When Disputing Credit Reports: What Reason Wins?

Disputing credit report errors can improve your credit score and ensure accurate financial information. Common reasons include incorrect personal details, fraudulent accounts, and reporting errors.

Credit reports play a crucial role in financial health. Errors on these reports can negatively impact your credit score and borrowing capabilities. Disputing inaccuracies is essential for maintaining a good credit standing. Common reasons for disputes include incorrect personal information, fraudulent accounts, and reporting errors.

Addressing these issues promptly can prevent long-term financial consequences. It’s important to regularly review your credit reports from major bureaus like Experian, TransUnion, and Equifax. Timely disputes can lead to corrections that improve your credit score and financial credibility. Always keep documentation to support your claims when filing a dispute.

Credit: formspal.com

The Power Of Accuracy In Credit Reporting

Credit reports play a key role in financial health. Accurate information is crucial for fair credit scoring. Errors in credit reports can lead to denied loans and higher interest rates. This section explores why accuracy matters and how to ensure your credit report is correct.

The Impact Of Errors On Your Credit Score

Credit scores determine many financial opportunities. Errors in your credit report can lower your score. This affects your ability to get loans, credit cards, and mortgages. Even small mistakes can have big impacts.

- Incorrect personal information

- Wrong account details

- Duplicate accounts

- Unrecorded payments

These errors can result in penalties. Your credit score might drop by dozens of points. It’s essential to identify and dispute these errors quickly.

The Importance Of Monitoring Credit Reports

Regularly checking your credit report helps catch errors early. It also allows you to track your financial health. Monitoring helps you stay informed about changes to your report.

| Monitoring Frequency | Benefits |

|---|---|

| Monthly | Quick error detection, better fraud prevention |

| Quarterly | Balanced approach, less frequent checks |

| Annually | Less effort, but may miss timely errors |

Free tools and services are available for monitoring. Use them to keep your report accurate and up-to-date.

Common Errors On Credit Reports

Credit reports often contain mistakes that can impact your credit score. These errors need immediate attention to ensure accurate financial representation. Identifying common errors is the first step in disputing them. Here are some frequent issues found on credit reports:

Mistaken Identity And Mixed Files

Mistaken identity and mixed files can occur when credit data from another person with a similar name or Social Security number appears on your report. This issue can lead to incorrect information affecting your credit score.

- Incorrect Social Security numbers

- Wrong names

- Addresses you’ve never lived at

These errors can be especially damaging and need swift correction.

Incorrect Account Information

Incorrect account information includes errors related to your existing credit accounts. These inaccuracies can significantly affect your credit score.

| Type of Error | Description |

|---|---|

| Wrong Balance | Reported balance differs from actual balance |

| Wrong Account Status | Open accounts reported as closed |

| Duplicate Accounts | Same account listed more than once |

Outdated Historical Data

Outdated historical data includes old information that should no longer be on your credit report. This data can unfairly lower your credit score.

- Old late payments

- Paid-off debts still showing as unpaid

- Bankruptcies older than ten years

Ensuring your credit report is current is crucial for maintaining a good credit score.

