Dispute Credit Report Errors: Win Back Your Score!

To dispute a credit report, contact the credit bureau and provide documentation supporting your claim. Request an investigation into the error.

Disputing a credit report is crucial for maintaining accurate financial records. Errors can impact your credit score, affecting loan approvals and interest rates. Begin by reviewing your credit report from all three major bureaus: Experian, Equifax, and TransUnion. Identify any inaccuracies such as incorrect personal information, wrong account details, or fraudulent activities.

Gather supporting documents like bank statements or correspondence to substantiate your claim. Submit a dispute letter to the credit bureau, detailing the error and including your evidence. The bureau typically has 30 days to investigate and respond. Keeping your credit report accurate ensures better financial opportunities and peace of mind.

The Importance Of A Clean Credit Report

A clean credit report is key to your financial health. It influences your ability to secure loans, rent apartments, and even get jobs. Mistakes on your credit report can cost you money and opportunities. Disputing inaccuracies on your credit report helps maintain your creditworthiness.

Your Credit Score’s Impact On Your Life

Your credit score affects many parts of your life. A high score can lead to lower interest rates on loans. It can help you get approved for credit cards with better rewards. Landlords often check credit scores before renting apartments. Employers sometimes review credit reports before offering jobs. A clean report improves your chances in these areas.

Common Causes Of Credit Report Errors

Credit report errors are common and can occur for many reasons. Here are a few:

- Mistaken Identity: Mixing up information with someone else’s.

- Data Entry Errors: Simple typos or wrong data entries.

- Outdated Information: Old accounts that should be closed.

- Duplicate Accounts: Same account listed more than once.

- Fraudulent Accounts: Accounts you did not open.

These errors can lower your credit score. Regularly checking your report can help you spot these issues early. Dispute any errors to keep your report accurate.

Credit: www.transunion.com

Identifying Errors On Your Credit Report

Your credit report is vital for your financial health. It affects your ability to secure loans, credit cards, and even jobs. Identifying errors on your credit report is crucial. Mistakes can lower your credit score and harm your financial standing. Let’s dive into the types of errors you might find and how to obtain your credit reports.

Types Of Credit Report Errors

Errors on your credit report can take many forms. Below are common types:

- Personal Information Errors: Incorrect name, address, or Social Security Number.

- Account Errors: Accounts that do not belong to you.

- Balance Errors: Incorrect account balances.

- Payment Status Errors: Late payments reported incorrectly.

- Duplicate Accounts: Same account listed multiple times.

Finding these errors early can save you from potential financial issues. Always check your reports for any inaccuracies.

How To Obtain Your Credit Reports

Getting your credit reports is simple. You are entitled to a free report from each of the three major credit bureaus annually. These bureaus are:

- Equifax

- Experian

- TransUnion

Follow these steps to get your reports:

- Visit AnnualCreditReport.com.

- Fill out the required information.

- Select the reports you want to view.

- Download and save the reports for your records.

Review each report carefully. Look for any of the errors mentioned above. Report any mistakes immediately to the respective credit bureau.

Ensuring your credit report is accurate helps maintain a healthy credit score. It also ensures your financial credibility.

Disputing Errors: The First Steps

Errors on your credit report can affect your financial health. Disputing these errors is essential. The process may seem daunting, but it’s manageable. Follow these steps to start:

Gathering Necessary Documentation

First, collect all relevant documents. These will support your claim. Essential documents include:

- Credit report copies

- Identification documents (ID, Social Security card)

- Proof of address (utility bills, lease)

- Statements or bills related to the error

Organize these documents in a folder. This will make the process smoother.

