FCRA Section 623: Understanding Compliance Requirements

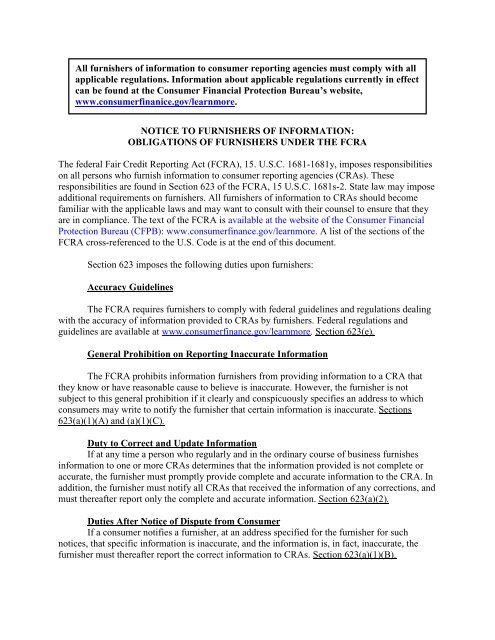

FCRA Section 623 regulates the responsibilities of information furnishers regarding the accuracy of credit report information. It ensures consumer protection against incorrect data.

FCRA Section 623 is vital for maintaining accurate credit reporting. This section mandates that entities providing information to credit bureaus must ensure its accuracy and completeness. These entities, often creditors or lenders, must investigate disputes raised by consumers. They are required to correct any inaccuracies found during the investigation.

This process safeguards consumers from potential financial harm due to incorrect credit information. Compliance with Section 623 helps maintain trust in the credit reporting system. Businesses must adhere to these guidelines to avoid penalties and uphold consumer rights. Understanding these responsibilities is crucial for both consumers and businesses in maintaining fair credit practices.

Introduction To Fcra Section 623

FCRA Section 623 deals with credit reporting rules. It ensures accurate reporting of credit information. Businesses must comply to avoid penalties. This section is vital for maintaining fair credit practices.

Importance Of Compliance

Compliance with FCRA Section 623 is crucial. It ensures accurate credit reports. This helps consumers get fair treatment. Businesses also avoid legal troubles.

- Accuracy: Ensures correct information in credit reports.

- Fairness: Prevents unfair credit practices.

- Legal Safety: Protects businesses from lawsuits.

Historical Context

The Fair Credit Reporting Act (FCRA) was enacted in 1970. It aimed to protect consumers. Section 623 was added to ensure accurate credit reporting. Over the years, it has evolved to address new challenges.

| Year | Event |

|---|---|

| 1970 | FCRA was enacted. |

| 1996 | Section 623 was added. |

| 2003 | FACT Act amendments. |

Credit: www.ecfr.gov

Key Compliance Requirements

Understanding Key Compliance Requirements under FCRA Section 623 is essential for data furnishers. This section mandates specific obligations to ensure the accuracy and integrity of consumer information. Let’s explore the critical areas in this section.

Accuracy Of Information

Data furnishers must ensure the accuracy of the information they provide. This involves verifying all details before submission. Inaccurate data can harm a consumer’s credit report.

- Verify consumer’s personal details

- Ensure all account information is up-to-date

- Cross-check payment histories

Maintaining accuracy prevents incorrect credit decisions and legal repercussions.

Duty To Correct Errors

Furnishers have a duty to correct errors promptly. If an error is discovered, it must be corrected within a reasonable time frame. This ensures that consumer reports are accurate and fair.

- Identify the error

- Investigate the cause

- Correct the information in all databases

Prompt error correction maintains trust and prevents disputes.

Responsibilities Of Furnishers

Furnishers play a crucial role in the credit reporting system. They provide data to consumer reporting agencies (CRAs). Ensuring the accuracy and integrity of this data is essential. Under FCRA Section 623, furnishers must follow specific guidelines.

Reporting Guidelines

- Ensure accuracy: Furnishers must report accurate information.

- Regular updates: Furnishers should update information regularly.

- Correct errors: If errors are found, they must correct them.

Furnishers must not report outdated or unverifiable data. They should use clear and consistent methods. This helps maintain data integrity.

Response To Disputes

Consumers have the right to dispute inaccuracies. Furnishers must handle these disputes promptly.

- Investigate disputes: Conduct a thorough investigation.

- Review evidence: Examine all relevant information.

- Correct errors: Update or delete incorrect data.

- Notify CRAs: Inform CRAs about any changes.

Furnishers must complete investigations within 30 days. They should also provide consumers with the results.

| Responsibility | Description |

|---|---|

| Accuracy | Report correct and up-to-date information. |

| Timeliness | Update information regularly and promptly. |

| Dispute Handling | Investigate and resolve disputes within 30 days. |

Consumer Rights Under Section 623

Section 623 of the Fair Credit Reporting Act (FCRA) outlines consumer rights. This section ensures accuracy in your credit reports. It obligates furnishers of information to follow certain duties.

Dispute Process

If you find an error in your credit report, you can dispute it. You can contact the furnisher directly to start a dispute. Furnishers must investigate your dispute within 30 days. They must inform the credit bureaus of the results. If an error is found, they must correct it.

- Submit your dispute in writing.

- Include any supporting documents.

- Keep copies of all correspondence.

