Best Strategy to Pay Off Credit Cards

The best strategy to pay off credit cards is to use the debt avalanche or debt snowball method. Focus on high-interest debts first or start with the smallest balances. By tackling high-interest debts first, you can save money on interest payments and pay off your debt more efficiently. Alternatively, starting with the smallest balances can provide a sense of accomplishment and motivation to keep going. Whichever method you choose, consistently making on-time payments and paying off debt will ultimately improve credit score. This is because a lower overall debt and a history of on-time payments are key factors in determining credit score. There are other best credit card payoff strategies you can also consider, such as transferring high-interest balances to a lower interest rate card, negotiating with creditors for lower interest rates, or seeking advice from credit counseling services. It’s important to assess your individual financial situation and choose the best strategy that fits your needs. Ultimately, the goal is to reduce your overall debt and improve your financial well-being.

Paying off credit card debt can be challenging, but with the right strategy, it’s achievable. The debt avalanche method involves prioritizing cards with the highest interest rates, helping you save on interest payments. Alternatively, the debt snowball method targets the smallest balances first, providing quick wins and motivation.

Both methods have their merits, and choosing the right one depends on your financial situation and personal preferences. Consistent payments, budgeting, and avoiding new debt are crucial components. By adopting a focused strategy, you can efficiently reduce your credit card balances and work towards financial freedom.

Credit: www.bankrate.com

The Credit Card Debt Challenge

Managing credit card debt is tough. Many struggle with high-interest rates. The debt can feel overwhelming. Let’s explore the best ways to tackle this challenge.

Current Landscape Of Credit Card Debt

Credit card debt is rising. More people are falling behind on payments.

The average American has over $5,000 in credit card debt. Interest rates keep increasing.

High-interest rates make it hard to pay off the principal. Monthly payments often only cover the interest.

Many end up in a cycle of debt. They use new credit to pay old debts.

Understanding the numbers is key to finding a solution.

The Psychological Toll Of Financial Burden

Debt affects mental health. Worrying about money causes stress and anxiety.

Many feel shame and guilt about their debt. This can lead to depression.

Financial stress impacts sleep and overall well-being. It can strain relationships with loved ones.

Addressing the emotional side of debt is as important as the financial side.

Seeking help can reduce the psychological burden.

Credit: research.stlouisfed.org

Assessing Your Debt Situation

Before tackling credit card debt, it’s crucial to assess your situation. Understanding the extent of your debt helps you create an effective payment strategy. This section will guide you through the process.

Gathering All Your Credit Card Information

Start by collecting all your credit card statements. You need to know the balance on each card, the interest rate, and the minimum payment required.

| Credit Card | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Card A | $2,000 | 18% | $50 |

| Card B | $1,500 | 20% | $45 |

| Card C | $3,000 | 15% | $60 |

Understanding Your Debt-to-income Ratio

Your debt-to-income ratio (DTI) is vital. It shows the percentage of your income that goes to debt payments. Calculate your DTI with this formula:

DTI = (Total Monthly Debt Payments / Monthly Income) x 100

List your total monthly debt payments:

- Credit Card A: $50

- Credit Card B: $45

- Credit Card C: $60

Assume your monthly income is $3,000. Your DTI would be:

DTI = (($50 + $45 + $60) / $3,000) x 100 = 5.16%

A lower DTI means a healthier financial situation. Aim to keep your DTI below 36%.

Budgeting Basics To Free Up Cash

Paying off credit cards requires a solid budgeting strategy. You need to free up extra cash. Understand your spending to find areas to save. This section will guide you through the basics of budgeting.

Tracking Your Spending Habits

Start by tracking your spending habits. Record every purchase you make. Use a notebook, app, or spreadsheet. This helps you see where your money goes.

Break down your spending into categories. Here is a simple table for reference:

| Category | Monthly Spending |

|---|---|

| Groceries | $300 |

| Utilities | $150 |

| Transportation | $100 |

| Entertainment | $200 |

Keep all receipts and bills. Log them daily. This habit makes a huge difference. The goal is to be aware of every dollar spent.

Identifying Areas To Cut Back

Once you have a clear picture, start identifying areas to cut back. Look at each category and ask, “Do I need this?”