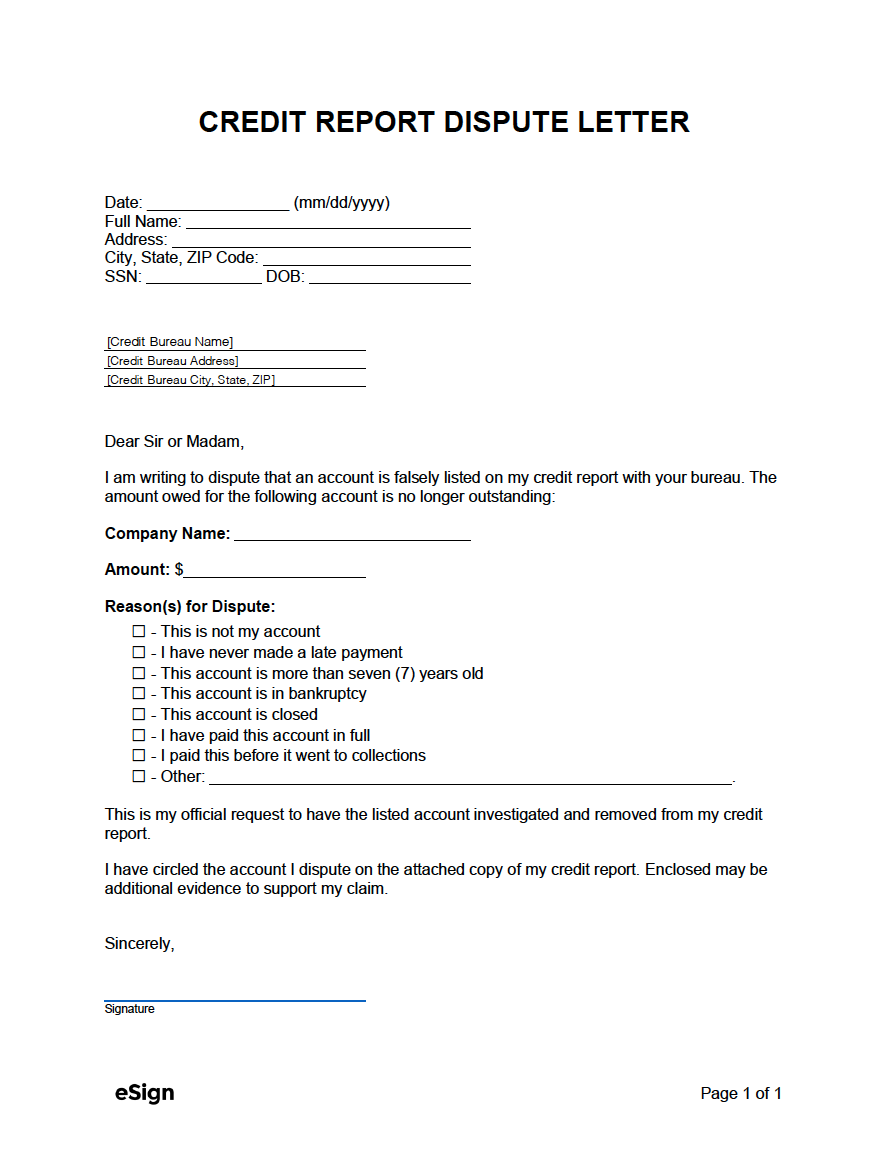

Writing A Dispute Letter

Next, write a dispute letter. This letter informs the credit bureau about the error. Include these elements in your letter: I am writing to dispute an error on my credit report. According to my records, there is an incorrect account listed under my name. I have never opened this particular account and I believe it has been mistakenly included in my credit report. It is important to rectify this mistake in order to safeguard your credit score and ensure that it reflects accurate and up-to-date information. Thank you for your attention to this matter.

- Your full name and address

- Report confirmation number

- Details about the error

- Reasons why the information is incorrect

- Copies of supporting documents

Keep the letter clear and concise. Use simple language to explain the issue.

Here’s a sample format:

[Your Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Credit Bureau Name]

[Address]

[City, State, Zip Code]

Re: Incorrect Information on Credit Report

Dear [Credit Bureau Name],

I am writing to dispute the following information on my credit report. The item I am disputing is [describe the error]. This information is inaccurate because [explain why]. Please see the attached documents supporting my position.

Please correct this information as soon as possible.

Thank you,

[Your Name]

Send the letter by certified mail. This ensures you have a record of your dispute.

