Derogatory on Credit Report: How to Bounce Back Fast!

Derogatory marks on a credit report indicate negative information, such as late payments or defaults. These can significantly lower your credit score.

Derogatory marks can linger on your credit report for several years, affecting your ability to secure loans or favorable interest rates. Understanding these marks is crucial for maintaining a healthy credit score. Common derogatory marks include late payments, collections, charge-offs, and bankruptcies.

Each of these can severely impact your financial standing and borrowing power. Proactively managing and addressing these issues can help improve your credit score over time. Regularly reviewing your credit report can also help you catch and dispute any inaccuracies. Taking these steps can lead to better financial health and opportunities.

Impact Of Derogatory Marks On Credit Health

Derogatory marks can significantly harm your credit health. They indicate financial missteps in your credit report. Understanding these marks is crucial for maintaining good credit health.

Types Of Derogatory Marks

Various types of derogatory marks can appear on your credit report. Each type has its implications.

| Type | Description |

|---|---|

| Late Payments | Payments made past the due date. |

| Collections | Unpaid debts transferred to collection agencies. |

| Charge-offs | Debts deemed uncollectible by lenders. |

| Bankruptcies | Legal proceedings to relieve debts. |

| Foreclosures | Loss of property due to unpaid mortgages. |

How Derogatory Marks Affect Your Credit Score

Derogatory marks can lower your credit score significantly. They signal lenders about your creditworthiness.

- Late Payments: Even a single late payment can hurt your score.

- Collections: Accounts in collections can drastically reduce your score.

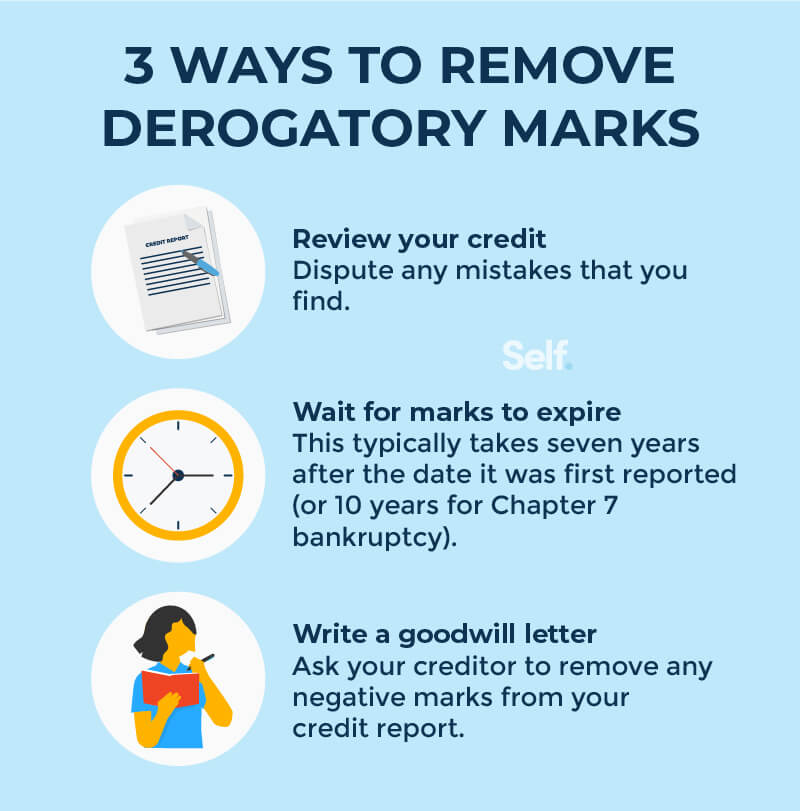

- Charge-offs: Charged-off accounts remain on your report for up to seven years.

- Bankruptcies: Bankruptcies can stay on your report for up to ten years.

- Foreclosures: Foreclosures can lower your score by several hundred points.

Identifying Derogatory Marks On Your Report

Understanding and identifying derogatory marks on your credit report is crucial. These marks can significantly affect your credit score. They can also impact your ability to obtain loans, mortgages, and even employment. Learning to read your credit report properly helps in spotting these marks.

Reading Your Credit Report

First, obtain a copy of your credit report. You can get it from any of the three major credit bureaus: Experian, TransUnion, and Equifax. Once you have your report, familiarize yourself with its sections.

- Personal Information: Contains your name, address, and social security number.

- Accounts: Lists all your credit accounts and their status.

