How To Remove Late Payments From Credit Report

To remove late payments from your credit report, dispute inaccuracies with the credit bureaus, or negotiate with creditors. Consistently monitor your credit report for any discrepancies.

Having late payments on your credit report can significantly impact your credit score and financial health. Addressing these issues promptly can prevent long-term damage and open up better financial opportunities. Begin by reviewing your credit report for any errors or inaccuracies.

Disputing incorrect late payments with the credit bureaus can help clean up your report. Negotiating with creditors to remove or update late payments can also improve your credit standing. Regular monitoring and proactive measures are essential to maintaining a healthy credit profile. Taking these steps can lead to a better financial future and more favorable credit terms.

Credit: www.wikihow.life

Introduction To Late Payments And Credit Health

Late payments can seriously harm your credit health. They lower your credit score and make it harder to get loans. Understanding how late payments affect your credit is key to improving your credit health.

The Impact Of Late Payments On Your Credit Score

Late payments can drop your credit score quickly. Here’s how:

- 35% of your score is payment history.

- One late payment can lower your score by 100 points.

- Late payments stay on your report for seven years.

Understanding The Components Of Your Credit Report

Your credit report has several parts. Knowing them helps you see how late payments affect your score.

| Component | Percentage |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| New Credit | 10% |

| Credit Mix | 10% |

First Steps After A Late Payment

A late payment can impact your credit score. Taking action quickly helps minimize damage. Here are the first steps you should take to address a late payment.

Review Your Credit Report For Errors

Check your credit report for any inaccuracies. Errors can often appear. These mistakes can negatively affect your score. You are entitled to a free report annually from each major bureau: Equifax, Experian, and TransUnion.

- Visit AnnualCreditReport.com

- Request your credit reports

- Examine each report carefully

Look for incorrect late payments, duplicate accounts, or wrong balances. If you find any errors, dispute them immediately. Correcting errors can boost your score.

Contact Your Creditor: The Importance Of Communication

Reach out to your creditor as soon as possible. Open communication shows responsibility. Explain the reason for your late payment. Many creditors are willing to help. They may remove the late payment from your report.

Here are some tips for contacting your creditor:

- Call customer service

- Be polite and honest

- Ask for a goodwill adjustment

- Provide any necessary documentation

Keeping a record of all communications is essential. It helps in case of future disputes. Good communication can often resolve issues quickly.

Strategies To Remove Late Payments

Late payments can hurt your credit score. Removing them can be challenging but not impossible. Various strategies can help you clean up your credit report. Below, we discuss two effective methods: Goodwill Letters and Negotiating Removal for Payment.

