FCRA Violations: Understanding the Consequences & Penalties

FCRA violations refer to breaches of the Foreign Contribution Regulation Act, which governs foreign donations to Indian entities. Violations can lead to severe penalties and restrictions on future contributions.

The Foreign Contribution Regulation Act (FCRA) is a significant legislation in India. It ensures that foreign contributions do not affect national security and public interest. Organizations receiving foreign funds must comply with FCRA regulations. Violations include failure to register, misuse of funds, or not adhering to reporting requirements.

Such breaches can result in hefty fines, cancellation of registration, or even imprisonment. Ensuring compliance is crucial for organizations to maintain their operations and credibility. Understanding FCRA guidelines helps avoid legal complications and promotes transparency in handling foreign contributions.

Credit: www.goodhire.com

FCRA Violations Explained

The Fair Credit Reporting Act (FCRA) is crucial for consumer rights. This law ensures fair and accurate credit reporting. Violating the FCRA can lead to serious penalties.

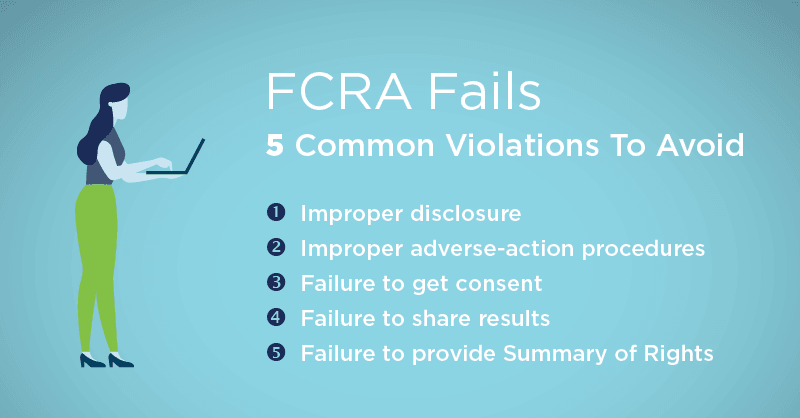

Common Violations

Understanding common violations helps in avoiding them.

- Reporting inaccurate information

- Failing to update incorrect data

- Accessing reports without a permissible purpose

- Not informing consumers of adverse actions

Reasons For Violations

There are many reasons why violations occur.

| Reason | Explanation |

|---|---|

| Negligence | Companies fail to follow FCRA rules carefully. |

| Ignorance | Some businesses are unaware of FCRA requirements. |

| Errors | Human errors in data entry can lead to violations. |

| Malpractice | Deliberate non-compliance to benefit financially. |

Legal Framework

The Legal Framework for FCRA violations ensures the protection of consumer rights. Understanding the laws and authorities involved is crucial. This section delves into the key components that form the legal basis for FCRA violations.

Relevant Laws

The Fair Credit Reporting Act (FCRA) is the primary law. It governs how consumer information is collected and used.

- FCRA: Ensures accuracy, fairness, and privacy of consumer information.

- FACTA: An amendment to FCRA, it addresses identity theft and credit reporting accuracy.

- GLBA: The Gramm-Leach-Bliley Act deals with personal financial information protection.

Regulatory Authorities

Various regulatory authorities enforce FCRA compliance. They ensure that companies adhere to the rules.

| Authority | Role |

|---|---|

| FTC | The Federal Trade Commission oversees consumer protection and FCRA compliance. |

| CFPB | The Consumer Financial Protection Bureau enforces FCRA and handles consumer complaints. |

| State AGs | State Attorneys General can enforce FCRA at the state level. |

Understanding these laws and authorities helps in preventing FCRA violations.

Consequences Of Violations

Violating the Foreign Contribution Regulation Act (FCRA) can lead to severe outcomes. These consequences can affect both financially and operationally. Understanding these impacts is crucial for organizations.

Financial Penalties

FCRA violations can result in hefty fines. The government imposes these fines to ensure compliance. Below is a table showing potential financial penalties:

| Violation Type | Penalty Amount |

|---|---|

| Minor Violations | $1,000 – $10,000 |

| Major Violations | $10,000 – $100,000 |

| Severe Violations | $100,000 – $1,000,000 |

Heavy fines can deplete an organization’s financial resources. Minor violations may still result in significant costs. Major and severe violations can lead to even greater financial distress.

Operational Impact

FCRA violations can also impact the organization’s operations.

- License Suspension: The government can suspend licenses.

- Operational Halt: Organizations may need to stop their activities.

