Credit Inquiry Removal Letter PDF: Boost Your Credit Score!

A Credit Inquiry Removal Letter PDF helps individuals request the removal of hard inquiries from their credit report. It can improve credit scores.

A Credit Inquiry Removal Letter PDF is a vital tool for anyone looking to enhance their credit report. Hard inquiries, often resulting from loan or credit card applications, can negatively impact your credit score. By formally requesting the removal of these inquiries, you can potentially boost your credit rating.

This letter should be concise, clearly stating the details of the inquiry and why you believe it should be removed. Always ensure to send it to the credit bureau and the creditor involved. Making this effort can lead to a healthier credit profile, which is essential for securing better financial opportunities.

Types Of Credit Inquiries

Understanding the types of credit inquiries is crucial for managing your credit score. There are two main types: hard inquiries and soft inquiries. Each type affects your credit score differently and serves distinct purposes.

Hard Inquiries

A hard inquiry occurs when a lender checks your credit report to make a lending decision. This usually happens when you apply for a loan, mortgage, or credit card.

Hard inquiries can lower your credit score by a few points. They stay on your credit report for up to two years. Multiple hard inquiries in a short period can significantly impact your credit score.

| Reason | Impact on Credit Score | Duration on Report |

|---|---|---|

| Loan Applications | Can lower score | Up to 2 years |

| Credit Card Applications | Can lower score | Up to 2 years |

Soft Inquiries

A soft inquiry occurs when you check your credit report. Employers and landlords also perform soft inquiries.

Soft inquiries do not affect your credit score. They are only visible to you on your credit report, not to lenders.

- Checking your credit score

- Pre-approval offers from lenders

- Background checks by employers

Soft inquiries provide valuable information without impacting your credit health. They are a useful tool for monitoring your credit status.

Impact Of Hard Inquiries

Hard inquiries happen when you apply for new credit. They can influence your credit score. Understanding their impact helps you manage your credit better.

Temporary Score Dip

Each hard inquiry can cause a temporary dip in your credit score. This drop is usually around 5-10 points. The impact can vary based on your credit history.

Hard inquiries stay on your credit report for two years. Most of the impact occurs within the first year. After that, the effect lessens.

Let’s look at an example:

| Event | Credit Score Impact |

|---|---|

| New Credit Card Application | -5 points |

| Mortgage Application | -10 points |

Long-term Effects

Multiple hard inquiries in a short time can signal risk. Lenders might see you as a higher risk if you have many inquiries.

This can affect your ability to get new credit. Your score can recover if there are no new inquiries. Good payment history helps your score recover.

Here are tips to manage hard inquiries:

- Space out credit applications.

- Check your credit report regularly.

- Use a Credit Inquiry Removal Letter PDF if needed.

Benefits Of Removing Inquiries

Removing credit inquiries from your report offers many benefits. These inquiries can lower your credit score and affect loan approval. Using a Credit Inquiry Removal Letter PDF can simplify the process. Here are the main benefits you will enjoy.

Score Improvement

Credit inquiries can lower your credit score. Each hard inquiry can deduct a few points. Removing these inquiries can lead to a score boost. A higher score can make a big difference in your financial life.

| Type of Inquiry | Effect on Score |

|---|---|

| Hard Inquiry | Negative |

| Soft Inquiry | Neutral |

Using a Credit Inquiry Removal Letter PDF can help remove hard inquiries. This can result in an immediate score increase. A better score can help you in many ways.

Better Loan Terms

A higher credit score can lead to better loan terms. Lenders use your score to decide loan interest rates. Lower interest rates mean less money paid over time.

- Lower interest rates

- Higher loan approval chances

- Better credit card offers

Removing inquiries can make you look more reliable to lenders. This can result in better loan offers. Use a Credit Inquiry Removal Letter PDF to start this process. Better loan terms can save you money in the long run.

Credit: www.scribd.com

Steps To Remove Credit Inquiries

Removing credit inquiries can improve your credit score. Below are the steps to remove credit inquiries effectively.

Review Credit Report

First, obtain a copy of your credit report from major credit bureaus. Review each section carefully. Look for any discrepancies or unfamiliar inquiries.

| Credit Bureau | Website |

|---|---|

| Experian | experian.com |

| TransUnion | transunion.com |

| Equifax | equifax.com |

Identify Unauthorized Inquiries

Highlight any unauthorized inquiries found on your report. Unauthorized inquiries can harm your credit score. List down the details of each suspicious inquiry.

- Inquiry date

- Creditor’s name

- Inquiry type (hard or soft)

Contact the creditor to confirm the inquiry’s legitimacy. If unauthorized, proceed to dispute it.

