action?

After understanding the reasons for the denial, decide your next step. You can either re-dispute the repossession or take legal action.

Re-dispute:

- Gather new evidence.

- Correct any mistakes in your initial request.

- Write a more detailed dispute letter.

Legal Action:

- Consult a legal expert.

- File a complaint with the Consumer Financial Protection Bureau (CFPB).

- Consider taking the issue to small claims court.

Understanding your options and the reasons for denial can guide you. Being well-informed can make your next attempt more successful.

Credit: www.solosuit.com

Maintaining A Healthy Credit Score Post-removal

Getting a repossession removed from your credit report is a big win. But, maintaining a healthy credit score post-removal needs effort. Here are some tips to build and maintain a good credit score.

Building Positive Credit Habits

Start by paying all your bills on time. This includes utilities, rent, and credit cards. Late payments can harm your credit score. Use automated payments to ensure you never miss a due date.

Keep your credit card balances low. High balances can affect your credit utilization ratio. Aim to use less than 30% of your available credit. If you can, pay off the full balance every month.

Diversify your credit mix. This can include credit cards, a car loan, or a mortgage. Having different types of credit shows you can manage various credit lines.

Regular Monitoring And Reporting

Check your credit report often. You can get a free credit report from each of the three major bureaus once a year. Regular monitoring helps you spot errors and signs of identity theft.

Dispute any inaccuracies you find. Wrong information can lower your credit score. Write a dispute letter to the credit bureau if you see mistakes.

Consider using a credit monitoring service. These services alert you to changes in your credit report. They can help you stay on top of your credit health.

| Action | Impact on Credit Score |

|---|---|

| Paying bills on time | Positive |

| Keeping balances low | Positive |

| Diversifying credit mix | Positive |

| Checking credit report | Neutral |

| Disputing inaccuracies | Positive |

Conclusion: Empowerment Through Knowledge

Understanding how to remove a repossession from your credit report can transform your financial health. With the right knowledge, you can take proactive steps to improve your credit score. This guide provides you with the tools to dispute a repossession effectively. Let’s recap the essential points and encourage proactive credit management.

Recap Of Key Points

- Understanding Repossession: Learn what repossession means and its impact on your credit report.

- Gathering Documents: Collect all necessary documents to support your dispute.

- Writing the Letter: Draft a clear, concise letter requesting the removal of the repossession.

- Sending the Letter: Send your letter to the credit bureaus and wait for a response.

- Follow-Up: Monitor your credit report for updates and follow up if needed.

Encouragement For Proactive Credit Management

Taking charge of your credit report empowers you. It’s crucial to monitor your credit regularly and address errors promptly.

Here are some tips for proactive credit management:

- Regular Monitoring: Check your credit report at least once a year.

- Dispute Errors: Dispute any inaccuracies you find immediately.

- Pay on Time: Ensure timely payments to avoid negative marks.

- Limit New Credit: Avoid opening multiple new accounts in a short period.

Managing your credit proactively can lead to a healthier financial future. Stay informed, act quickly, and take control of your credit today.

Are FCRA letters similarly effective in removing repossessions from a credit report?

Yes, you can remove collections with FCRA letter, but it may not be as effective for repossessions. While FCRA letters can help dispute and remove certain items from a credit report, repossessions may require additional steps and negotiation with the creditor or lender.

Can Removing Credit Inquiries Help with Repossession Removal?

Removing credit inquiries may help improve a credit report, but it won’t directly erase a repossession record. A repossession stays on a credit report for up to seven years. However, using a credit inquiry removal letter pdf can dispute unauthorized hard inquiries, potentially boosting credit scores and improving financial standing.

Frequently Asked Questions

1. Can I Remove A Repossession From My Credit Report?

Yes, you can remove a repossession from your credit report. Dispute errors with credit bureaus or negotiate with the lender. Consider hiring a credit repair company for help.

2. What Is A 623 Dispute Letter?

A 623 dispute letter challenges inaccurate information on your credit report. It refers to Section 623 of the FCRA. This letter requests creditors to verify or correct the reported data. It’s a crucial tool for improving your credit score.

3. What Is The 609 Loophole?

The 609 loophole refers to a credit repair strategy. Consumers can dispute negative items on their credit reports under Section 609 of the Fair Credit Reporting Act (FCRA).

4. What Is A 609 Letter To Remove Debt?

A 609 letter disputes inaccurate or unverifiable information on your credit report. It requests proof of the debt’s validity.

5. How To Write A Letter For Repossession Removal?

Draft a concise, polite letter. Include your personal details, account information, and reasons for the request.

Conclusion

Clearing a repossession from your credit report can significantly boost your credit score. Use our sample letter to start the process. Tailor it to your situation and follow up with the credit bureaus. Good credit health is achievable with persistence and the right steps.

Act now for a brighter financial future.