- Can you reduce grocery expenses? Use coupons or buy in bulk.

- Are there subscriptions you don’t use? Cancel them.

- Do you spend on entertainment often? Opt for free activities.

Small cuts can add up. Make a list of needs vs. wants. Focus on cutting wants first. This will free up cash for your credit card payments.

- Track your spending daily.

- Analyze your monthly expenses.

- Cut unnecessary spending.

- Use saved cash to pay off credit cards.

By following these budgeting basics, you can free up cash. This helps you pay off your credit cards faster and more effectively.

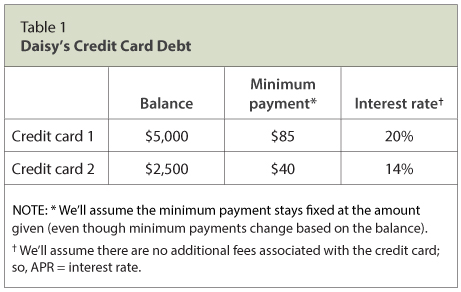

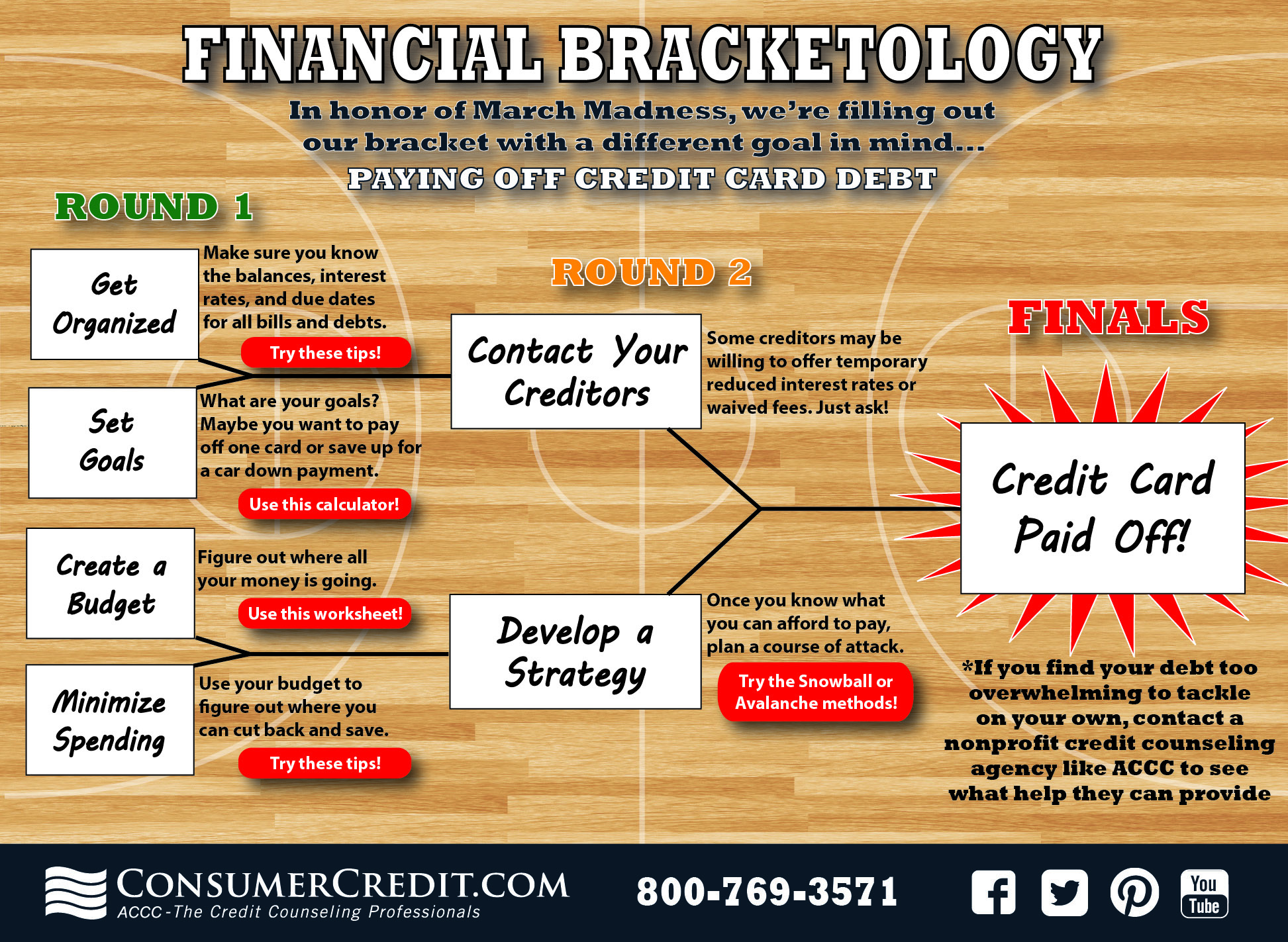

Choosing The Right Repayment Strategy

Paying off credit card debt can seem hard. But, having the right strategy makes it easier. There are different methods to consider. Choosing the best one can save you money and stress.

Snowball Vs. Avalanche Methods

The snowball method focuses on paying off the smallest debts first. This gives quick wins and keeps you motivated. Here’s how it works:

- List your debts from smallest to largest.

- Pay the minimum on all debts except the smallest.

- Put extra money towards the smallest debt.

- Once the smallest debt is paid, move to the next smallest.

The avalanche method targets debts with the highest interest rates first. This saves more money over time. Here’s how to use it:

- List your debts from highest to lowest interest rate.

- Pay the minimum on all debts except the one with the highest rate.

- Put extra money towards the debt with the highest interest rate.

- Once that debt is paid, move to the next highest interest rate.

Both methods have their benefits. The snowball method keeps you motivated. The avalanche method saves more money. Choose the one that fits your needs and personality.

Considering Consolidation And Balance Transfers

Debt consolidation and balance transfers can simplify payments. They can also lower interest rates.

| Option | Benefits | Considerations |

|---|---|---|

| Debt Consolidation |

|

|

| Balance Transfers |

|

|

Debt consolidation can make life simpler. Balance transfers offer short-term relief. Choose the option that fits your situation best.

Leveraging Low-interest Opportunities