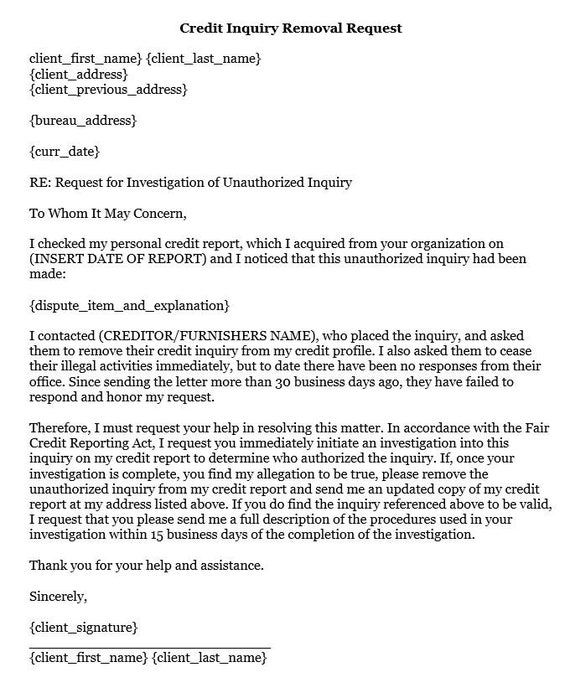

Writing The Removal Letter

Creating a Credit Inquiry Removal Letter can help clean up your credit report. A well-written letter can convince credit bureaus to remove inaccurate inquiries. Follow the steps below to draft an effective letter.

Essential Components

A strong removal letter should include several key elements:

- Personal Information: Include your full name, address, and contact details.

- Date: Write the date when you draft the letter.

- Credit Bureau Details: Address the letter to the correct credit bureau.

- Subject Line: Clearly state the purpose of the letter, e.g., “Request for Credit Inquiry Removal.”

- Account Information: Provide details of the account related to the inquiry.

- Dispute Information: Specify the inquiry you believe is incorrect.

- Supporting Evidence: Attach documents that support your claim.

- Closing: Politely request the removal of the inquiry.

- Signature: Sign the letter to validate it.

Sample Templates

Use these templates to guide your writing process:

| Template | Details |

|---|---|

| Basic Template |

Your Name Your Address City, State, Zip Code Date Credit Bureau Name Credit Bureau Address City, State, Zip Code Subject: Request for Credit Inquiry Removal Dear [Credit Bureau], I am writing to request the removal of an unauthorized credit inquiry. The inquiry in question was made on [Date] by [Creditor Name]. I did not authorize this inquiry and it is negatively impacting my credit score. I have attached a copy of my credit report highlighting the unauthorized inquiry. Please investigate this matter and remove the inquiry from my credit file. Thank you for your prompt attention to this matter. Sincerely, [Your Name] |

| Advanced Template |

Your Name Your Address City, State, Zip Code Date Credit Bureau Name Credit Bureau Address City, State, Zip Code Subject: Dispute of Unauthorized Credit Inquiry Dear [Credit Bureau], I am writing to dispute an unauthorized credit inquiry listed on my credit report. The inquiry was made on [Date] by [Creditor Name]. I did not authorize this inquiry, and it is causing unjust harm to my credit score. Enclosed are copies of my credit report highlighting the disputed inquiry, a copy of my ID, and proof of residence. Kindly investigate this matter and remove the unauthorized inquiry from my credit report. Please confirm receipt of this letter and inform me of the results of your investigation. Thank you for your cooperation. Best regards, [Your Name] |

Using A PDF Format

Creating a Credit Inquiry Removal Letter in PDF format has many benefits. PDFs are widely accepted and easy to share. They maintain the original formatting of your letter. This ensures your letter looks professional.

Why PDF?

PDFs are secure and can be password-protected. This adds an extra layer of safety to your sensitive information. Credit bureaus prefer PDF documents due to their consistent layout. This makes your credit inquiry removal letter more credible.

PDFs are cross-platform compatible. They work on any device or operating system. This ensures the recipient can easily view your letter.

How To Create A Pdf Letter

Creating a Credit Inquiry Removal Letter in PDF is simple. Follow these steps:

- Open a word processing software like Microsoft Word or Google Docs.

- Type your credit inquiry removal letter. Ensure it contains all necessary details.

- Save your document in PDF format. In Microsoft Word, click ‘File’ > ‘Save As’ > ‘PDF’. In Google Docs, click ‘File’ > ‘Download’ > ‘PDF Document’.