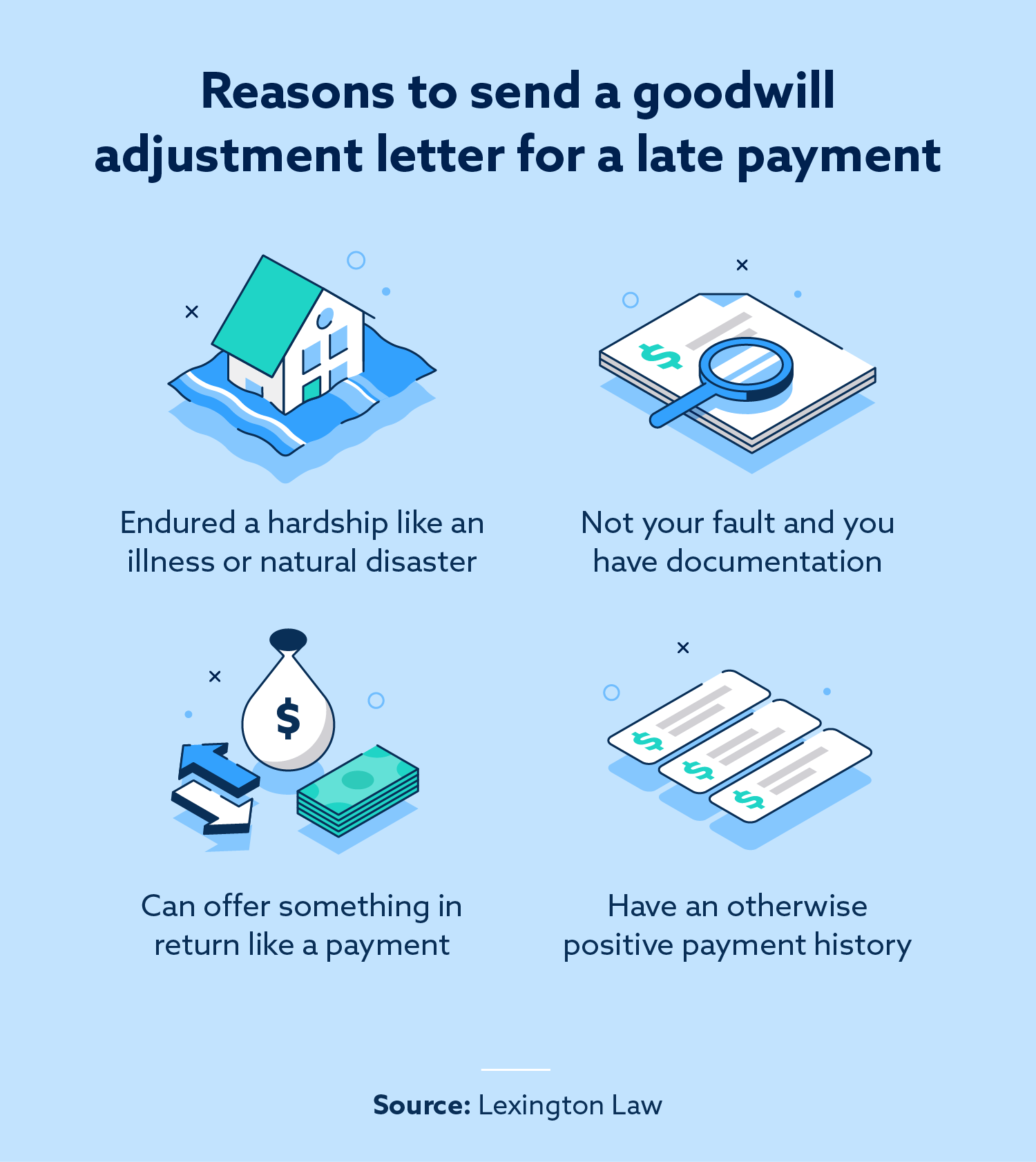

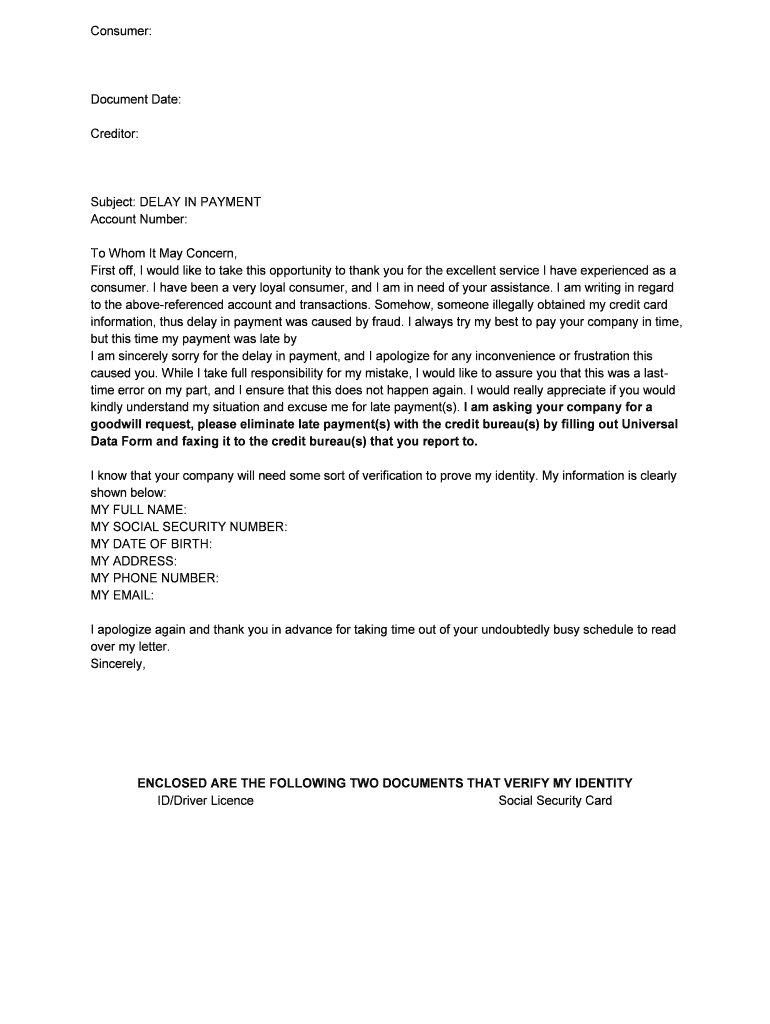

Goodwill Letters: A Personal Appeal

A goodwill letter is a personal appeal to your creditor. You ask them to remove the late payment from your credit report. A goodwill letter works best if you have a history of on-time payments.

