Consumer Report Definition: A Comprehensive Guide

A consumer report evaluates the quality and performance of products or services. It helps consumers make informed purchasing decisions.

Consumer reports provide valuable insights into various products and services. They include detailed evaluations, ratings, and comparisons, helping consumers choose the best options available.

These reports often come from independent organizations, ensuring unbiased and accurate information. By reading consumer reports, individuals can avoid poor-quality products and save money.

They also highlight safety concerns, warranty information, and customer satisfaction levels. The goal is to empower consumers with knowledge, enabling them to make smarter choices. As a result, businesses strive to improve their offerings, fostering a competitive market that benefits everyone.

Introduction To Consumer Reports

Consumer Reports are valuable tools for buyers. They help make informed choices. These reports offer unbiased product reviews and ratings. Understanding their purpose and history is essential.

Purpose And Importance

Consumer Reports serve a critical role in the market. Their primary purpose is to provide objective information about products and services. They help consumers avoid bad purchases. This saves both time and money.

Another key role of these reports is to promote transparency. They reveal product flaws and strengths. This encourages manufacturers to improve their offerings. Better products lead to happier consumers.

Consumer Reports also educate the public. They provide detailed analyses and comparisons. This helps consumers understand product features and benefits. Knowledgeable buyers make smarter choices.

Brief History

The history of Consumer Reports began in 1936. A group of consumers and researchers founded it. They wanted to provide reliable product information.

Their first publication focused on everyday items. They reviewed household goods and appliances. The goal was to help families make better decisions.

Over the decades, Consumer Reports expanded its scope. They started reviewing cars, electronics, and more. Today, they cover a wide range of products and services.

The organization remains non-profit and independent. This ensures their reviews stay unbiased and trustworthy. Their commitment to consumer advocacy continues to grow.

:max_bytes(150000):strip_icc()/credit-score-4198536-1-be5ef29182f442768057006465be06be.jpg)

Credit: www.investopedia.com

Types Of Consumer Reports

Consumer reports are important. They help businesses and people make decisions. There are different types of consumer reports. Each type provides unique information.

Credit Reports

Credit reports show your credit history. They include your loans and credit cards. These reports also show your payment history.

Lenders use credit reports. They decide if you can get a loan. They also decide the interest rate. The three main credit bureaus are:

- Equifax

- Experian

- TransUnion

It’s important to check your credit report. Make sure all information is correct.

Background Checks

Background checks provide information about a person’s past. Employers use them. They decide if a person is fit for a job.

Background checks can include:

- Criminal records

- Employment history

- Education verification

Some background checks also show credit reports. This helps employers assess financial responsibility.

Key Components

A consumer report provides crucial details about an individual’s financial history. This information is essential for lenders, employers, and landlords. Understanding the key components of a consumer report helps you manage your financial health better.

Personal Information

This section includes your full name, address, and date of birth. It also lists your Social Security Number (SSN). The personal information section verifies your identity and ensures that the report belongs to you.

| Detail | Description |

|---|---|

| Full Name | Your legal name as it appears on official documents. |

| Address | Current and previous addresses where you have lived. |

| Date of Birth | Your birthdate to confirm your identity. |

| SSN | Your unique Social Security Number. |

Credit Information

This section is crucial for lenders. It includes your credit accounts and loan history. Lenders look at your payment history to determine your creditworthiness. Here are the main components:

- Credit Accounts: Details of your credit cards, loans, and mortgages.

- Payment History: Records of on-time and late payments.

- Credit Inquiries: List of entities that have accessed your credit report.

- Public Records: Information on bankruptcies, liens, and judgments.

Knowing the key components of a consumer report helps you maintain a good credit score. This knowledge is essential for financial planning and securing loans.

Credit: en.wikipedia.org

Sources Of Consumer Data

Consumer data comes from various sources. Companies use this data to create consumer reports. These reports help in making financial decisions. Let’s explore the main sources of consumer data.

Credit Bureaus

Credit bureaus collect information on consumers’ credit activities. They gather data from different lenders and creditors. This data includes loan details, credit card usage, and payment history.