Here’s a quick template to get you started:

| Section | Content |

|---|---|

| Header | Your Name, Address, and Date |

| Body |

|

| Closing | Thank you and your signature |

Submitting Your Letter

Submitting your Credit Inquiry Removal Letter PDF is a crucial step in improving your credit score. This process can help remove unauthorized or inaccurate inquiries. Below, you will find detailed steps for contacting credit bureaus and effective follow-up strategies.

Contacting Credit Bureaus

First, gather all necessary documents. These include your Credit Inquiry Removal Letter PDF, identification, and proof of address. Ensure your letter is concise and clearly states your request.

- Identify the credit bureaus you need to contact: Experian, Equifax, and TransUnion.

- Find their mailing addresses on their official websites or use their online dispute forms.

- Send your letter via certified mail to ensure delivery.

Here is a quick reference table for the mailing addresses:

| Credit Bureau | Mailing Address |

|---|---|

| Experian | P.O. Box 4500, Allen, TX 75013 |

| Equifax | P.O. Box 740241, Atlanta, GA 30374-0241 |

| TransUnion | P.O. Box 2000, Chester, PA 19016-2000 |

Follow-up Strategies

After submitting your letter, follow up to ensure your request is processed. Begin by keeping track of the date you sent the letter. Wait for a response from the credit bureaus, usually within 30 days.

- If you do not hear back, send a follow-up letter or call their customer service.

- Use the reference number from your certified mail receipt to track your request.

- Keep detailed records of all communications and responses.

Effective follow-up ensures your Credit Inquiry Removal Letter PDF is reviewed and acted upon. Consistency and persistence are key to achieving your credit goals.

Credit: www.dochub.com

Monitoring Your Credit Score

Keeping track of your credit score is essential for financial health. Regular monitoring helps you spot errors and maintain a good score. A Credit Inquiry Removal Letter PDF can help correct inaccuracies on your report.

Regular Checks

Regular credit checks ensure your report is accurate. Check your credit score at least once a month. This helps you identify errors early.

Use free credit score services to monitor your score. These services often provide insights and tips for improvement.

Check for unauthorized credit inquiries on your report. If you find any, a Credit Inquiry Removal Letter PDF can help dispute them.

Additional Tips For Improvement

Improving your credit score requires consistent effort. Here are some tips:

- Pay your bills on time. Late payments can harm your score.

- Keep your credit card balances low. High balances can lower your score.

- Limit new credit inquiries. Too many inquiries can negatively impact your score.

- Regularly review your credit report for errors. Dispute any inaccuracies immediately.

Using a Credit Inquiry Removal Letter PDF can help clean up your credit report. This ensures your score reflects your true creditworthiness.

| Action | Impact on Credit Score |

|---|---|

| Paying Bills on Time | Positive |

| Keeping Balances Low | Positive |

| Limiting New Credit Inquiries | Positive |

| Disputing Errors | Positive |

Remember, maintaining a good credit score opens many financial opportunities. Stay vigilant and proactive in monitoring your credit score.

Credit: www.etsy.com

Can an FCRA Letter Help Remove Credit Inquiries as Well?

An FCRA letter can help dispute inaccurate credit inquiries, but its effectiveness depends on the situation. While it primarily addresses incorrect reporting, combining it with an fcra collections removal letter may strengthen a case for removing unauthorized inquiries. Always ensure accuracy and compliance with the Fair Credit Reporting Act when disputing credit issues.

Frequently Asked Questions

1. How Do You Write A Letter To Remove Credit Inquiries?

To write a letter to remove credit inquiries, include your details, and the inquiry details, and request removal. Address it to the credit bureau, provide supporting documents, and request confirmation.

2. What Is A 609 Letter To Remove Inquiries?

A 609 letter disputes inaccurate inquiries on your credit report. It requests the credit bureau to verify the legitimacy of the inquiries.

3. Do 609 Letters Still Work?

Yes, 609 letters can still be effective. They help dispute errors on credit reports under the Fair Credit Reporting Act. Results may vary.

4. What Is A 609 Address Removal Letter?

A 609 address removal letter requests credit bureaus to remove incorrect addresses from your credit report, citing Section 609 of the FCRA.

5. What Is A Credit Inquiry Removal Letter?

A credit inquiry removal letter requests the removal of hard inquiries from your credit report.

Conclusion

Crafting a credit inquiry removal letter PDF can boost your credit score. This process helps remove unwanted inquiries. Follow the steps outlined, and you’ll see positive results. Remember, persistence is key. Stay proactive in monitoring your credit report. Your financial health will thank you. If you’re unsure how to craft a credit inquiry removal letter, there are resources available to help. You can easily find a sample letter for repossession removal online, which can serve as a helpful template for creating your own personalized letter. By taking the time to send out these letters, you can take control of your financial future and improve your credit standing.