Paying off credit cards can be challenging. Leveraging low-interest opportunities can make it easier. By finding low-interest credit card offers and utilizing personal loans, you can manage debt better.

Finding Low-interest Credit Card Offers

Low-interest credit card offers are a great way to reduce your debt. They usually come with introductory 0% APR periods. This means you won’t pay interest for a set time. Here’s how to find them:

- Search online: Many websites compare credit card offers.

- Check your mail: Banks often send promotional offers.

- Visit your bank: Ask about low-interest credit cards available.

Make sure to read the terms carefully. Look for offers with a long 0% APR period. Also, check the interest rate after the introductory period ends. This ensures you get the best deal possible.

Benefits Of Personal Loans For Consolidation

Personal loans can help consolidate credit card debt. Here are some benefits:

| Benefit | Description |

|---|---|

| Lower Interest Rates | Personal loans often have lower rates than credit cards. |

| Fixed Monthly Payments | You’ll have a set amount to pay each month. |

| Single Payment | Combine multiple debts into one payment. |

Applying for a personal loan is simple. Here’s a step-by-step guide:

- Check your credit score.

- Compare personal loan offers online.

- Apply with your chosen lender.

- Use the loan to pay off credit card debt.

By using personal loans, you can reduce your interest payments. This will help you pay off your credit cards faster.

Negotiating With Credit Card Companies

Negotiating with credit card companies can help you reduce debt faster. You might secure lower interest rates, waived fees, or a more manageable payment plan. Here are some strategies to approach and negotiate successfully.

How To Approach Creditors For Better Terms

Approaching creditors requires preparation and confidence. Here’s a step-by-step guide:

- Gather Information: Know your current balance, interest rate, and payment history.

- Set Clear Goals: Decide what terms you need, like lower interest or waived fees.

- Contact the Right Department: Speak to the debt settlement or customer retention department.

- Be Honest: Explain your financial situation and why you need help.

- Stay Polite: Kindness can go a long way in negotiations.