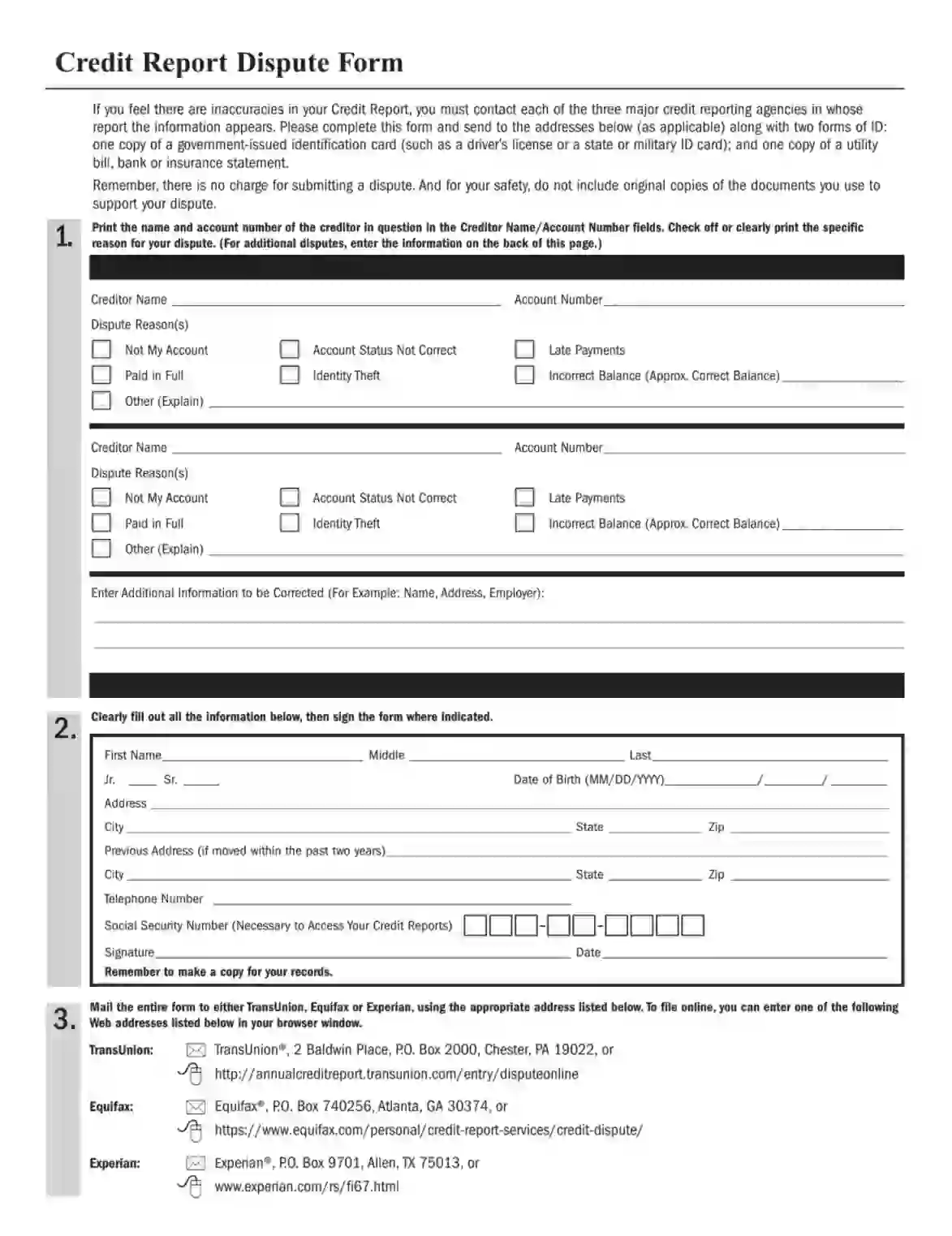

The Dispute Process Explained

Disputing errors on your credit report is crucial. It ensures accurate financial records. This process involves specific steps. Knowing these steps helps you correct mistakes efficiently.

Starting A Credit Report Dispute

Begin by obtaining a copy of your credit report. You can get a free report annually from each of the three major bureaus: Equifax, Experian, and TransUnion.

Once you have your report, review it carefully. Look for inaccuracies such as incorrect personal information, wrong account details, or fraudulent activities.

To start a dispute, contact the credit bureau in writing. Include the following details:

- Your complete name and address

- Details of the disputed item

- Explanation of why you are disputing it

- Supporting documents as evidence

Send your dispute via certified mail. Request a return receipt to ensure your letter is received.

What Happens After Filing A Dispute?

After you file a dispute, the credit bureau investigates. They contact the information provider, usually within 30 days.

The information provider must review your dispute. They examine the evidence you provided. They then report back to the credit bureau.

If your dispute is valid, the credit bureau updates your report. They remove or correct the inaccurate information. You receive a free copy of your updated report.

If your dispute is denied, the bureau will notify you. They provide reasons for the denial. You can add a statement to your report. This statement explains your dispute for future creditors.

Understanding the dispute process is vital. It helps maintain accurate and fair credit records. This ensures better financial opportunities in the future.

Effective Dispute Reasons

Disputing credit report errors is essential for maintaining a healthy credit score. Understanding the effective dispute reasons can help you correct inaccuracies swiftly. Below are some powerful reasons to use when disputing your credit report.

Unverifiable Information

Credit bureaus must verify the information they report. If they can’t, they must remove it. Unverifiable information includes:

- Incorrect account numbers

- Outdated personal details

- Unrecognized credit inquiries

Always check for information that doesn’t match your records. Request verification for any discrepancies. Ensure all details are accurate and up-to-date.