Credit: esign.com

Online Vs. Mail Disputes: Pros And Cons

Disputing credit report errors can be daunting. You can choose between online and mail disputes. Each method has its own benefits and drawbacks. Read on to find out which method suits you best.

Choosing The Right Method For You

Selecting the right dispute method depends on your needs. Online disputes are fast and convenient. Mail disputes offer a physical record. Here are the pros and cons of each:

| Online Disputes | Mail Disputes | |

|---|---|---|

| Pros |

|

|

| Cons |

|

|

Ensuring Your Dispute Is Received

Ensuring your dispute is received is crucial. Online disputes provide instant confirmation. Always save or print this confirmation. For mail disputes, use certified mail. This provides proof of delivery.

Here are steps to ensure your dispute is received:

- Online: Screenshot or print confirmation page.

- Mail: Use certified mail with a return receipt.

- Track dispute status on credit bureau websites.

What Happens After You File A Dispute

Filing a dispute on your credit report is the first step. This can help correct any errors that might affect your credit score. But what happens after you file a dispute? This section will guide you through the next steps. Understand the process, timeline, and what to expect.

The Credit Bureau’s Investigation Process

Once you file a dispute, the credit bureau starts an investigation. They contact the creditor or data furnisher. The creditor must verify the information in question.

If the creditor confirms the information, the bureau updates your report. If not, the bureau corrects the error. The investigation usually involves checking documents and records.

The bureau may ask you for more information. This helps them better understand the issue. Provide any requested documents as soon as possible.

Timeline For Dispute Resolution

The credit bureau has 30 days to investigate your dispute. This period can extend to 45 days if you provide more information during the investigation.

After the investigation, the bureau must notify you of the results. They will send you a written report.

If your dispute leads to changes, you get a free copy of your updated credit report. This helps you verify that the corrections have been made.

| Step | Action | Timeframe |

|---|---|---|

| 1 | File a dispute | Day 1 |

| 2 | Credit bureau investigates | Day 1-30 |

| 3 | Provide additional info (if needed) | Day 1-45 |

| 4 | Receive results | Day 30-45 |

| 5 | Updated credit report (if changes made) | Day 45 |

If Your Dispute Is Denied

Disputing a credit report error can be stressful. Sometimes, your dispute may be denied. This can be frustrating, but understanding why is key. Let’s explore the reasons and next steps if your dispute is denied.

Understanding The Reasons

Your dispute may be denied for several reasons. The credit bureau might believe the information is accurate. Sometimes, they may lack enough evidence to support your claim.

Other reasons include:

- Incomplete dispute forms

- Insufficient documentation

- Errors in your submission

Ensuring your dispute is complete and accurate is crucial. Double-check your documents and forms before submission.

Next Steps: Re-disputing And Escalation

If your dispute is denied, don’t worry. You have options. Start by gathering more evidence. Collect any missing documents or additional proof.

Follow these steps:

- Review the denial reasons carefully

- Gather new evidence

- Submit a re-dispute with complete information

Sometimes, re-disputing may not be enough. You might need to escalate the issue.

Consider these escalation options:

- Contacting the creditor directly

- Filing a complaint with the Consumer Financial Protection Bureau (CFPB)

- Seeking help from a credit repair organization

Persistence is key. Keep thorough records of all communication. Stay organized and patient.

Protecting Your Credit During Disputes

Disputing errors on your credit report is crucial. Your credit score affects many aspects of your life. During disputes, it’s vital to protect your credit score. Follow these simple steps to keep your credit safe. If you find errors on your credit report, the first step is to contact the credit reporting agency and provide evidence to support your dispute. You can also reach out to the creditor who provided the incorrect information. It may also be helpful to consult with a fair credit reporting act attorney to ensure your rights are protected and to guide you through the process of disputing any errors on your credit report. By taking these steps, you can work towards maintaining a healthy credit score and financial stability.

Monitoring Your Credit Report

Consistently check your credit report. This helps you catch errors early. You can get a free report from each credit bureau once a year. Use this opportunity to review every detail.