- Inquiries: Shows who has accessed your credit report.

- Public Records: Includes bankruptcies, liens, and judgments.

Each section is important. Carefully review the accounts and public records sections to identify any derogatory marks.

Spotting Errors And Inaccuracies

Errors and inaccuracies can negatively affect your credit score. To spot them, compare the information on your report with your records. Common errors include:

- Incorrect personal information.

- Accounts that do not belong to you.

- Duplicate accounts.

- Incorrect account status (e.g., marked as late when paid on time).

If you identify any inaccuracies, dispute them immediately. You can dispute errors online through the credit bureau’s website. Provide supporting documents for faster resolution. Correcting these errors can help improve your credit score.

Regularly reviewing your credit report helps in maintaining an accurate credit history. It also aids in identifying and disputing derogatory marks promptly.

Legal Rights And Credit Reporting

Your credit report is crucial. It can impact your financial future. Derogatory marks on your credit report can harm your credit score. But you have legal rights to protect yourself. Knowing these rights can help you manage your credit report effectively.

Fair Credit Reporting Act (FCRA) Basics

The Fair Credit Reporting Act (FCRA) ensures accuracy in credit reporting. It grants you the right to access your credit report. The FCRA also mandates that credit bureaus correct any errors. Here are some key points:

- Right to access your credit report for free once a year

- Right to dispute incorrect information

- Credit bureaus must investigate disputes within 30 days

Disputing Inaccuracies Under The FCRA

If you find errors on your credit report, you can dispute them. Follow these steps:

- Gather evidence of the error

- Write a dispute letter to the credit bureau

- Include copies of your evidence

- Send your dispute letter via certified mail

Credit bureaus must investigate your dispute. They usually complete this within 30 days. If the bureau finds an error, they must correct it. This helps improve your credit score.

Strategies For Addressing Derogatory Marks

Derogatory marks on your credit report can hinder financial goals. They can lower your credit score and limit loan approvals. Luckily, several strategies can help you address these marks. By using these methods, you can improve your credit profile and regain control of your financial health.

Negotiating With Creditors

Negotiating with creditors can be a powerful way to remove derogatory marks. Follow these steps to start the process:

- Contact your creditor via phone or email.

- Explain your situation honestly and respectfully.

- Request a payment plan or settlement agreement.

- Ask if they would consider removing the derogatory mark upon payment.

Creditors might be willing to help if you show good faith. Make sure to get any agreement in writing. This ensures you have proof of the arrangement. Keep records of all communications and payments.

Writing A Goodwill Letter

A goodwill letter is another effective tool. This letter is a formal request to remove a derogatory mark from your credit report. Here’s how to write one:

- Address the letter to the creditor’s customer service department.

- Start with a polite greeting and state your request clearly.

- Explain the reasons behind the missed payments or derogatory marks.

- Highlight any positive history you have with the creditor.

- Express your commitment to maintaining good credit habits.

Here’s a simple template for a goodwill letter:

Dear [Creditor’s Name],

I hope this letter finds you well. I am writing to request the removal of a derogatory mark on my credit report. Due to [briefly explain reason], I was unable to make timely payments. I have since improved my financial situation and have made consistent payments.

I have been a loyal customer and value our relationship. I kindly ask for your goodwill in removing the negative mark from my credit report.

Thank you for considering my request.

Sincerely,

[Your Name]

Goodwill letters don’t always guarantee success, but they can be worth the effort. Always remain polite and professional in your communication.

The Dispute Process Explained

Understanding the dispute process for derogatory marks on your credit report is crucial. Mistakes can happen, and you have the right to correct them. This guide will help you navigate the steps involved in disputing errors on your credit report.

Filing A Credit Dispute

To start, gather all necessary documents. This includes your credit report, personal identification, and any proof supporting your claim. Next, you will need to file a dispute with the credit bureau. You can do this online, by mail, or by phone.

Here is a simple step-by-step process:

- Get your credit report from all three bureaus: Equifax, Experian, and TransUnion.

- Identify the incorrect information.

- Prepare your dispute letter.

- Submit the dispute through the bureau’s website or mail.

Follow-up And Resolution

After filing, the credit bureau will investigate your dispute. This process usually takes about 30 days. They will contact the creditor to verify the information.

