FCRA Adverse Action: Understanding Your Rights

FCRA Adverse Action refers to a negative employment decision based on a consumer report. Employers must notify candidates if such actions are taken.

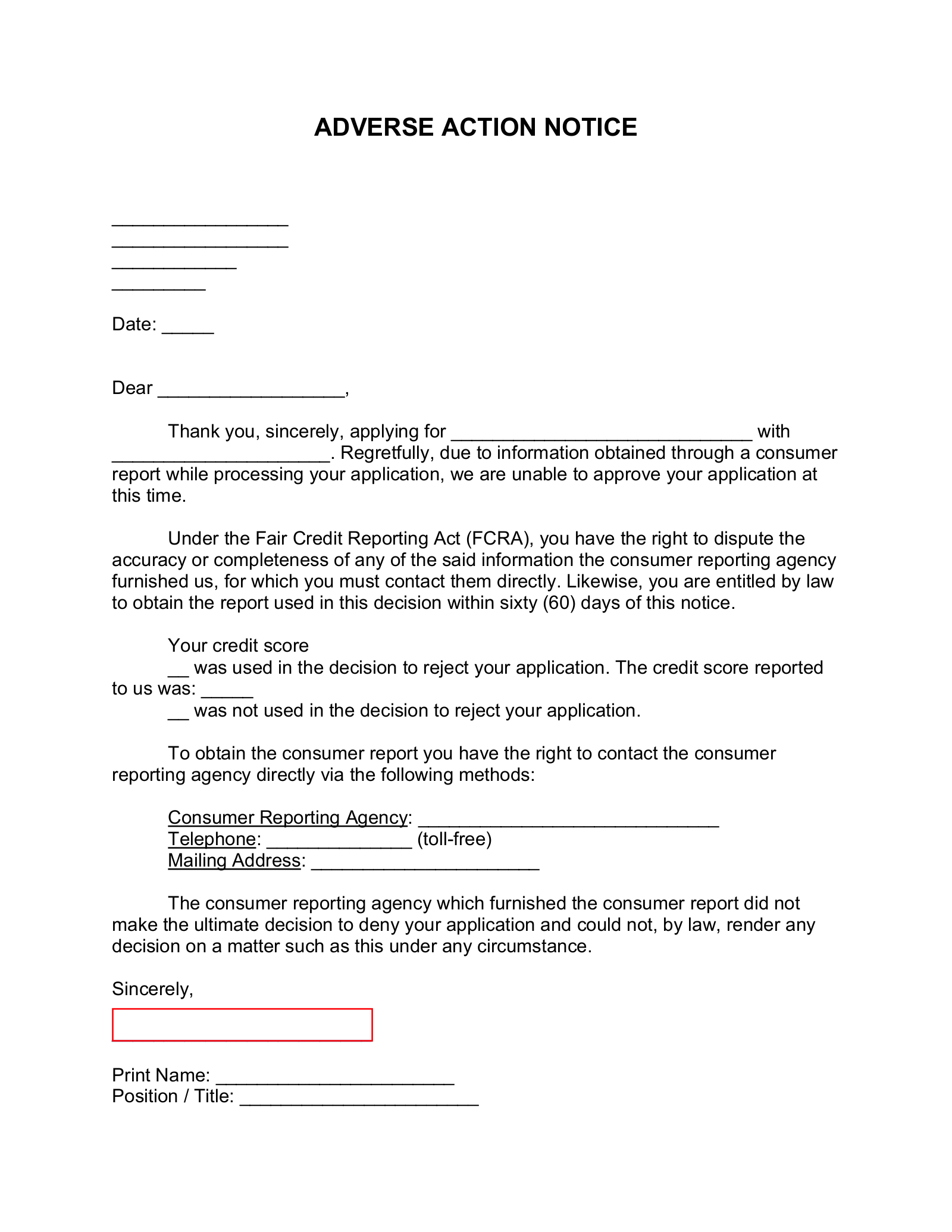

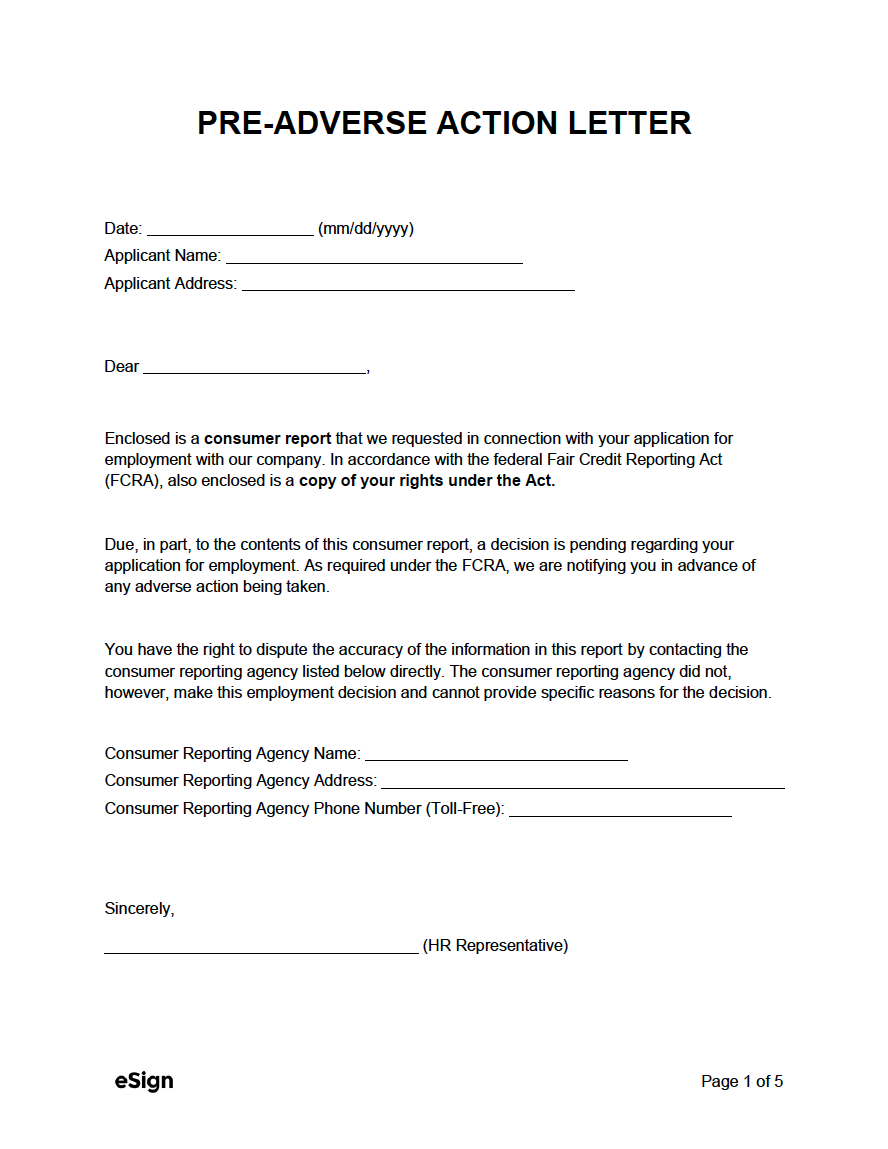

Adverse action is a crucial aspect of the Fair Credit Reporting Act (FCRA). It occurs when an employer takes a negative employment decision—like denial of employment, demotion, or termination—based on information found in a consumer report. Employers must follow specific procedures to remain compliant with FCRA regulations.

They must provide a pre-adverse action notice, a copy of the consumer report, and a summary of rights under the FCRA to the affected individual. This ensures transparency and allows the individual to dispute any inaccuracies in the report. Proper adherence to these steps helps maintain fairness in employment practices.

Credit: preemploymentdirectory.com

What Is Fcra Adverse Action?

The Fair Credit Reporting Act (FCRA) safeguards consumers’ rights. One of its key aspects is adverse action. This happens when a decision negatively impacts a consumer based on their credit report. Understanding FCRA adverse action is crucial for both businesses and consumers.

Definition And Importance

Adverse action refers to any negative decision impacting a consumer. This can include rejecting a loan application, denying a rental agreement, or refusing a job offer. The FCRA ensures that consumers are informed about these decisions.

Businesses must notify consumers of adverse actions. This allows consumers to know the reason behind the decision. It also gives them a chance to correct any errors in their credit report.

Legal Implications

The FCRA mandates specific steps for adverse actions. Businesses must provide a notice of adverse action to the consumer. This notice should include:

- The name, address, and phone number of the credit reporting agency.

- A statement that the agency did not make the decision.

- The consumer’s right to obtain a free copy of their report.

- The right to dispute any inaccuracies in the report.