When writing a goodwill letter:

- Be polite and respectful.

- Explain your situation honestly.

- Mention any good payment history.

- Request the removal of the late payment.

Here is a sample goodwill letter:

Dear [Creditor's Name], I hope this message finds you well. I am writing to you to request a goodwill adjustment for a late payment on my account. Due to [explain your situation], I was unable to make the payment on time. However, this was an isolated incident, and I have a history of making timely payments. I kindly request that you consider removing this late payment from my credit report. This gesture would greatly assist me in improving my credit score and financial standing. Thank you for your understanding and consideration. Sincerely, [Your Name]

Negotiating Removal For Payment

Another strategy is to negotiate removal for payment. This involves negotiating with your creditor to remove the late payment in exchange for full payment of the debt.

Steps to negotiate removal for payment:

- Contact your creditor.

- Offer to pay the full amount owed.

- Request removal of the late payment.

- Get the agreement in writing.

Many creditors are willing to negotiate. Especially if you show willingness to clear the debt. Always ensure you get any agreements in writing. This protects you if the creditor does not follow through.

Using these strategies can help you improve your credit score. A higher credit score can lead to better financial opportunities.

The Role Of Credit Repair Companies

Credit repair companies help improve your credit score. They work to remove negative items, like late payments, from your credit report. These companies use various strategies to dispute errors and negotiate with creditors.

Services Offered By Credit Repair Companies

- Credit Report Analysis: A detailed review of your credit report.

- Dispute Filing: They file disputes for inaccurate items.

- Debt Validation: Requesting proof of debt from creditors.

- Goodwill Letters: Asking creditors to remove late payments as a goodwill gesture.

- Credit Counseling: Offering advice to improve credit habits.

Pros And Cons Of Using Credit Repair Services

| Pros | Cons |

|---|---|

| Professional expertise. | Service costs. |

| Time-saving. | No guarantees. |

| Legal knowledge. | Possible scams. |

Credit repair companies offer many services. They help with credit report analysis, dispute filing, debt validation, goodwill letters, and credit counseling.

Using these services has pros and cons. The pros include professional expertise, saving time, and legal knowledge. The cons include service costs, no guarantees, and possible scams.

Disputing Inaccuracies On Your Own

Late payments on a credit report can lower your credit score. Sometimes, these late payments are due to errors. You can dispute these inaccuracies yourself. This process can be simple if you follow the correct steps. Below, we’ll guide you through the process of filing a dispute and managing follow-up and documentation.

How To File A Dispute

First, you need to gather your credit report. You can get a free copy from AnnualCreditReport.com. Once you have your report, look for the late payment entries.

If you find an error, you need to write a dispute letter. This letter should include:

- Your full name and address

- A clear description of the mistake

- Any supporting documents

- Your contact information

Send this letter to the credit bureau that reported the error. You can use the following addresses:

| Credit Bureau | Address |

|---|---|

| Equifax | P.O. Box 740256, Atlanta, GA 30374-0256 |

| Experian | P.O. Box 4500, Allen, TX 75013 |

| TransUnion | P.O. Box 2000, Chester, PA 19016 |

Follow-up And Documentation

After sending your dispute, keep track of all correspondence. This includes any letters or emails you receive. Create a file for your dispute. This file should contain:

- Copies of your dispute letter

- Proof of mailing

- Any responses from the credit bureaus

Credit bureaus have 30 days to investigate your claim. During this time, they will contact the creditor. The creditor needs to verify the information. If they can’t, the late payment will be removed.

If the dispute is successful, you will receive a letter from the credit bureau. This letter will confirm the correction. Keep this letter for your records.

If the dispute is denied, you can request a reinvestigation. You can also add a statement of dispute to your credit report. This statement tells future creditors that you disagree with the entry.

Credit: www.lexingtonlaw.com

Maintaining Good Credit After Resolving Late Payments

Once you’ve removed late payments from your credit report, maintaining good credit is essential. Implementing effective strategies ensures your credit score remains healthy. Below are some practical tips to help you stay on track.

Automating Payments

Automating payments can help avoid missed due dates. Set up auto-pay with your bank. This ensures timely payments every month.

Consider linking your bank account to your credit card. This ensures automatic withdrawals for minimum payments. Always check your balance to avoid overdrafts.

Using reminders is also helpful. Set monthly reminders on your phone or calendar. This will keep you informed about upcoming payments.