Here are the main credit bureaus:

- Equifax – Collects data from banks and lenders.

- Experian – Gathers information from various credit sources.

- TransUnion – Tracks credit activities across multiple platforms.

Credit bureaus provide detailed credit reports. These reports show how well a person manages credit. Lenders use these reports to assess risk.

Public Records

Public records are another important source of consumer data. These records are available to the public and include various types of information.

Key types of public records include:

| Type of Record | Description |

|---|---|

| Bankruptcies | Details on individuals who have declared bankruptcy. |

| Tax Liens | Information on unpaid taxes owed to the government. |

| Legal Judgments | Records of court decisions and financial obligations. |

Public records help in assessing financial stability. They provide insights into a person’s financial behavior. Companies use these records to verify consumer information.

How To Access Reports

Accessing consumer reports is vital for making informed decisions. These reports provide valuable insights into various products and services. Learn how to access these reports easily with our step-by-step guide.

Requesting Reports

Requesting reports can be done in a few steps. Here are the main methods:

- Contact the Organization: Reach out to the organization that publishes the report. Many organizations allow consumers to request copies directly.

- Visit Local Libraries: Many libraries have subscriptions to consumer report publications. You can access these reports for free.

- Purchase Individual Reports: Some reports can be bought directly from the publisher’s website.

Online Access

Accessing reports online is quick and convenient. Here are the main methods:

- Subscription Services: Many websites offer subscription services for consumer reports. By subscribing, you gain access to a wide range of reports.

- Free Reports: Some websites provide limited free reports. Always check the website’s terms to understand what is available for free.

- Downloadable PDFs: Many organizations offer reports in PDF format. These can be downloaded directly from their websites.

| Method | Details |

|---|---|

| Subscription Services | Access a wide range of reports by subscribing. |

| Free Reports | Some websites offer limited free reports. |

| Downloadable PDFs | Many reports are available in PDF format. |

Interpreting The Information

Understanding a consumer report can be tricky. This section will help you decode the important details. We will look at the scores and common terms used in these reports.

Understanding Scores

Scores in consumer reports tell you how well a product performs. These scores are usually on a scale from 1 to 100. A higher score means better performance.

Here’s a simple breakdown:

| Score Range | Performance Level |

|---|---|

| 90-100 | Excellent |

| 80-89 | Very Good |

| 70-79 | Good |

| 60-69 | Fair |

| Below 60 | Poor |

Always check the scores before buying any product. It helps to know what others think.

Common Terminology

Consumer reports use specific terms. Knowing these can help you understand the report better.

- Reliability: How well a product works over time.

- Durability: How long a product lasts before breaking.

- Value for Money: If the product is worth its price.

- Customer Satisfaction: How happy users are with the product.

These terms are key to understanding what the report is saying. They help you make a smart choice.

Impact On Financial Decisions

Consumer reports greatly impact financial decisions. They affect loan approvals and interest rates. Understanding this can help you make better choices.

Loan Approvals

Banks use consumer reports to approve loans. A good report means you can get a loan easily. A bad report makes it hard to get a loan.

A consumer report shows your credit score. It also shows your payment history. Banks trust these reports to decide if you can repay a loan.

Look at your consumer report before applying for a loan. Fix any errors you find. This can improve your chances of approval.

Interest Rates

Your consumer report affects the interest rate you get. A high credit score means a lower interest rate. A low score means a higher rate.

Banks see people with high scores as low risk. They offer better rates to these people. If your score is low, you are seen as high risk. This results in higher rates.

Check your report regularly. Pay bills on time. This will help improve your credit score and get better interest rates.

| Credit Score | Interest Rate |

|---|---|

| 750-850 | Low |

| 600-749 | Medium |

| 300-599 | High |

Credit: slideplayer.com

Tips For Maintaining Good Reports

Maintaining good consumer reports is crucial for your financial health. Good reports can help you get better loan rates and job opportunities. Follow these tips to keep your reports in top shape.

Regular Monitoring

Check your reports regularly to spot errors early. You can get free reports from major agencies each year. Use these free checks to stay updated on your report status. Monitoring helps you catch identity theft quickly. Here are some steps:

- Request your free report from each agency.

