How to Freeze a Child’s Credit: Protect Their Future Today

To freeze a child’s credit, contact each of the three major credit bureaus. Provide necessary documents and complete their forms.

Freezing a child’s credit is a crucial step in protecting them from identity theft. Parents can safeguard their child’s financial future by taking this proactive measure.

Identity thieves often target children’s credit profiles because they are clean and unmonitored. A credit freeze restricts access to a child’s credit report, making it difficult for fraudsters to open accounts in their name.

This process involves contacting Equifax, Experian, and TransUnion, the three major credit bureaus. Parents must submit proof of identity and documentation to complete the freeze. By doing this, they can ensure their child’s financial security until they are old enough to manage their credit responsibly.

Why Freeze Your Child’s Credit

Freezing your child’s credit protects them from identity theft. It ensures their financial future stays secure. Thieves target kids because they have clean credit histories. By freezing their credit, you block unauthorized access.

Prevent Identity Theft

Identity theft can harm your child’s future. Thieves use stolen identities to open accounts. This can hurt your child’s credit score. A poor credit score affects future loans and job opportunities.

Freezing credit stops thieves from using your child’s information. It makes it harder for them to open new accounts. This keeps your child’s identity safe.

Safeguard Financial Future

A clean credit history is vital. Your child will need it for loans. Good credit helps with buying a car or a home. It also affects job applications.

Freezing credit now ensures a clean slate later. It protects your child’s financial future. Your child will thank you when they are older. They will have better opportunities because of your actions today.

| Benefit | Description |

|---|---|

| Prevent Identity Theft | Stops unauthorized use of your child’s personal information. |

| Safeguard Financial Future | Ensures a clean credit history for future financial needs. |

Understanding Credit Freezing

Freezing a child’s credit can protect their financial future. It helps prevent identity theft. This guide will explain the process. Let’s dive into the details.

What Is A Credit Freeze?

A credit freeze blocks access to a credit report. This stops new accounts from being opened. It’s a safety measure for your child’s credit.

People can’t check your child’s credit report. This means they can’t open new accounts. Your child’s credit stays safe.

How It Works

Freezing credit is simple. Follow these steps:

- Contact the three major credit bureaus: Equifax, Experian, and TransUnion.

- Provide proof of identity and guardianship.

- Request a credit freeze for your child.

Here’s a table showing what you need to provide:

| Document | Purpose |

|---|---|

| Birth Certificate | Proof of child’s identity |

| Social Security Card | Child’s Social Security Number |

| Parent ID | Proof of parent or guardian |

| Address Proof | Parent’s address verification |

Once the credit freeze is in place, it stays until you lift it. You can lift it temporarily or permanently.

When To Consider Freezing

Freezing a child’s credit is a smart move. It protects against identity theft. Knowing when to freeze is crucial. Two key times to consider are during early warning signs and ideal timing.

Early Warning Signs

Be vigilant for early warning signs. These signs include:

- Unexpected bills in your child’s name

- Credit offers addressed to your child

- Phone calls from collection agencies

Act quickly if you notice these signs. Freezing credit can prevent further damage.

Ideal Timing

Sometimes, freezing credit is preventive. Ideal timings include:

- Before your child gets a job

- When enrolling in school

- After a data breach

Protect your child by freezing credit during these times. It adds a layer of security.

