Residential Energy Credit: Slash Bills & Save Big!

Residential Energy Credit: This tax credit helps homeowners offset the cost of energy-efficient home improvements. It covers solar panels, wind turbines, and more.

The Residential Energy Credit is a federal incentive designed to promote the use of renewable energy sources in homes. It allows homeowners to claim a percentage of the cost of qualifying energy-efficient upgrades, such as solar panels, wind turbines, and geothermal heat pumps, on their federal tax returns.

This credit not only encourages the adoption of green technology but also helps reduce overall energy consumption and lower utility bills. Homeowners benefit financially while contributing to environmental sustainability. The credit has specific eligibility requirements and limits, making it essential to review the guidelines before claiming.

Introduction To Residential Energy Credit

Many homeowners want to save money on energy bills. The Residential Energy Credit helps them do that. This credit encourages the use of clean energy solutions. It’s a win for both your wallet and the environment.

What Is Residential Energy Credit?

The Residential Energy Credit is a tax incentive. It helps homeowners offset costs of energy-efficient home improvements. These improvements can include solar panels, wind turbines, and more. The credit reduces your tax bill dollar for dollar.

Eligible Improvements | Credit Percentage |

|---|---|

Solar Panels | 26% |

Wind Turbines | 26% |

Geothermal Heat Pumps | 26% |

Fuel Cells | 26% |

Why It Matters For Homeowners

The Residential Energy Credit reduces the cost of energy improvements. This makes it easier to invest in clean energy solutions. Homeowners can enjoy lower energy bills. They also help the environment by reducing carbon footprints.

Lower Energy Bills: Save money each month.

Environmentally Friendly: Reduce your carbon footprint.

Increase Home Value: Energy-efficient homes can be worth more.

Tax Savings: Reduce your tax bill directly.

Eligible Improvements For Energy Credit

Are you thinking of saving money on energy bills? The Residential Energy Credit can help. This credit rewards homeowners for making energy-efficient improvements. Let’s dive into the eligible improvements for this credit.

Solar Panels And Solar Water Heaters

Solar panels are a great investment. They convert sunlight into electricity. This can reduce your electric bills significantly. Solar panels also help the environment by reducing carbon footprints.

Solar water heaters use sunlight to heat water. This can reduce your water heating costs. Both of these options are eligible for the Residential Energy Credit.

Windows, Doors, And Insulation

Energy-efficient windows and doors can help maintain indoor temperature. This reduces the need for heating and cooling. Look for windows with Energy Star ratings. These windows meet strict energy efficiency guidelines.

Proper insulation is another effective improvement. It keeps your home warm in winter and cool in summer. Good insulation can lower your energy bills. Types of insulation that qualify include:

Spray foam insulation

Fiberglass insulation

Blown-in cellulose insulation

Make sure to choose high-quality materials. This ensures better efficiency and higher savings.

Improvement | Benefit |

|---|---|

Solar Panels | Generate electricity, reduce bills |

Solar Water Heaters | Heat water using sunlight |

Energy-Efficient Windows | Maintain indoor temperature |

Proper Insulation | Lower heating and cooling costs |

How To Qualify For Energy Credits

Understanding how to qualify for energy credits can save you money. These credits reward you for using energy-efficient systems in your home. Let’s dive into the key aspects to help you qualify for these valuable credits.

Understanding The Requirements

To qualify for residential energy credits, your home must meet specific requirements. The energy-efficient systems should be installed in your primary residence. The installation must be new and meet energy efficiency standards set by the government.

Your home must be located in the USA.

The energy-efficient system must be new.

The system must meet government energy standards.

Eligible improvements include solar panels, wind turbines, and geothermal systems. These systems must be certified for energy efficiency.

Documentation Needed

Proper documentation is crucial for claiming energy credits. Keep all receipts and invoices from the installation. You will also need the manufacturer’s certification statement.

Here is a list of documents you should keep:

Receipts and Invoices

Manufacturer’s Certification Statement

Proof of Residence

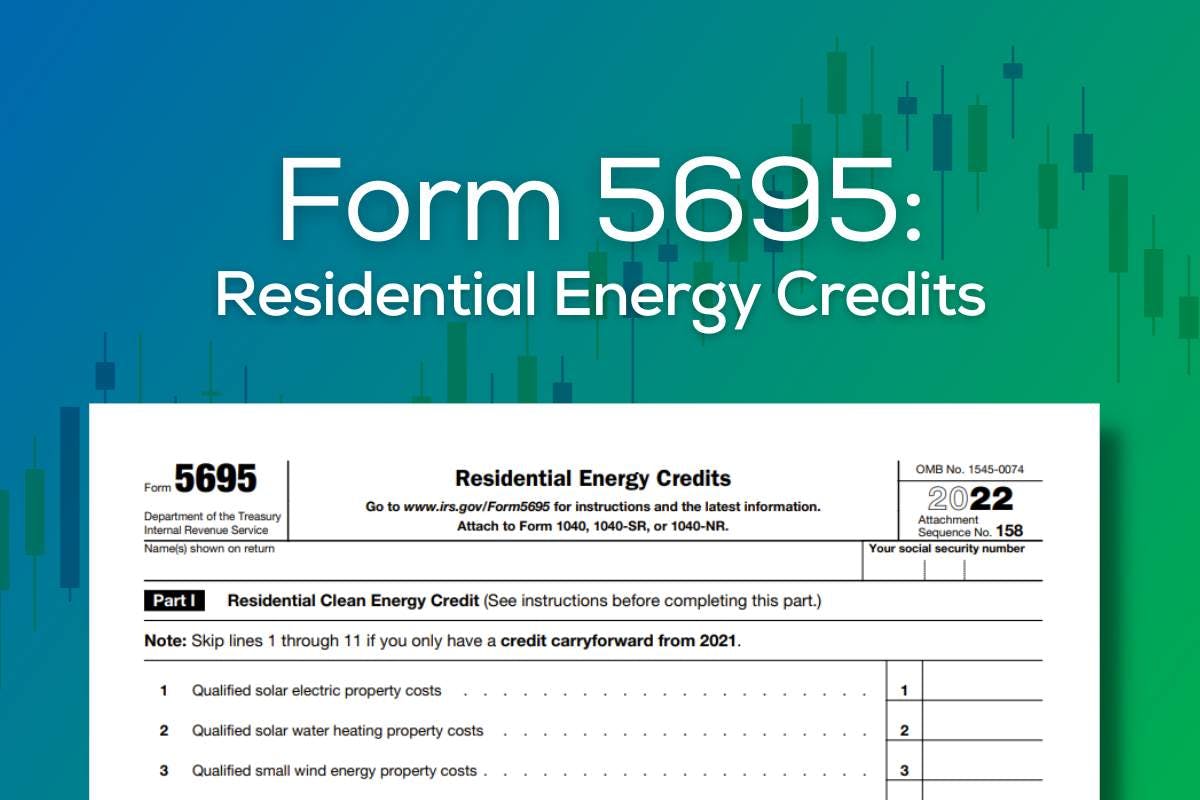

Keeping these documents organized will make the process smoother. You may also need to fill out IRS Form 5695. This form helps you calculate your residential energy credits.

Here is a table summarizing the documentation:

Document | Purpose |

|---|---|

Receipts and Invoices | Proof of purchase and installation |

Manufacturer’s Certification | Proof that the system meets standards |

Proof of Residence | Verify your primary residence |

Having the right documentation ensures you can claim your energy credits without issues.

Credit: palmetto.com

Maximizing Your Savings

Saving on your energy bills is more important than ever. The Residential Energy Credit can help you. By understanding how to maximize this credit, you can save more money. Let’s explore two key strategies: Combining Credits and Rebates and Planning Your Home Improvements.

Combining Credits And Rebates

You can combine the Residential Energy Credit with other rebates. This can boost your savings. Many states offer energy rebates. Check your local energy provider’s website. Often, they list available rebates.

Here is a simple table to help you understand:

Type of Credit/Rebate | Provider | Potential Savings |

|---|---|---|

Residential Energy Credit | Federal Government | 10%-30% of costs |

State Energy Rebates | State Government | Varies by state |

Utility Company Rebates | Local Utility Provider | Up to $500 |

Combining these can lead to huge savings. Ensure you file for each one.

Planning Your Home Improvements

Plan your home improvements wisely. Prioritize projects that qualify for the Residential Energy Credit. Focus on these areas:

Insulation: Keeps your home warm in winter and cool in summer.

Energy-efficient windows: Reduce heat loss and lower energy bills.

Solar panels: Generate your own electricity and reduce reliance on the grid.

Energy-efficient appliances: Use less energy and save money over time.

Make a list of all potential improvements. Then, estimate the costs and savings. This will help you decide which projects to tackle first.

Here’s an example list:

Install attic insulation: $1,000, save $150/year.

Replace windows: $5,000, save $200/year.

Add solar panels: $10,000, save $1,000/year.

Upgrade to energy-efficient appliances: $2,000, save $250/year.

Remember, the goal is to maximize savings. Plan each step carefully. This way, you can make the most of the Residential Energy Credit.

Case Studies: Success Stories

Discover how the Residential Energy Credit transforms homes and lives. Real families share their journeys from energy drain to energy gain.

From High Bills To High Savings

Meet the Johnson family. They once faced sky-high energy bills. Their 3,000 sq ft home cost a fortune to heat and cool. They decided to invest in energy-efficient upgrades.

Upgrades | Initial Cost | Energy Savings |

|---|---|---|

Solar Panels | $15,000 | $200/month |

Insulation | $2,500 | $50/month |

Energy-efficient Windows | $5,000 | $75/month |

With the Residential Energy Credit, the Johnsons saved 30% on their upgrades. Their investments started paying off within a few years. Now, they enjoy lower bills and a greener home.