During this time, it’s important to keep track of your dispute. Follow up with the credit bureau if needed. You can use a table to track your progress:

| Action | Date | Notes |

|---|---|---|

| Filed Dispute | MM/DD/YYYY | Submitted online |

| Received Response | MM/DD/YYYY | Under investigation |

| Resolution | MM/DD/YYYY | Dispute resolved |

Once the investigation is complete, the bureau will send you the results. If the dispute is resolved in your favor, your credit report will be updated. If not, you can add a statement to your report explaining the dispute.

This statement can help future creditors understand your side of the story. It’s essential to stay proactive and follow up until your report is accurate.

Building Positive Credit History

Creating a positive credit history is essential for a healthy financial future. It can help you get loans, credit cards, and better interest rates. In this section, we will discuss some key strategies to build a strong credit history.

Importance Of On-time Payments

Paying bills on time is crucial for maintaining a good credit score. Lenders see on-time payments as a sign of reliability. Always pay at least the minimum amount due by the due date.

Set up automatic payments if you tend to forget deadlines. This ensures you won’t miss any payments. Consider using a calendar reminder as an additional safeguard.

Late payments can stay on your credit report for up to seven years. This can significantly damage your credit score. Therefore, prioritize punctuality in your payments.

Strategic Credit Use And Limits

Using credit wisely is another critical aspect of building a positive credit history. Keep your credit card balances low. High balances can negatively impact your credit score.

A good rule of thumb is to keep your credit utilization below 30%. This means if you have a $1,000 credit limit, aim to use no more than $300. This shows lenders you can manage credit responsibly.

Another strategy is to spread your credit use across multiple accounts. This helps keep individual account balances low. It also improves your credit utilization ratio.

| Credit Limit | Recommended Usage |

|---|---|

| $1,000 | Below $300 |

| $5,000 | Below $1,500 |

| $10,000 | Below $3,000 |

In addition to low balances, avoid maxing out your credit cards. Maxed-out cards can signal financial distress to lenders. This could make it harder to get approved for new credit.

Lastly, do not close old credit accounts. Longer credit histories are beneficial for your credit score. Keeping older accounts open can positively impact your credit history length.

Professional Help: Credit Repair Services

Dealing with derogatory marks on your credit report can be stressful. Professional credit repair services can help you navigate this complex process. These services offer expert assistance to improve your credit score. They can negotiate with creditors and challenge inaccuracies in your report. This ensures a smoother path to financial health.

Choosing A Credit Repair Company

Selecting the right credit repair company is crucial. Not all companies offer the same level of service. Here are some tips to help you choose:

- Research: Look for companies with positive reviews and high ratings.

- Transparency: Ensure they provide clear information about their fees and services.

- Experience: Choose a company with a proven track record in credit repair.

- Accreditation: Check if they are accredited by the Better Business Bureau (BBB).

What To Expect From Credit Repair

Understanding what to expect from credit repair services helps set realistic goals. Here are the key steps involved:

- Initial Consultation: A thorough review of your credit report.

- Action Plan: Development of a tailored action plan to address derogatory marks.

- Dispute Process: Filing disputes with credit bureaus to challenge errors.

- Negotiations: Negotiating with creditors for better terms or debt settlement.

- Monitoring: Regular monitoring and updates on your credit score progress.

A reliable credit repair service will keep you informed at every step. They will ensure you understand the progress being made.

Remember, credit repair is not an overnight process. Patience and persistence are key to seeing lasting improvements.

Maintaining Good Credit Post-recovery

Recovering from derogatory marks on your credit report is a significant achievement. The next step is to maintain this improved credit status. This ensures long-term financial health and freedom. Below are key strategies to help you sustain good credit post-recovery.

Regular Monitoring And Review

Regular monitoring and review of your credit report is essential. Check your credit report at least once a month. This helps you catch errors early. It also helps you spot any suspicious activity.

You can use free credit monitoring services. These services alert you to changes in your report. Always dispute any inaccuracies you find. Doing so helps you maintain a high credit score.

Consider setting up alerts on your credit card accounts. These alerts notify you of large purchases or changes. This adds an extra layer of security.

Healthy Financial Habits For The Future

Building and maintaining healthy financial habits is crucial. Start with creating a monthly budget. A budget helps you track your spending and savings.

Pay your bills on time. Late payments can hurt your credit score. Set up automatic payments to avoid missing due dates.

Keep your credit card balances low. Aim to use less than 30% of your available credit. This is known as your credit utilization ratio. A lower ratio positively impacts your credit score.

Save a portion of your income each month. Having savings helps you avoid debt in emergencies. It also provides financial stability.