- Get Agreements in Writing: Always ask for written confirmation of new terms.

Here’s an example of how to start the conversation:

"Hello, my name is [Your Name], and I have been a customer for [X] years. I am currently facing financial difficulties and would like to discuss options for lowering my interest rate or adjusting my payment plan."

When To Seek Professional Debt Negotiation Help

Sometimes, negotiating yourself isn’t enough. In these cases, seeking professional help is wise.

Consider professional help if:

- You owe a significant amount of money.

- Creditors refuse to negotiate.

- You feel overwhelmed by the negotiation process.

- You need expert advice on debt management.

Professional negotiators can:

- Assess your financial situation.

- Negotiate on your behalf.

- Help create a manageable repayment plan.

Remember, choosing the right professional is crucial. Look for reputable agencies with good reviews and transparent fees.

Automating Payments And Monitoring Progress

Paying off credit cards can feel overwhelming. Automating payments and monitoring progress simplifies the process. This strategy ensures timely payments and tracks your debt reduction journey. Below, we explore how to set up automatic payments and use apps to track your progress.

Setting Up Automatic Payments To Avoid Late Fees

Automatic payments ensure you never miss a due date. Missing a payment can result in late fees and damage your credit score. Here’s how to set up automatic payments:

- Log in to your online banking account.

- Navigate to the payments or bills section.

- Select your credit card account.

- Choose the option for automatic payments.

- Enter the amount you want to pay each month.

- Confirm your settings and save.

Setting up automatic payments can save time and reduce stress. It ensures you always pay on time.

Using Apps And Tools To Track Debt Repayment

Tracking your debt repayment progress is crucial. Various apps and tools help you stay on track. Here are some popular options:

- Mint: This app connects to your accounts and tracks spending.

- YNAB (You Need a Budget): Helps you create a budget and track debt.

- Credit Karma: Monitors your credit score and provides debt insights.

- Debt Payoff Planner: Helps you create a debt payoff plan and track it.

Using these tools can provide a clear picture of your progress. They can help you stay motivated and on track.

Here’s a table comparing the features of these apps:

| App | Budgeting | Credit Score Monitoring | Debt Tracking |

|---|---|---|---|

| Mint | Yes | No | Yes |

| YNAB | Yes | No | Yes |

| Credit Karma | No | Yes | Yes |

| Debt Payoff Planner | No | No | Yes |

Select the app that best fits your needs and start tracking your debt repayment progress today.

Maintaining Healthy Credit Habits Post-debt

Maintaining healthy credit habits post-debt is crucial for your financial future. After paying off credit cards, staying disciplined ensures lasting financial wellness. Here’s how to sustain those good habits.

Creating A Sustainable Spending Plan

Design a sustainable spending plan to keep your finances in check. Use a simple budget that aligns with your income. Track every expense and categorize them:

- Essential Needs (rent, utilities, groceries)

- Wants (dining out, entertainment)

- Savings (emergency fund, retirement)

Stick to your budget and avoid impulse buys. Utilize cash envelopes for discretionary spending. This method limits overspending and keeps you accountable.

Set up automatic transfers to savings accounts. This ensures you save consistently. Automate bill payments to avoid late fees and maintain a good credit score.

Continuing Credit Monitoring And Education

Regularly monitor your credit reports. Use free tools like Credit Karma or annual credit reports. Check for errors and dispute any inaccuracies. This helps maintain a healthy credit score.

Stay educated about credit and personal finance. Read books, attend workshops, or take online courses. Knowledge empowers you to make better financial decisions.

Consider using a secured credit card if needed. This type of card helps rebuild credit while minimizing risk. Use it responsibly and pay the balance in full each month.

Follow these steps to keep your financial life in order. Consistent effort ensures your credit health stays on track.

When To Consider Professional Debt Relief Services

Credit card debt can feel overwhelming. Sometimes, professional help is essential. Professional debt relief services offer structured plans to manage and reduce debt. These services provide expertise and guidance that can make a significant difference. Below, we explore when to consider such services.

Credit Counseling And Debt Management Plans

Credit counseling agencies help manage debt through structured plans. They review your financial situation and offer advice. Credit counselors can negotiate lower interest rates with creditors. They often create a Debt Management Plan (DMP) tailored to your needs.

