Credit Fraud Alert: How to Protect Your Finances Today

A credit fraud alert notifies you of suspicious activities on your credit report. It helps prevent identity theft.

Credit fraud alerts are crucial for protecting your financial health. They notify you of any unusual activities on your credit report, allowing you to take immediate action. Setting up a fraud alert is simple and effective. It helps safeguard your personal information and financial accounts from potential threats.

By staying vigilant, you can prevent identity theft and maintain a good credit score. Regular monitoring and prompt responses to alerts are essential. Taking these precautions ensures your financial security and peace of mind. Always report any suspicious activities to your financial institutions and credit bureaus promptly.

Introduction To Credit Fraud

Credit fraud is a serious issue affecting many people worldwide. It involves the unauthorized use of someone’s personal information. This can lead to financial loss and damaged credit scores. Learning about credit fraud can help you protect yourself.

What Is Credit Fraud?

Credit fraud happens when someone uses your credit without permission. They might use your credit card or open new accounts in your name. This can harm your financial health. Credit fraud can be hard to detect if you don’t monitor your accounts.

Common Types Of Credit Fraud

| Type | Description |

|---|---|

| Credit Card Fraud | Unauthorized use of your credit card for purchases. |

| Account Takeover | Someone gains control of your existing accounts. |

| Application Fraud | Using your information to open new credit accounts. |

| Identity Theft | Stealing your personal information for financial gain. |

- Credit Card Fraud: This involves unauthorized transactions on your card.

- Account Takeover: Here, a fraudster gains access to your account.

- Application Fraud: Someone uses your details to open new accounts.

- Identity Theft: This is stealing your identity for financial benefits.

Recognizing these types can help you stay alert. Always monitor your credit reports. Use strong passwords and be cautious with your personal information.

Signs Of Credit Fraud

Credit fraud can happen to anyone. It’s important to know the signs. Recognizing these signs early can save you from financial loss. Here are some key indicators of credit fraud.

Unfamiliar Transactions

Check your credit card statements regularly. Look for any unfamiliar transactions. Even small charges can be a sign of fraud. Thieves often test the waters with small amounts.

- Charges you did not make

- Unknown vendors or merchants

- Repeated small charges

Report any suspicious activity to your bank immediately. The sooner you act, the better.

Unexpected Credit Denials

Has your credit application been denied unexpectedly? This could be a sign of fraud. Someone may have opened accounts in your name. This can lower your credit score.

| Sign | Detail |

|---|---|

| Credit denial | Unexpected rejection of your credit application |

| Low credit score | Credit score lower than expected |

Check your credit report regularly. Look for accounts you did not open. Dispute any errors with the credit bureaus.

Stay vigilant and protect your credit. Early detection is key to preventing major issues.

Preventive Measures

Preventing credit fraud is essential. Simple steps can protect your financial health. This section focuses on key preventive measures. Implementing these strategies can save you from potential financial ruin.

Regular Monitoring

Regularly monitoring your credit report is crucial. Check for any suspicious activity. This can include unknown accounts or unexpected charges. Early detection helps mitigate damage. Use free credit report services to stay updated.

- Check your credit report every month

- Look for unfamiliar transactions

- Report any discrepancies immediately

Set up alerts for unusual activity. Most banks offer this service. It’s a simple yet effective way to stay vigilant.

Strong Passwords

Strong passwords are your first line of defense. Weak passwords make you vulnerable. Create complex passwords with a mix of letters, numbers, and symbols. Avoid using easily guessable information like birthdays or names.

| Password Tips |

|---|

| Use at least 12 characters |

| Include uppercase and lowercase letters |

| Add numbers and special characters |

| Change passwords regularly |

Consider using a password manager. This tool helps generate and store strong passwords. Remember, your online security is only as strong as your password.