Renovations That Pay Off

The Smiths transformed their old house into a model of efficiency. They installed a new HVAC system, energy-efficient appliances, and smart thermostats.

HVAC System: $10,000

Energy-efficient Appliances: $5,000

Smart Thermostats: $1,500

The Residential Energy Credit reduced their costs by 30%. The Smiths now save $250 each month on energy. Their home is comfortable and efficient.

These success stories show the power of the Residential Energy Credit. Families save money and improve their homes. It’s a win-win situation.

.png)

Credit: www.whitehouse.senate.gov

Navigating The Application Process

Applying for the Residential Energy Credit can seem daunting. This guide simplifies the process. Learn the steps, avoid common mistakes, and maximize your credit.

Step-by-step Guide

Gather Necessary Documents: Collect receipts and installation documents.

Complete IRS Form 5695: This form is crucial for claiming the credit.

Calculate Your Credit: Use the form to figure out your credit amount.

Submit with Your Tax Return: Attach Form 5695 to your tax return.

Common Pitfalls To Avoid

Missing Receipts: Always keep receipts for energy-efficient purchases.

Incorrect Form: Ensure you use IRS Form 5695 for the credit.

Wrong Calculations: Double-check your math to avoid errors.

Late Submission: File your taxes on time to claim the credit.

The Future Of Residential Energy Credits

Residential Energy Credits are evolving rapidly. This evolution is driven by new laws and tech advances. Homeowners benefit from these changes. They help save money and the planet.

Legislative Changes On The Horizon

Lawmakers are focusing on green energy. New laws are coming soon. These laws will help more people get energy credits. They will make it easier to install solar panels and other green tech.

Here are some expected changes:

Increased tax incentives for solar power

Subsidies for energy-efficient home improvements

Grants for renewable energy projects

These changes aim to make green energy accessible. They encourage everyone to adopt sustainable practices.

Technological Advances And Their Impact

New technology is making green energy better. Solar panels are now more efficient. Batteries can store more energy for longer periods. Smart home systems can manage energy use better.

Here’s a table showing recent tech advances:

Technology | Benefit |

|---|---|

High-Efficiency Solar Panels | Generate more power |

Advanced Batteries | Store energy longer |

Smart Home Systems | Manage energy use |

These advances make it easier to save energy. They also reduce energy costs for homeowners.

Credit: www.wincorewindows.com

Faqs: Your Questions Answered

Understanding the Residential Energy Credit can be confusing. We’ve compiled a list of frequently asked questions to help you navigate this topic. Let’s dive into some common queries.

Do I Need A Professional To Qualify?

Many wonder if hiring a professional is necessary. The short answer is no. You can qualify for the Residential Energy Credit without professional help. But, there are advantages to consulting an expert:

They ensure all forms are correctly filled out.

Professionals know the latest tax codes.

They can maximize your potential savings.

If you feel confident, you can handle the process on your own. Just make sure to gather all required documentation and follow the instructions carefully.

How Long Does It Take To Receive The Credit?

The timeline for receiving your Residential Energy Credit can vary. After submitting your claim, it typically takes around 6-8 weeks. Here’s a step-by-step breakdown:

Submit your tax return with the energy credit form.

The IRS processes your return.

Your credit is applied to your tax liability.

If eligible, you receive your refund.

If you have questions about your status, you can check with the IRS. They provide updates on the processing of your return.

How Do Climate Bill Tax Credits Relate to Residential Energy Credits?

The climate bill savings directly impact homeowners through residential energy credits, providing financial incentives for adopting clean energy solutions. These tax credits help reduce upfront costs for solar panels, energy-efficient appliances, and home upgrades, making sustainable choices more affordable. By leveraging these benefits, homeowners can lower energy bills while supporting environmental efforts.

Frequently Asked Questions

1. What Is Residential Energy Credit Irs?

The Residential Energy Credit IRS offers tax credits for energy-efficient home improvements, like solar panels, wind turbines, and insulation.

2. Did The Residential Energy Credit Expire?

Yes, the residential energy credit expired at the end of 2021. However, new legislation may extend it. Always check current IRS guidelines for updates.

3. What Appliances Qualify For Energy Tax Credit 2024?

Energy tax credits for 2024 include solar panels, energy-efficient windows, HVAC systems, water heaters, and insulation. Check IRS guidelines for specifics.

4. How Many Times Can You Claim Residential Energy Credit?

You can claim the residential energy credit for eligible improvements each tax year. There’s no lifetime limit.

5. What Is The Residential Energy Credit?

The Residential Energy Credit is a federal tax incentive for homeowners who invest in energy-efficient home improvements.

Conclusion

Claiming the Residential Energy Credit can save you money and reduce your carbon footprint. Make energy-efficient upgrades to your home now. Take advantage of available incentives and contribute to a sustainable future. Start your journey towards a greener home and enjoy the financial benefits today.