Failing to comply with these requirements can lead to legal consequences. Consumers can file complaints with the Federal Trade Commission (FTC). They can also take legal action to seek damages.

Common Reasons For Adverse Action

Adverse action refers to any decision that negatively affects an individual. It often involves employment, credit, or housing applications. Understanding the common reasons helps you prepare and address potential issues. Below, we explore some primary causes.

Credit Report Issues

Credit report issues often lead to adverse action. Lenders and employers review your credit history. They assess your financial responsibility. Common credit report issues include:

- Late payments: Missing payments on loans or credit cards.

- High debt-to-income ratio: Owing more than your income.

- Bankruptcy: Previous bankruptcy filings.

- Foreclosure: Losing property due to unpaid mortgage.

Monitoring your credit report regularly can help. Dispute inaccuracies to improve your score.

Background Check Concerns

Background checks reveal critical information. Employers and landlords use them to make decisions. Common concerns that result in adverse action include:

- Criminal history: Past convictions or arrests.

- Employment history: Job gaps or terminations.

- Education verification: Inaccurate degree information.

- Professional licenses: Issues with required certifications.

Being honest about your history can help. Provide explanations for any potential concerns.

Your Rights Under Fcra

The Fair Credit Reporting Act (FCRA) provides you with important rights. These rights protect you during adverse actions related to your credit reports. Understanding your rights helps ensure fair treatment.

Notification Requirements

Under the FCRA, companies must notify you about adverse actions. This includes denied credit, employment, or insurance. You must receive a notice explaining the decision.

The notice must include:

- The name of the credit reporting agency (CRA) that provided the report.

- Your right to receive a free copy of your credit report.

- Your right to dispute inaccurate or incomplete information.

Dispute Process

If you find errors in your credit report, you can dispute them. The FCRA gives you the right to correct inaccurate or incomplete information.

To dispute an error, follow these steps:

- Contact the CRA: Write to the CRA that provided the report.

- Provide evidence: Include copies of documents supporting your dispute.

- Wait for investigation: The CRA must investigate your dispute within 30 days.

If the CRA finds an error, they must correct it. You will receive a written notice of the results. Your updated report will also be sent to anyone who received it in the last six months.

Steps To Take After Receiving An Adverse Action Notice

Receiving an Adverse Action Notice under the Fair Credit Reporting Act (FCRA) can be unsettling. But knowing the steps to take can help you address the situation effectively. Here are some essential steps to follow.

Review Your Report

First, you need to review your credit report carefully. The notice should include details about the adverse action. Look for any errors or inaccuracies in the report.

- Check personal information.

- Review account details.

- Look for unfamiliar entries.

Identify any discrepancies that might have led to the adverse action.

Contacting The Agency

After reviewing your report, the next step is to contact the agency that provided the report. The notice should include the contact information of the reporting agency.

- Call the agency.

- Explain the issues.

- Request a corrected report.

Ensure you have all your documents ready before making the call. It will help you explain your case better.

If you find any inaccuracies, the agency is required to investigate. They must correct any errors within 30 days.

Following these steps can help you address the adverse action notice efficiently. Understanding your report and contacting the agency are crucial steps to rectify any issues.

How To Dispute Errors On Your Report

Finding mistakes on your credit report can be stressful. These errors might affect your financial health. Disputing these errors is essential. Follow these steps to correct your report.

Gathering Evidence

Start by collecting proof of the error. This includes bank statements, receipts, or any related documents. Make a list of all inaccurate information.

| Type of Evidence | Description |

|---|---|

| Bank Statements | Show transactions and balances. |

| Receipts | Proof of purchases or payments. |

| Correspondence | Emails or letters related to the error. |

Include dates and amounts in your notes. This will help you keep track.

Submitting A Dispute

Write a dispute letter to the credit bureau. Explain the error clearly. Attach copies of your evidence. Include your contact information and the report number.

Dear [Credit Bureau Name],

I am writing to dispute an error on my credit report. The report number is [Report Number]. The inaccurate information is [Describe Error]. I have attached copies of [List of Evidence] supporting my claim.

Please correct this mistake as soon as possible.

Sincerely,

[Your Name]

[Your Contact Information]

You can also submit a dispute online. Visit the credit bureau’s website for instructions. Keep a record of all your communications.

Preventing Future Adverse Actions

Preventing adverse actions on your credit report is essential. It helps secure your financial future. Taking proactive steps can save you from potential headaches.