Building A Buffer: Financial Management Tips

Building a financial buffer helps manage unexpected expenses. Create an emergency fund with at least three months’ expenses. This provides a safety net during tough times.

Track your expenses to identify unnecessary costs. Use budgeting apps to monitor and categorize spending. This helps you save more each month.

Here’s a simple table to help you track your expenses:

| Category | Monthly Budget | Actual Spending |

|---|---|---|

| Rent/Mortgage | $1000 | $950 |

| Utilities | $200 | $180 |

| Groceries | $300 | $250 |

Reducing unnecessary expenses can free up more money. Use that money to pay off debts faster.

Here are some extra tips to help you:

- Review your credit report regularly.

- Dispute any errors you find.

- Keep your credit utilization below 30%.

Following these steps can improve your financial health. It ensures you maintain a good credit score.

Legal Protections For Consumers

Consumers have legal protections when dealing with late payments on credit reports. These protections help ensure fair treatment and accuracy. Understanding your rights can empower you to remove inaccurate late payments.

Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law. It promotes accuracy, fairness, and privacy of information in consumer reports. The FCRA provides guidelines for credit reporting agencies and data furnishers.

Under the FCRA, you have the right to dispute inaccurate information. Credit reporting agencies must investigate and correct any errors. This legal framework ensures that your credit report reflects true and accurate information.

Consumer Rights Under The Fcra

| Right | Description |

|---|---|

| Access to Your Credit Report | You can request a free credit report every 12 months from each major credit reporting agency. |

| Dispute Inaccurate Information | You can dispute inaccuracies directly with the credit reporting agencies. |

| Notification of Negative Information | Creditors must notify you before reporting negative information to a credit reporting agency. |

| Limitations on Access | Your credit report can only be accessed for legitimate business needs. |

Exercising your rights under the FCRA can help you maintain a clean credit report. Here’s a quick list of steps to follow:

- Request your free credit report.

- Review your report for inaccuracies.

- Dispute any errors with the credit reporting agencies.

- Follow up to ensure corrections are made.

Understanding these legal protections can help you navigate disputes effectively. Stay informed and proactive to protect your credit health.

Conclusion: Restoring Your Financial Health

Removing late payments from your credit report can be a game-changer. It paves the way to financial stability. This final section wraps up key strategies and offers guidance on rebuilding credit.

Recap Of Key Strategies

To remove late payments, consider these steps:

- Dispute Errors: Check your credit report for mistakes. Dispute any inaccuracies.

- Goodwill Letters: Write to creditors. Request removal of late payments.

- Negotiation: Settle debts. Request removal of negative marks.

- Automate Payments: Set up automatic payments. Avoid future late payments.

The Path Forward: Rebuilding Your Credit

After removing late payments, focus on rebuilding your credit. Here are the steps:

- Pay Bills on Time: Timely payments boost your credit score.

- Reduce Debt: Lower your credit card balances. Aim for under 30% utilization.

- Check Credit Reports: Regularly review your credit reports. Ensure accuracy.

- Build Positive History: Use credit responsibly. Demonstrate good financial habits.

Restoring your financial health requires dedication. Follow these steps to achieve a better credit score.

Credit: www.dochub.com

Can Cancelled Debt Affect Late Payments on My Credit Report?

Cancelled debt can impact late payments on a credit report, depending on how the lender reports it. If a debt is forgiven but was previously delinquent, the late payments may still appear. It’s important to check your credit file and take necessary steps to remove cancelled debt report if inaccuracies exist.

Frequently Asked Questions

Can I Get A Late Payment Removed From My Credit Report?

Yes, you can get a late payment removed. Contact your creditor and request a goodwill adjustment. Dispute inaccuracies with credit bureaus. Consider using a credit repair service. Regular timely payments improve your credit report.

What Is A 609 Letter To Remove Late Payments?

A 609 letter disputes inaccurate credit report items, including late payments. It leverages Section 609 of the Fair Credit Reporting Act.

What Do You Say To A Creditor To Remove Late Payments?

Politely request a goodwill adjustment. Explain the reason for the late payment and highlight your positive payment history.

How Long Does It Take To Repair Credit After Late Payments?

Repairing credit after late payments can take 6 months to 2 years. Consistent on-time payments speed up the process.

How To Remove Late Payments From Credit Report?

You can dispute inaccuracies, negotiate with creditors, or use goodwill letters to remove late payments from your credit report.

Conclusion

Removing late payments from your credit report boosts your financial health. Follow the steps outlined for better results. Consistent monitoring and timely actions can significantly improve your credit score. Take control of your financial future today. Stay persistent, and you’ll see positive changes in your credit report over time.