Credit: www.experian.com

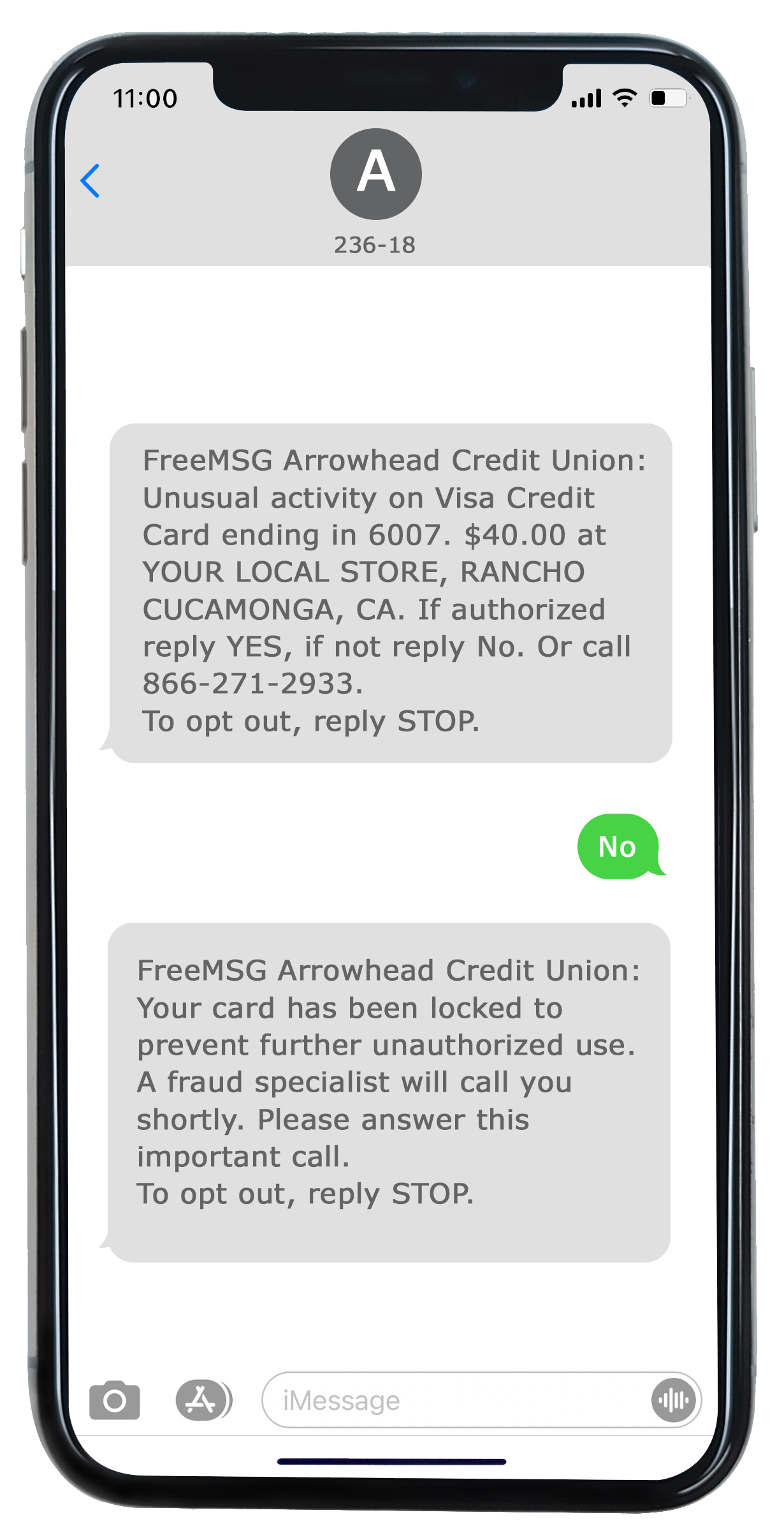

Using Credit Alerts

Credit fraud can harm your financial health. Setting up credit alerts is a smart way to protect yourself. These alerts notify you of suspicious activity on your credit report. They help you take quick action against fraud.

Setting Up Alerts

Setting up credit alerts is simple. Most credit bureaus offer this service for free. You can also use third-party services. Follow these steps to set up alerts:

- Create an account with a credit bureau or service.

- Provide your personal information securely.

- Select the types of alerts you want to receive.

- Set the threshold for alert notifications.

- Confirm your email and phone number for notifications.

Once set up, you will receive alerts via email or text.

Benefits Of Alerts

Credit alerts offer many benefits. They keep you informed about changes to your credit report. Here are some key benefits:

- Early Detection: Spot suspicious activity quickly.

- Prevent Fraud: Take action before it affects your credit.

- Peace of Mind: Know your credit is being monitored.

- Credit Score Protection: Avoid sudden drops in your credit score.

- Convenience: Receive alerts directly on your phone or email.

Using credit alerts helps you stay on top of your financial health. It’s a proactive measure to prevent credit fraud.

Protecting Personal Information

Protecting personal information is crucial to avoid credit fraud. Simple steps can keep your sensitive data safe. This section covers safe online practices and secure document handling.

Safe Online Practices

Safe online practices are essential for protecting personal information. Follow these tips to safeguard your data:

- Use strong passwords: Combine letters, numbers, and symbols.

- Enable two-factor authentication: Adds an extra layer of security.

- Avoid public Wi-Fi: Use a VPN if necessary.

- Update software regularly: Protect against vulnerabilities.

- Beware of phishing scams: Do not click on suspicious links.

Secure Document Handling

Secure document handling prevents unauthorized access to your information. Consider these best practices:

- Shred sensitive documents: Prevents identity theft.

- Store documents in a safe place: Use a locked drawer or safe.

- Limit physical copies: Keep only what you need.

- Use electronic statements: Reduces paper clutter.

- Monitor your mail: Prevents theft of sensitive information.

By following these tips, you can protect personal information and prevent credit fraud.

Credit: www.arrowheadcu.org

Responding To Fraud

Discovering credit fraud can be alarming. Swift action is essential to limit the damage. Here, we outline steps to protect yourself and report the fraud.

Immediate Actions

Upon suspecting fraud, take these immediate actions:

- Contact your bank: Call your bank or credit card issuer. Inform them about the suspicious activity.

- Freeze your accounts: Request a freeze on your accounts. This prevents further unauthorized transactions.

- Change your passwords: Change passwords for all online banking accounts. Use strong, unique passwords.