Monitoring Your Credit

Regularly check your credit report. It helps you spot errors early. Use free credit monitoring services. These services alert you to changes. Make it a habit to review your credit report annually.

- Review credit reports from all three bureaus.

- Look for unfamiliar accounts.

- Check for incorrect personal information.

Set up alerts for significant changes. This includes new accounts or hard inquiries.

Correcting Inaccuracies

Dispute any inaccuracies you find. Contact the credit bureau reporting the error. Provide evidence to support your dispute. Keep copies of all correspondence.

- Identify the error on your credit report.

- Gather supporting documents.

- Write a dispute letter to the credit bureau.

- Wait for the bureau to investigate.

- Review the bureau’s response.

Use online dispute forms for faster processing. Follow up if you don’t get a response within 30 days.

Stay proactive to maintain a healthy credit report. This reduces the risk of future adverse actions.

Seeking Legal Assistance

Facing an FCRA Adverse Action can be stressful. You may need legal help. This guide helps you know when to seek a lawyer and where to find resources.

When To Consult A Lawyer

- If you receive a notice of adverse action.

- If you believe the action is unfair.

- If you need to dispute inaccurate information.

- If you face discrimination.

- If your rights under the FCRA are violated.

Consulting a lawyer ensures your rights are protected. They help you understand legal terms.

Finding Legal Resources

There are many ways to find legal help:

- Online Legal Services: Websites like LegalZoom offer consultations.

- Lawyer Directories: Use sites like Avvo to find lawyers by specialty.

- Local Bar Associations: They often provide lawyer referrals.

- Legal Aid Societies: They offer free or low-cost legal help.

Choosing the right resource can save you time and money. Always check reviews and ratings of services.

| Resource Type | Details |

|---|---|

| Online Legal Services | Affordable and accessible legal advice. |

| Lawyer Directories | Search for lawyers by expertise and location. |

| Local Bar Associations | Provide trusted referrals to qualified lawyers. |

| Legal Aid Societies | Offer free or low-cost legal services for those in need. |

Always remember to verify the credentials of any legal professional you consider.

Credit: eforms.com

Resources And Support

Dealing with FCRA adverse action can be challenging. Fortunately, there are many resources and support systems available. These resources can guide you through the process and provide necessary assistance. Below, you’ll find information on government agencies and non-profit organizations that offer support.

Government Agencies

Government agencies play a crucial role in providing support for FCRA-related issues. They ensure compliance and protect consumer rights. Here are some key agencies you can reach out to:

- Federal Trade Commission (FTC): The FTC enforces FCRA regulations. They provide educational materials and guidance.

- Consumer Financial Protection Bureau (CFPB): The CFPB handles consumer complaints. They also offer resources for understanding credit reports.

- Equal Employment Opportunity Commission (EEOC): The EEOC addresses employment discrimination issues related to FCRA.

Non-profit Organizations

Non-profit organizations offer valuable support for those impacted by FCRA adverse actions. They provide resources and advocacy. Here are some organizations to consider:

- National Consumer Law Center (NCLC): The NCLC offers legal advice and advocacy for consumers.

- Consumer Federation of America (CFA): The CFA provides information on consumer rights and financial education.

- Public Citizen: Public Citizen focuses on protecting consumer rights through advocacy and education.

These resources are designed to help you navigate FCRA-related challenges. They offer guidance, support, and advocacy to protect your rights.

Credit: esign.com

Frequently Asked Questions

1. What Is An Adverse Action Under The FCRA?

An adverse action under the FCRA is a denial or negative change in credit, employment, or insurance based on a consumer report.

2. What Is An Example Of Adverse Action?

An example of adverse action is firing an employee due to their race, gender, or age. This discriminatory practice violates employment laws.

3. Which Of The Following Scenarios Requires An FCRA Adverse Action Notice?

An FCRA adverse action notice is required when a decision is made based on information from a consumer report. This includes denying employment, credit, insurance, or housing.

4. What Does Adverse Action Mean On A Credit Report?

Adverse action on a credit report means a negative decision by lenders, like denying credit or increasing interest rates.

Conclusion

Understanding FCRA’s adverse action is crucial for both employers and employees. It ensures fair hiring practices. Staying informed helps avoid legal complications. Regularly review your policies and procedures.

Compliance not only protects your business but also promotes trust. Always prioritize transparency and fairness in your hiring process. Your commitment will foster a positive work environment.