| Event | Action |

|---|---|

| Unexpected bills | Freeze credit immediately |

| Before a job | Freeze credit |

| Data breach | Freeze credit |

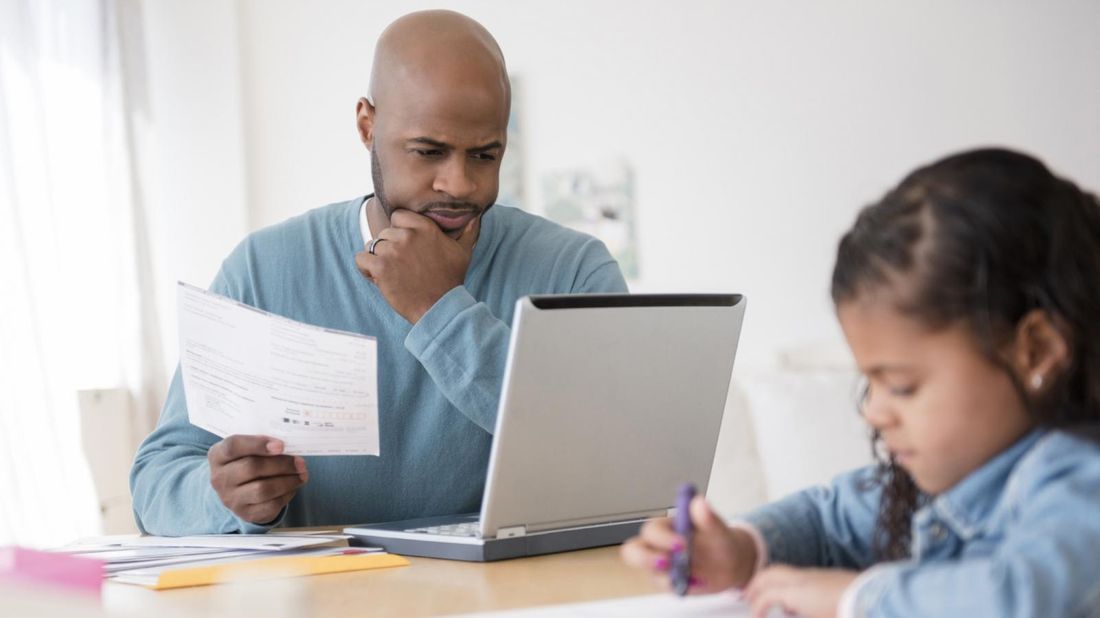

Credit: www.northwesternmutual.com

Required Documentation

Freezing your child’s credit is an important step to prevent identity theft. It requires specific documents to verify your identity and guardianship. Below, we outline the essential documents needed for this process.

Proof Of Identity

To freeze your child’s credit, you need to provide proof of identity. This helps confirm you are who you say you are. Acceptable forms include:

- Government-issued ID (Driver’s License, Passport)

- Social Security card

- Birth certificate

Ensure these documents are current and unexpired. Photocopy each one clearly and legibly. This makes the verification process smoother and faster.

Proof Of Guardianship

You’ll also need to provide proof of guardianship. This confirms you have the legal right to manage your child’s credit. Required documents include:

- Child’s birth certificate

- Legal guardianship papers (if not the biological parent)

- Custody agreement (if applicable)

These documents must be official and up-to-date. They establish your authority to act on behalf of your child. If documents are not in English, provide a certified translation.

| Document Type | Examples | Notes |

|---|---|---|

| Proof of Identity | ID, Passport, Social Security card | Must be current |

| Proof of Guardianship | Birth Certificate, Guardianship Papers | Must be official |

Gathering these documents in advance saves time. It ensures the credit freeze request proceeds without delays.

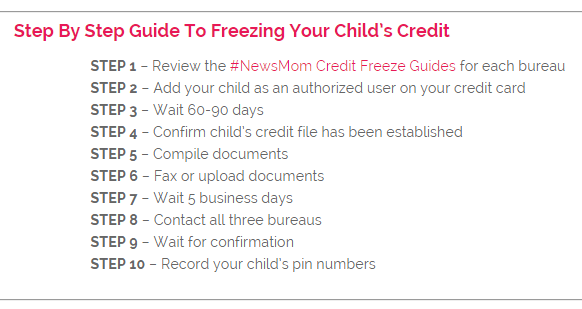

Steps To Freeze Credit

Freezing your child’s credit is a crucial step. It protects them from identity theft. Follow these steps to ensure their financial safety.

Contact Credit Bureaus

First, you must contact the three major credit bureaus. These are Equifax, Experian, and TransUnion. You can call them or visit their websites. Below is their contact information:

| Credit Bureau | Phone Number | Website |

|---|---|---|

| Equifax | 1-800-685-1111 | equifax.com |

| Experian | 1-888-397-3742 | experian.com |

| TransUnion | 1-800-916-8800 | transunion.com |

Submit Necessary Forms

Next, you need to submit the required forms. Each bureau has its forms. You will need:

- Your child’s birth certificate

- Your child’s Social Security card

- Your ID (driver’s license or passport)

- Proof of address (utility bill or bank statement)

Make sure you have copies of these documents. Send them to each credit bureau. You can mail or upload them online. Follow the instructions on each bureau’s website.

After submitting, the bureaus will process your request. They will notify you once the freeze is in place. This process may take a few days. Keep a record of all correspondences for future reference.

Credit: www.cbsnews.com

Managing The Freeze

Freezing a child’s credit is a smart way to protect against identity theft. After freezing their credit, it’s important to manage and monitor it. This ensures your child’s information stays safe.

Monitoring Credit Reports

Regularly check your child’s credit reports for any suspicious activity. Use the three major credit bureaus: Equifax, Experian, and TransUnion.

- Request a copy of your child’s credit report from each bureau.

- Look for any accounts you did not open.

- Note any incorrect personal information.

Set reminders to check these reports every year. This helps catch any issues early.

Lifting The Freeze

Sometimes, you might need to lift the freeze temporarily. This can be for things like applying for a student loan or a job. Here’s how to do it:

- Contact each of the three credit bureaus.