Lastly, avoid opening too many new credit accounts at once. Each application can temporarily lower your credit score. Space out new credit applications to minimize the impact.

| Action | Benefit |

|---|---|

| Regularly monitor your credit report | Catch errors and spot suspicious activity |

| Create a monthly budget | Track spending and savings |

| Pay bills on time | Avoid late payment penalties |

| Keep credit card balances low | Maintain a low credit utilization ratio |

| Save a portion of income | Provide financial stability |

| Avoid opening too many new accounts | Minimize temporary credit score dips |

Preventing Future Derogatory Marks

Derogatory marks can hurt your credit score for years. Preventing them is key to maintaining a good financial health. This section will guide you on how to prevent future derogatory marks.

Financial Planning And Budgeting

Good financial planning starts with a budget. A budget helps you track your income and expenses. This ensures you don’t spend more than you earn.

| Income | Expenses |

|---|---|

| Salary | Rent |

| Freelance Work | Utilities |

| Investments | Groceries |

Start by listing all sources of income. Next, list all your expenses. Compare these lists to see your financial status.

Use budgeting tools to simplify this process. Apps like Mint or YNAB can help. These tools track your spending and offer insights on how to save more.

Understanding Credit And Debt Management

Knowing how credit works is essential. Your credit score affects your loan approvals and interest rates. A good score can save you money in the long run.

- Pay your bills on time

- Keep credit card balances low

- Review your credit report regularly

Always pay your bills by the due date. Late payments can result in derogatory marks. Set reminders to avoid missing payments.

Keep your credit card balances below 30% of your credit limit. High balances can hurt your credit score.

Check your credit report at least once a year. Look for errors or fraudulent activities. Correcting these can prevent future issues.

By following these steps, you can avoid derogatory marks on your credit report. This keeps your financial health in good shape.

Bouncing Back: Success Stories And Tips

Having a derogatory mark on your credit report can feel overwhelming. Yet, many have bounced back and rebuilt their credit. This section highlights real-life success stories and offers expert tips to help you recover swiftly.

Real-life Credit Recovery Journeys

Here are inspiring stories of individuals who turned their credit around:

| Name | Challenge | Outcome |

|---|---|---|

| John | Bankruptcy | Credit score improved by 150 points in 2 years |

| Maria | Foreclosure | Secured a new mortgage within 3 years |

| Lisa | Credit card debt | Paid off $20,000 in 18 months |

Expert Advice For Quick Recovery

Experts share valuable tips to help you recover from derogatory marks:

- Check your credit report: Regularly review your credit report for errors.

- Pay bills on time: Timely payments improve your credit score.

- Reduce debt: Aim to lower your credit card balances.

- Build an emergency fund: Save money to avoid future financial troubles.

- Seek professional help: A credit counselor can offer personalized advice.

Following these tips can accelerate your credit recovery journey. Remember, rebuilding credit takes time and consistency.

Can Disputing Credit Report Errors Help Remove Derogatory Marks Faster?

Disputing credit report errors can help remove derogatory marks faster by ensuring inaccuracies are corrected promptly. Taking the right steps to fix credit report errors effectively improves credit scores and prevents negative impacts on financial opportunities. Regularly reviewing reports and addressing discrepancies ensures a more accurate and favorable credit profile.

Frequently Asked Questions

1. Can A Derogatory Mark Be Removed From Credit?

Yes, a derogatory mark can be removed from credit. Dispute inaccuracies with credit bureaus or negotiate with creditors.

2. Should I Pay Off Derogatory Accounts?

Yes, paying off derogatory accounts can improve your credit score. It shows responsibility and financial recovery. Always negotiate for a “pay for delete” agreement to remove negative entries. This can enhance your credit report faster. Consult a financial advisor for personalized advice.

3. How Long Does A Derogatory Stay On Your Credit Report?

A derogatory mark stays on your credit report for up to 7 years. Bankruptcies can remain for up to 10 years.

4. What Does Derogatory Mean On My Credit Report?

A derogatory mark on your credit report indicates negative information, such as late payments, collections, or bankruptcy. This harms your credit score.

5. What Is A Derogatory On Credit Report?

A derogatory on a credit report is a negative mark indicating a history of late payments or defaults.

Conclusion

Addressing derogatory marks on your credit report is crucial for financial health. Regularly check your report for errors. Dispute inaccuracies promptly to improve your score. Stay committed to paying bills on time and managing debt wisely. These steps will help you maintain a strong credit profile and secure better financial opportunities.