A DMP consolidates your debts into one monthly payment. This can simplify your finances. It usually involves closing credit card accounts to avoid further debt. Here are some benefits of using a DMP:

- Lower interest rates

- Waived late fees

- Single monthly payment

Credit counseling services often provide educational resources. These resources help you understand budgeting and financial planning. They also offer support to stay on track with your DMP.

The Role Of Bankruptcy In Severe Debt Situations

In extreme cases, bankruptcy may be the best option. Bankruptcy provides legal protection from creditors. It can eliminate or reduce debt significantly. There are two main types of bankruptcy for individuals:

| Type | Description |

|---|---|

| Chapter 7 | Liquidates assets to pay off debts. Remaining debts are discharged. |

| Chapter 13 | Creates a repayment plan to pay debts over 3-5 years. |

Bankruptcy has serious consequences. It remains on your credit report for up to 10 years. This can affect your ability to get loans or credit. Speaking with a bankruptcy attorney helps understand the implications. They can guide you through the process and assess if bankruptcy is right for you.

Before deciding on bankruptcy, consider other options. Debt management plans or debt settlement might be viable alternatives.

The Future Of Credit Management

Credit management is changing fast. New trends and tools are emerging. These innovations help manage credit card debt more efficiently. People can now control their finances better than before.

Emerging Trends In Credit Card Usage

More people use digital wallets. These wallets store credit card information securely. They make transactions faster and safer.

Another trend is the rise of reward programs. Credit cards offer cash back and points. This encourages users to spend more responsibly.

Contactless payments are also growing. They allow quick and touch-free transactions. This trend gained popularity during the COVID-19 pandemic.

Innovative Financial Tools For Managing Debt

Many apps track spending and set budgets. These apps notify users about their spending limits. This helps avoid overspending.

Debt consolidation tools are now available. They combine multiple debts into one. This makes payments easier to manage.

AI-based financial advisors give personalized advice. They analyze spending habits and suggest ways to save. This makes managing credit card debt simpler and smarter.

| Tool | Benefit |

|---|---|

| Digital Wallets | Secure, quick transactions |

| Reward Programs | Encourages responsible spending |

| Contactless Payments | Fast, touch-free transactions |

| Spending Tracker Apps | Helps avoid overspending |

| Debt Consolidation Tools | Easier debt management |

| AI-based Financial Advisors | Personalized saving advice |

Credit: www.consumercredit.com

Can Credit Repair Services Help in Paying Off Credit Card Debt Faster?

Credit repair services focus on improving credit scores but do not directly pay off credit card debt. They help by disputing inaccuracies and negotiating with creditors, potentially lowering interest rates. Understanding credit repair cloud pricing can be useful for businesses offering such services, helping clients manage financial situations more effectively.

Frequently Asked Questions

Is The Best Strategy For Paying Your Credit Card Bill?

Pay your credit card bill in full monthly. This avoids interest charges. Set up automatic payments to avoid late fees. Prioritize high-interest cards first. Monitor your spending and stay within your budget.

What Is The Correct Way To Pay Off A Credit Card?

Pay off your credit card by making more than the minimum payment. Focus on high-interest balances first. Set up automatic payments to avoid missing due dates. Consider consolidating debt with a balance transfer. Regularly monitor your statements for accuracy.

What Is The Best Order To Pay Off Credit Card Debt?

Pay off credit card debt using the avalanche method. Start with the highest interest rate card. Make minimum payments on others. After clearing the highest, move to the next highest. This saves money on interest.

Is It Better To Pay Off One Credit Card Or Pay Down Several?

It’s better to pay off one credit card first. This reduces interest charges and can improve your credit score faster. Prioritize the card with the highest interest rate to save money.

What Is The Snowball Method?

The snowball method focuses on paying off the smallest debt first to build momentum.

Conclusion

Paying off credit cards requires a solid strategy. Focus on high-interest debts first and create a budget. Consistent payments will lead to financial freedom. Remember, the key is discipline and planning. Start today and watch your debt decrease over time.

Achieving financial stability is within your reach.