Fraudulent Activity And Identity Theft

Fraudulent activity or identity theft can damage your credit score. If you find any suspicious accounts or transactions, use these steps:

- File a police report

- Contact the Federal Trade Commission (FTC)

- Notify the credit bureaus

Provide documentation to support your claims. Request the removal of fraudulent accounts. Protect your identity to avoid future issues.

Errors In Account Status

Errors in account status can lead to lower credit scores. Common errors include:

| Error Type | Description |

|---|---|

| Late Payments | Reported as late when paid on time |

| Closed Accounts | Marked as open or vice versa |

| Incorrect Balances | Showing incorrect debt amounts |

Always verify your account status. Report any errors you find. Request corrections to reflect accurate information.

Evidence That Strengthens Your Dispute

When disputing credit report errors, evidence is key. Solid proof can expedite your case. It can also increase the likelihood of a favorable outcome.

Gathering Documentation

Start by collecting all relevant documents. These include bank statements, loan agreements, and payment receipts. Keep everything organized. Create a folder for each account in question.

Use copies, not originals. Highlight important details, like transaction dates and amounts. This helps the credit bureau quickly identify errors.

| Document Type | Purpose |

|---|---|

| Bank Statements | Show proof of payments made |

| Loan Agreements | Verify loan details and terms |

| Payment Receipts | Confirm transactions |

Statements From Creditors

Contact your creditors for statements. These statements can confirm your claims. Request a letter from them. The letter should outline the error and the correct information.

Ensure the letter is on the creditor’s letterhead. It should include the creditor’s contact details. This adds credibility to your dispute.

- Creditor’s letterhead

- Contact information

- Clear explanation of the error

- Corrected information

Gathering strong evidence is crucial. It supports your dispute and strengthens your case. Ensure your evidence is clear and concise.

Credit: www.cambiomoney.com

Communicating With Credit Bureaus

Disputing errors on your credit report is essential. Communicating with credit bureaus is the first step. It is vital to follow proper procedures. This ensures your dispute gets attention. Learning the best ways can improve your chances of success.

Crafting A Convincing Dispute Letter

Writing a clear and concise dispute letter is crucial. Your letter should include:

- Your personal information: name, address, and Social Security number

- Details of the disputed item: account number, creditor’s name

- A clear explanation of the error

- Any supporting documents

Use a polite and professional tone. This increases the chances of a positive response. Clearly state your request. For example:

“I am writing to dispute the following information in my file. The item I dispute is incorrect. Please correct or remove this information.”

Attach copies, not originals, of supporting documents. This includes bank statements or payment receipts. These documents back up your claim.

Following Up On Disputes

After sending your dispute letter, follow up. Ensure the bureau received your letter. You can call or email the bureau. Keep track of dates and responses.

Check your credit report again after 30 days. The bureau must investigate within this time. If the error remains, escalate the issue. Contact the creditor directly. Provide them with the same information.

| Step | Action |

|---|---|

| 1 | Send dispute letter |

| 2 | Follow up with bureau |

| 3 | Check report after 30 days |

| 4 | Escalate if necessary |

Persistence is key. Keep all records of communication. This helps in case of further disputes.

Legal Rights Under The Fcra

Disputing errors on your credit report can be daunting. Understanding your legal rights under the Fair Credit Reporting Act (FCRA) is crucial. The FCRA provides protections and ensures your credit report is accurate and fair.

Understanding Your Protections

The FCRA offers several protections for consumers. These include:

- The right to access your credit report annually for free.

- The right to dispute incomplete or inaccurate information.

- The right to have incorrect information corrected or deleted.

- The right to know if your credit information is used against you.

You also have the right to a response from the credit bureau within 30 days. They must investigate your dispute and report back to you.

When To Seek Legal Assistance

Sometimes, you may need legal help to resolve credit report disputes. Consider seeking legal assistance if:

- Your dispute is ignored by the credit bureau.

- Incorrect information remains on your report after a dispute.

- You face identity theft or fraud issues.

- You experience significant financial harm due to errors.

Consulting a lawyer can help enforce your rights under the FCRA. Legal professionals can guide you through the process and ensure fair treatment.

Avoiding Dispute Denials

Disputing credit reports can be challenging, but avoiding denials is crucial. Many disputes fail due to common errors. Learn how to navigate the process effectively.

Common Pitfalls In Credit Disputes

Many people make simple mistakes in their credit disputes. These errors often lead to denial of their claims. Below are some common pitfalls:

- Incomplete Information: Missing details can weaken your dispute.