- Review your personal details and account information.

- Look for any unfamiliar or suspicious entries.

Dispute Errors

If you find errors in your reports, act fast. Dispute them with the reporting agency. Provide evidence to support your claim. Correcting errors can improve your report score. Follow these steps to dispute errors:

- Identify the error on your report.

- Gather documents to prove the mistake.

- Contact the reporting agency to file a dispute.

- Wait for the agency to investigate and correct the error.

By following these tips, you can maintain good consumer reports. A good report opens doors to many opportunities.

Frequently Asked Questions

1. What Is In A Consumer Report?

A consumer report includes credit history, payment patterns, outstanding debts, employment details, and public records. It helps lenders assess financial reliability.

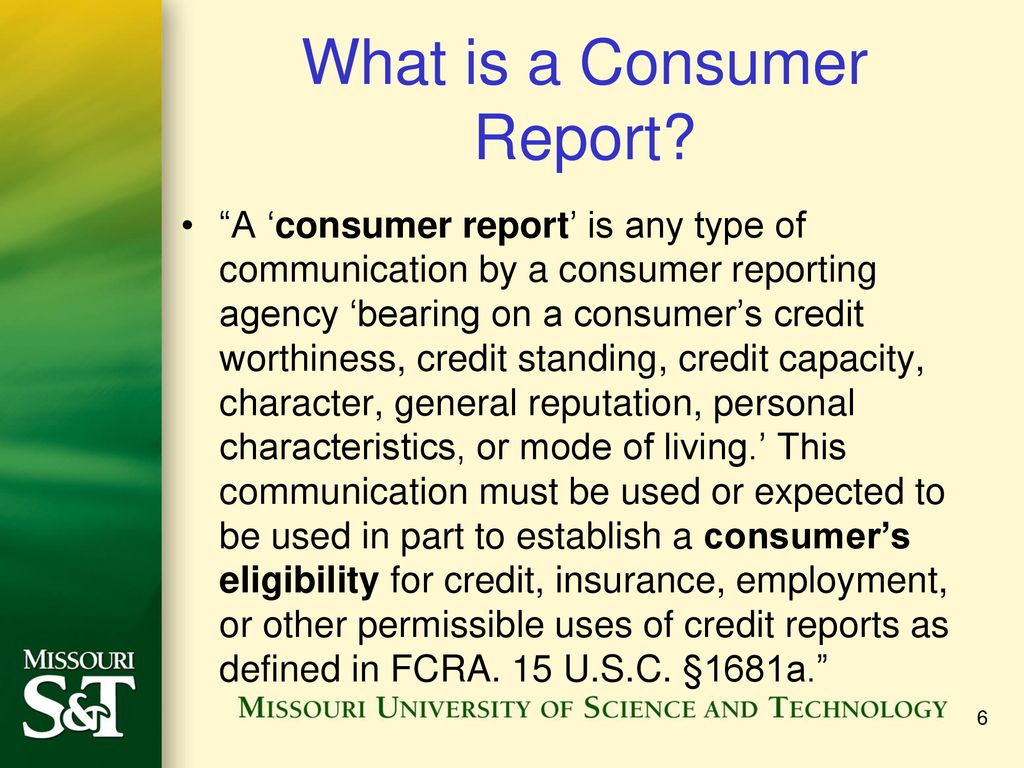

2. What Is The FCRA definition Of A Consumer Report?

A consumer report, as defined by the FCRA, includes information on creditworthiness, credit standing, and credit capacity used for determining eligibility.

3. What Is A Consumer Data Report?

A consumer data report compiles personal information, purchasing habits, and preferences of customers. Companies use it for targeted marketing.

4. What Is The Point Of Consumer Reports?

Consumer reports provide unbiased reviews and ratings of products and services. They help consumers make informed purchasing decisions.

Conclusion

Understanding consumer reports is essential for making informed decisions. These reports provide valuable insights into products and services. Use them to compare options and choose wisely. A well-informed consumer is always a step ahead. Stay informed and make smart choices based on reliable consumer reports.