Look for inaccuracies in:

- Personal information

- Account details

- Payment history

- Credit inquiries

Report any discrepancies immediately. This helps to maintain your credit score during disputes.

Avoiding New Credit Applications

During a dispute, avoid applying for new credit. New applications can lower your credit score. Each application results in a hard inquiry on your report. This can drop your score by a few points.

Also, new credit lines can confuse the dispute process. Lenders might see you as risky if you apply for new credit during disputes. Focus on resolving errors first.

Here are some tips to avoid new credit applications:

- Wait until disputes are resolved.

- Use existing credit lines responsibly.

- Pay off current debts on time.

By following these tips, you can protect your credit score effectively.

Success Stories: Reclaiming Financial Health

Many people believe that fixing their credit reports is hard. But real-life stories show how possible it is. These inspiring tales highlight the power of disputing credit reports. They prove you can reclaim your financial health.

Real-life Dispute Victories

John had a false late payment on his report. He disputed it and got it removed. This raised his credit score by 50 points. Sarah found an old debt listed twice. She filed a dispute and cleared it. Her credit score improved by 70 points. Mark saw the wrong credit card account on his report. He disputed it and saw a 60-point jump in his score.

| Person | Error | Dispute Result | Score Increase |

|---|---|---|---|

| John | False late payment | Removed | 50 points |

| Sarah | Old debt listed twice | Cleared | 70 points |

| Mark | Wrong credit card account | Removed | 60 points |

The Long-term Benefits Of A Clean Credit Report

A clean credit report brings many long-term benefits. First, it allows you to get better interest rates on loans. This saves you money over time. Second, you can get approved for credit cards with better rewards.

- Lower interest rates on loans

- Approval for better credit cards

- Higher credit limits

Third, it improves your chances of getting a job. Many employers check credit reports before hiring. A clean report makes you look responsible. Lastly, it can help you qualify for better housing options. Landlords often check credit reports before renting. A good credit report gives you more choices.

- Improves job prospects

- Better housing options

- More financial freedom

These benefits show the value of disputing errors on your credit report. Start today and reclaim your financial health.

Credit: legaltemplates.net

How Can I Fix Credit Report Errors Without Using Credit Repair Services?

If you want to boost your credit score without using credit repair services, start by reviewing your credit report for errors. Dispute any inaccuracies directly with the credit bureau. It’s essential to provide documentation to support your claims and follow up to ensure the corrections are made.

How Does Removing a Remark Code Affect Disputing Credit Report Errors?

Disputing credit report errors becomes more effective when you remove remark code from credit report. These remark codes can signal past disputes or special conditions that may raise red flags for lenders. Eliminating them ensures a clean report, improving your chances of loan approvals and better financial opportunities.

Frequently Asked Questions

Is It A Good Idea To Dispute Credit Report?

Yes, disputing errors on your credit report is a good idea. It can improve your credit score. Ensure accuracy by providing supporting documents. Regularly monitor your credit report for mistakes. Correcting errors can lead to better loan terms and interest rates.

What Is The Best Way To Dispute A Credit Report?

Dispute inaccuracies by contacting the credit bureau directly. Provide documentation supporting your claim. Use online dispute forms for faster processing. Monitor your report regularly for updates.

What Qualifies For A Credit Dispute?

Errors on your credit report qualify for a dispute. These include incorrect personal information, outdated accounts, and unauthorized transactions. Misreported payments or duplicate accounts also qualify.

What Happens If I Dispute Everything On My Credit Report?

Disputing everything on your credit report may raise red flags with credit bureaus. They might consider your disputes frivolous. This can delay resolution. Always provide evidence to support your claims for a smoother process.

How Do I Dispute A Credit Report?

To dispute a credit report, contact the credit bureau and provide evidence to support your claim.

Conclusion

Disputing a credit report can improve your financial health. Take action to correct errors promptly. Protect your credit score by staying vigilant. Regularly monitor your credit report for any discrepancies. Correcting inaccuracies can lead to better loan terms and financial opportunities.

Stay proactive for a healthier financial future.