Reporting To Authorities

After securing your accounts, report the fraud to authorities:

- File a police report: Visit your local police station. Provide all relevant details about the fraud.

- Contact the Federal Trade Commission (FTC): Visit the FTC’s website. File a complaint about the credit fraud.

- Notify credit bureaus: Contact major credit bureaus (Experian, Equifax, TransUnion). Request a fraud alert on your credit report.

Taking these steps promptly can help you mitigate the effects of credit fraud. Stay vigilant and protect your financial health.

Recovery After Fraud

Experiencing credit fraud can be devastating. It’s not just about the lost money; it’s also about rebuilding your financial health. Here, we discuss essential steps for recovery after fraud, focusing on repairing your credit and seeking legal assistance.

Repairing Credit

Start by ordering a copy of your credit report. Check for any unauthorized transactions or accounts. Contact the credit bureaus to dispute fraudulent items. They can remove these from your report.

Create a plan to rebuild your credit score. Pay all your bills on time. Keep your credit card balances low. Avoid opening new credit accounts unless necessary. Consider using a secured credit card to help improve your score.

Monitor your credit regularly. Set up alerts to catch any unusual activity quickly. This helps you stay on top of your credit health.

Legal Assistance

Credit fraud is a serious crime. You might need legal help to navigate the process. Consider consulting with a lawyer who specializes in credit fraud. They can guide you through the steps you need to take.

Report the fraud to the Federal Trade Commission (FTC). Use their online tools to create a recovery plan. File a police report to document the crime. This can be crucial if you need to prove the fraud to creditors.

Keep detailed records of all your actions. Document phone calls, emails, and any communication related to the fraud. This can be useful if disputes arise later.

Recovery Tips Table

| Step | Action |

|---|---|

| 1 | Order your credit report |

| 2 | Dispute fraudulent items |

| 3 | Pay bills on time |

| 4 | Monitor credit regularly |

| 5 | Consult a lawyer |

| 6 | Report to FTC |

| 7 | File a police report |

| 8 | Keep detailed records |

Credit: www.incharge.org

Future-proofing Your Finances

In today’s digital age, credit fraud is a growing concern. Future-proofing your finances ensures you stay secure. It involves long-term strategies and staying informed. These steps will help protect your financial future.

Long-term Strategies

Building a robust financial plan is crucial. Consider these steps:

- Regular Monitoring: Check your credit reports monthly.

- Strong Passwords: Use complex passwords for your accounts.

- Two-Factor Authentication: Enable this for extra security.

- Secure Transactions: Use encrypted websites for online transactions.

- Financial Education: Learn about the latest fraud tactics.

These strategies help you stay ahead. They make it harder for fraudsters to target you.

Staying Informed

Staying updated is key. Follow these tips:

- Read News: Follow financial news regularly.

- Join Forums: Participate in financial safety forums.

- Alerts: Sign up for fraud alert notifications.

- Workshops: Attend online or local financial security workshops.

- Consult Experts: Talk to financial advisors about security.

Knowledge is power. The more you know, the safer you are.

| Strategy | Description |

|---|---|

| Regular Monitoring | Check credit reports monthly for suspicious activity. |

| Strong Passwords | Use complex passwords for all online accounts. |

| Two-Factor Authentication | Enable extra layers of security for online accounts. |

| Secure Transactions | Use encrypted websites for safe online transactions. |

| Financial Education | Stay updated on the latest fraud tactics and trends. |

By following these guidelines, you can future-proof your finances. Ensure your financial safety and peace of mind.

How Can I Protect My Finances from Credit Fraud Using Credit Card Protection Services?

Credit card protection services can help guard against credit card fraud by providing real-time alerts for suspicious activity. They also offer identity theft protection and insurance for unauthorized transactions. Utilizing these services can provide peace of mind and additional security for your finances.

Can Paying Off the Right Credit Card Help Prevent Credit Fraud?

Paying off the right credit card can reduce the risk of credit fraud by lowering outstanding balances and limiting exposure to potential breaches. Using the best credit card payoff strategy helps prioritize high-risk accounts, ensuring better financial security while maintaining a strong credit score and minimizing vulnerabilities to unauthorized transactions.

Frequently Asked Questions

1. What Is A Credit Card Fraud Alert?

A credit card fraud alert notifies you of suspicious activity on your card. It helps prevent unauthorized transactions.

2. How Do I Notify The Credit Bureaus Of Identity Theft?

Contact the three major credit bureaus: Experian, Equifax, and TransUnion. File a report and request a fraud alert. Provide necessary documentation and details.

3. Can I Still Open A Credit Card With A Fraud Alert?

Yes, you can open a credit card with a fraud alert. Lenders may require extra verification.

4. Can I Freeze All Three Credit Bureaus At Once?

Yes, you can freeze all three credit bureaus at once. Contact Equifax, Experian, and TransUnion individually to request a freeze.

Conclusion

Staying vigilant against credit fraud is crucial for protecting your finances. Regularly monitor your accounts and report suspicious activity promptly. Use strong passwords and update them frequently. Educate yourself about common scams and stay informed about security practices. By taking these steps, you can safeguard your financial future and peace of mind.