Furnishers must notify credit bureaus if information is disputed. They must not report disputed information without noting the dispute.

Timely Corrections

Errors in your credit report should be corrected promptly. Furnishers must correct mistakes within 30 days. This ensures your credit report stays accurate. If they find an error, they must update the information with all credit bureaus.

| Action | Timeframe |

|---|---|

| Investigation of Dispute | 30 Days |

| Correction of Errors | 30 Days |

Furnishers who fail to correct errors face penalties. You can report non-compliance to the Consumer Financial Protection Bureau (CFPB). Keeping your credit report accurate helps maintain your financial health.

Penalties For Non-compliance

Non-compliance with FCRA Section 623 brings serious consequences. Businesses and individuals must adhere to this law. Understanding the penalties can help avoid violations.

Legal Consequences

Violating FCRA Section 623 can lead to legal actions. The Federal Trade Commission (FTC) enforces these rules.

Legal consequences include:

- Fines imposed by the FTC

- Lawsuits from affected consumers

- Injunctions to prevent further violations

These legal actions can tarnish a company’s reputation. They also result in costly court battles.

Financial Repercussions

Non-compliance can hurt financially. Companies face heavy financial penalties.

Financial repercussions include:

- Fines up to $3,500 per violation

- Compensatory damages to affected consumers

- Class-action lawsuits leading to massive payouts

These financial hits can cripple small businesses. They also strain resources of larger firms.

Maintaining compliance is vital. It safeguards against these severe penalties.

Credit: www.scribd.com

Best Practices For Compliance

Compliance with FCRA Section 623 is crucial for credit information furnishers. Following best practices helps avoid penalties and ensures accurate reporting. Here are some key practices to ensure compliance.

Regular Audits

Performing regular audits is essential. Audits help identify errors in credit reporting. They also ensure that the data furnished is accurate and up-to-date. Here are some steps for effective audits:

- Schedule audits quarterly.

- Review all credit reports.

- Compare reported data with internal records.

- Correct any discrepancies immediately.

Training And Education

Proper training and education for staff is vital. Ensure that all team members understand FCRA Section 623 requirements. Training programs should cover:

- Details of FCRA Section 623.

- Procedures for accurate data reporting.

- Steps to correct errors promptly.

Regular training sessions help reinforce knowledge and update staff on any changes in regulations.

Case Studies

Studying case studies of Fcra Section 623 can provide valuable insights. This section explores real-world examples of both successful compliance and lessons from violations.

Successful Compliance

Many companies have successfully implemented Fcra Section 623. These cases highlight best practices:

- ABC Corp – They trained their staff effectively. This led to accurate reporting and minimal errors.

- XYZ Inc. – They used automated systems. This ensured timely updates and compliance.

These businesses achieved success by focusing on key areas:

| Company | Strategy | Outcome |

|---|---|---|

| ABC Corp | Staff Training | Accurate Reporting |

| XYZ Inc | Automated Systems | Timely Updates |

Lessons From Violations

Some companies faced violations under Fcra Section 623. These examples teach important lessons:

- DEF Ltd – They failed to update records. This led to outdated information and penalties.

- GHI Co – They neglected consumer disputes. This resulted in customer complaints and legal issues.

These violations highlight the need for:

- Regular updates to records

- Prompt resolution of consumer disputes

By understanding these cases, businesses can avoid similar mistakes. Focus on compliance to ensure successful outcomes.

Credit: www.yumpu.com

Future Trends

The future of Fcra Section 623 is evolving. Key trends will shape its path. Let’s explore these trends.

Regulatory Changes

Regulatory changes will impact Fcra Section 623. Governments will update laws to improve transparency. New rules will ensure data accuracy and privacy. Compliance will become more stringent.

Here are some expected changes:

- Stricter data reporting standards

- Enhanced consumer rights

- Increased penalties for non-compliance

Technological Advancements

Technological advancements will revolutionize Fcra Section 623. Innovations will make data handling more efficient. Automation and AI will play significant roles.

Key technological trends include:

| Advancement | Impact |

|---|---|

| Artificial Intelligence | Improves data accuracy |

| Blockchain | Enhances data security |

| Automation | Streamlines reporting processes |

These trends will redefine Fcra Section 623. Organizations must stay updated. The future promises better data practices.

Frequently Asked Questions

1. What Is Section 623 Of Fcra?

Section 623 of the FCRA regulates how financial institutions report consumer credit information. It ensures accuracy and completeness.

2. What Is Section 623?

Section 623 of the Fair Credit Reporting Act regulates the responsibilities of information furnishers to credit reporting agencies. It ensures accuracy and integrity in credit reporting.

3. What Is 623 Credit Law?

The 623 credit law allows consumers to dispute inaccurate information on their credit report directly with the creditor. This law ensures that credit reporting agencies and creditors maintain accurate records, offering protection to consumers.

4. What Does It Mean If A Debt Meets FCRA Requirements?

A debt meeting FCRA requirements means it complies with Fair Credit Reporting Act standards. It ensures accurate, fair credit reporting.

Conclusion

Understanding FCRA Section 623 is crucial for managing your credit report. Adhering to its guidelines protects your financial health. Stay informed and proactive to ensure accuracy. Regularly check your credit report for discrepancies. This knowledge empowers you to maintain a strong credit standing.

Take control of your financial future today.