- Vague Descriptions: Be specific about the errors you find.

- Unorganized Documentation: Ensure all documents are well-organized.

- Failure to Follow Up: Always follow up on your dispute status.

Keeping Disputes Focused And Clear

A focused and clear dispute has a higher chance of success. Here are some tips to keep your disputes on point:

- Identify the Error: Clearly state the error you are disputing.

- Provide Evidence: Attach copies of documents that support your claim.

- Use a Simple Explanation: Write a brief and clear explanation of the error.

- Stay Organized: Keep all your documents and correspondence in order.

By following these steps, you can avoid common pitfalls and improve your chances of a successful credit report dispute.

When Credit Bureaus Don’t Budge

Disputing credit reports can be a complex process. Sometimes, credit bureaus refuse to change your report. This can be frustrating. Knowing your options is crucial. Let’s explore what steps you can take next.

Options After A Dispute Is Rejected

If your dispute is rejected, don’t lose hope. Here are some steps to consider:

- Review the rejection reason: Understand why your dispute was denied.

- Gather more evidence: Collect additional documents to support your claim.

- Re-submit your dispute: With new evidence, try again.

- Contact the creditor: Sometimes, the issue is with the original creditor.

| Step | Action |

|---|---|

| 1 | Review the rejection reason |

| 2 | Gather more evidence |

| 3 | Re-submit your dispute |

| 4 | Contact the creditor |

The Role Of The Consumer Financial Protection Bureau

If all else fails, the Consumer Financial Protection Bureau (CFPB) can help. The CFPB protects consumers in the financial sector. They handle complaints about credit reporting.

You can file a complaint with the CFPB. Follow these steps:

- Visit the CFPB website.

- Fill out the complaint form.

- Provide all relevant details and documents.

- Submit the complaint.

The CFPB will investigate your complaint. They will contact the credit bureau on your behalf. This can often lead to a resolution.

Maintaining Healthy Credit Post-dispute

Disputing credit reports can be a challenging task. Once the dispute is settled, maintaining healthy credit is crucial. This ensures long-term financial stability and peace of mind. The following sections provide essential steps to keep your credit in good shape.

Regularly Reviewing Your Credit Report

It is important to regularly review your credit report to ensure accuracy. Mistakes can occur, and catching them early helps avoid future issues. You can request a free credit report from major bureaus once a year.

| Credit Bureau | Website |

|---|---|

| Experian | experian.com |

| Equifax | equifax.com |

| TransUnion | transunion.com |

Review your report for any discrepancies. Look for incorrect personal information, wrong account details, and unfamiliar inquiries. If you find errors, dispute them immediately with the credit bureau.

Building Positive Credit Habits

Developing positive credit habits is essential for maintaining a healthy credit score. Start by paying your bills on time. Late payments can significantly impact your credit score.

Another key habit is keeping your credit utilization low. Aim to use less than 30% of your available credit. This shows lenders you can manage your credit responsibly.

- Set up automatic payments to avoid missing due dates.

- Pay off high-interest debts first to save on interest.

- Monitor your credit score regularly to track your progress.

- Avoid opening too many new accounts at once.

- Keep old accounts open to maintain a long credit history.

These habits can help you build and maintain a strong credit profile. Remember, a healthy credit score opens up better financial opportunities.

Credit: nwclc.org

Frequently Asked Questions

What Is The Best Reason To Use When You Dispute A Credit Report?

The best reason to dispute a credit report is to correct inaccurate information. Errors can harm your credit score. Accurate reports ensure fair lending decisions. Always provide supporting documents to strengthen your case.

What Is The Best Reason To Put When Disputing A Collection?

The best reason is inaccurate information. Dispute based on errors in the account details, dates, or amounts owed.

What Should I Say To Dispute On My Credit Report?

State the incorrect item, provide evidence, and request correction. Be polite, concise, and include your contact information.

What Qualifies For A Credit Dispute?

Errors in your credit report qualify for a credit dispute. Inaccurate personal information, incorrect account details, and fraudulent activity are common reasons. Always provide supporting documents.

What Is A Credit Report Dispute?

A credit report dispute is when you challenge incorrect information on your credit report with the credit bureaus.

Conclusion

Addressing credit report errors can significantly improve your financial health. Always check your reports regularly and dispute inaccuracies promptly. A clean credit report opens doors to better loan terms and financial opportunities. Stay proactive and informed to maintain a strong credit profile.

Your future self will thank you.