- Provide the necessary identification and proof of guardianship.

- Request a temporary lift or permanent removal of the freeze.

Keep the PIN or password you used to freeze the credit. You will need it to lift the freeze.

| Credit Bureau | Contact Information |

|---|---|

| Equifax | 1-800-685-1111 |

| Experian | 1-888-397-3742 |

| TransUnion | 1-800-916-8800 |

Always keep a record of your interactions with the credit bureaus. This helps in case you need to reference them later.

Potential Challenges

Freezing your child’s credit is a smart move to protect them. Yet, this process isn’t always straightforward. Parents may encounter several obstacles along the way. Understanding these challenges will help you navigate them more effectively.

Common Obstacles

Parents often face three main issues when freezing their child’s credit:

- Gathering Required Documents

- Dealing with Different Credit Bureaus

- Understanding Legal Requirements

Gathering required documents can be time-consuming. You need to collect birth certificates, social security cards, and your ID. Each credit bureau may ask for different documents. This adds to the complexity.

Dealing with different credit bureaus is another hurdle. Equifax, Experian, and TransUnion have their own processes. You must contact each bureau separately. This can be confusing and tedious.

Understanding legal requirements can also be tricky. Each state has its own laws regarding credit freezes. Keeping track of these laws is essential but challenging.

How To Overcome Issues

There are ways to tackle these challenges effectively:

| Challenge | Solution |

|---|---|

| Gathering Required Documents | Create a checklist of needed documents. Organize them in advance. |

| Dealing with Different Credit Bureaus | Visit each bureau’s website. Follow their specific instructions carefully. |

| Understanding Legal Requirements | Research your state’s laws. Consult a legal expert if needed. |

Creating a checklist for documents can simplify the process. Ensure all required papers are ready before starting. This saves time and reduces stress.

Visiting each credit bureau’s website helps you follow their specific steps. Each bureau has detailed instructions. Reading these carefully will guide you through their process.

Researching state laws is crucial. Legal requirements vary by state. Knowing these laws helps you comply without issues. If unsure, consult a legal expert for advice.

Credit: www.nerdwallet.com

Long-term Benefits

Freezing a child’s credit has several long-term benefits. This protective measure ensures their financial future is safeguarded. Parents can rest easy knowing their child’s credit is secure. Let’s explore the key benefits below.

Peace Of Mind

Freezing your child’s credit provides peace of mind. It prevents identity thieves from opening accounts in their name. Parents don’t need to worry about unauthorized loans or credit cards. This safeguard ensures their child’s financial identity remains intact. It reduces the risk of unexpected debts appearing later.

Future Financial Health

Ensuring a child’s credit is frozen benefits their future financial health. They will have a clean credit report when they become adults. This clean slate helps them secure loans or credit cards easily.

Key benefits include:

- Better interest rates

- Higher chances of loan approvals

- Improved credit score

Freezing credit early can shape a child’s financial stability. It prepares them for a successful financial future.

Can Freezing a Child’s Credit Help Remove Negative Items from Their Credit Report?

Freezing a child’s credit can prevent identity theft, but it won’t remove negative items from their credit report. To remove repossession from a child’s credit report, the parent or legal guardian can send a sample letter to remove repossession to the credit bureaus, requesting the item’s removal.

Can an Experian Freeze Help Protect My Child’s Credit?

An Experian freeze can be a crucial step in safeguarding your child’s financial future. By placing an experian freeze to protect your credit easily, you can help prevent identity thieves from opening accounts in your child’s name. This security measure ensures their credit remains intact until they’re ready to use it.

Frequently Asked Questions

1. Can You Freeze Your Child’s Credit?

Yes, you can freeze your child’s credit. Contact the three major credit bureaus: Equifax, Experian, and TransUnion. Provide necessary documents.

2. Can I Freeze My Child’s Social Security Number?

Yes, you can freeze your child’s social security number. Contact major credit bureaus to initiate the freeze. This helps protect against identity theft.

3. How Do I Lock My Child’s Social Security Number For Taxes?

To lock your child’s Social Security number, contact the IRS and request an Identity Protection PIN. This PIN prevents unauthorized use.

4. Can I Use My Child’s Social Security Number For Credit?

No, using your child’s social security number for credit is illegal. It constitutes identity theft and can lead to severe penalties. Always protect your child’s personal information.

5. What Is A Credit Freeze?

A credit freeze restricts access to your child’s credit report, preventing identity theft.

Conclusion

Freezing your child’s credit is a crucial step to protect their financial future. It’s straightforward and highly effective. Follow the steps outlined in this guide to ensure your child’s personal information stays secure. Taking action now can prevent potential identity theft and provide peace of mind.