- Reputation Damage: Trust with donors and stakeholders can erode.

- Legal Complications: Legal battles can drain time and resources.

License suspensions can paralyze operations. Operational halts may lead to project delays. Reputation damage affects future funding opportunities. Legal complications can be long and costly.

Understanding the consequences of violations is vital. It helps organizations maintain compliance and avoid severe repercussions.

Credit: www.clantonlawoffice.com

Criminal Penalties

Understanding the criminal penalties for FCRA violations is crucial. Violating the Fair Credit Reporting Act can lead to severe consequences. Both individuals and businesses must comply to avoid harsh punishments.

Jail Terms

Jail terms can be a severe consequence of FCRA violations. Violators might face imprisonment depending on the severity of the offense. The law can impose sentences of up to two years in prison. Repeat offenders may receive longer sentences.

Even first-time offenders are not immune to jail time. Courts take FCRA violations seriously. Protecting consumer information is a priority. Violating this trust can lead to incarceration.

Fines

Fines are another significant penalty for FCRA violations. Individuals and businesses can face hefty fines. Fines can range from $100 to $1,000 per violation. Some cases can result in even higher fines.

Courts may impose fines based on the number of violations. Each violation can lead to a separate fine. This can add up quickly, resulting in substantial financial penalties. Repeat offenders may face even steeper fines. Ensuring compliance with FCRA is essential to avoid these penalties.

| Violation Type | Possible Penalty |

|---|---|

| First-Time Offender | Up to 2 years in prison |

| Repeat Offender | Longer jail terms |

| Per Violation Fine | $100 to $1,000 |

Understanding these penalties can help in avoiding them. Compliance with FCRA is not just a legal requirement. It is also a way to protect consumer trust and business reputation.

Administrative Actions

The Foreign Contribution Regulation Act (FCRA) maintains strict guidelines. These are meant to regulate foreign contributions to non-profit organizations in India. Violations of FCRA rules can lead to serious administrative actions. These actions ensure organizations adhere to legal standards and transparency.

License Suspension

License suspension is a common administrative action for FCRA violations. Authorities may suspend a license for a specific period. During this suspension, the organization cannot receive foreign contributions. This period allows authorities to investigate and verify compliance.

Suspension can be temporary, often lasting up to 180 days. This provides time for corrective measures. If violations are minor, the suspension may end sooner. Organizations must submit required documents and rectify issues promptly.

Revocation

Revocation is a more severe administrative action. It permanently cancels the FCRA license of an organization. Once revoked, the organization can no longer receive foreign contributions. Revocation usually follows severe or repeated violations.

The process involves a thorough investigation. Authorities ensure that the organization has failed to comply repeatedly. Revocation is often the last resort after other measures fail. It aims to uphold the integrity of the foreign contribution system.

Organizations facing revocation must take immediate corrective actions. They may appeal the decision within a specific timeframe. However, compliance with FCRA norms is crucial to avoid such outcomes.

Compliance Measures

Ensuring compliance with the Fair Credit Reporting Act (FCRA) is vital. It helps businesses avoid legal issues and maintain trust. This section highlights key compliance measures to prevent FCRA violations.

Best Practices

Adopting best practices is crucial for FCRA compliance. Start with clear policies and procedures.

- Train employees on FCRA requirements.

- Use secure methods to handle consumer information.

- Review and update your policies regularly.

Another best practice is to document all processes. This includes how you collect, store, and share consumer data. Documentation helps prove compliance if audited.

Implementing a robust system for data accuracy is also important. Incorrect data can lead to FCRA violations. Regularly check and correct any errors in your database.

Regular Audits

Conducting regular audits is essential for FCRA compliance. Audits help identify and fix potential issues.

| Audit Type | Frequency |

|---|---|

| Internal Audits | Quarterly |

| External Audits | Annually |

Internal audits should be done quarterly. These audits review your processes and policies. They ensure they align with FCRA requirements.

External audits should be done annually. Hire an independent auditor for this. They provide an unbiased review of your compliance status.

Regular audits help maintain high standards. They also prepare you for any unexpected regulatory checks.

Case Studies

Understanding FCRA violations through case studies provides invaluable insights. These real-world scenarios highlight what went wrong and what can be learned. Below, we delve into some notable cases and the lessons they offer.

Notable Cases

There have been several high-profile FCRA violation cases in recent years. These cases often involve large corporations and have significant implications.

| Case | Details | Outcome |

|---|---|---|

| Spokeo, Inc. v. Robins | Spokeo allegedly provided inaccurate information about Robins. | Supreme Court ruled on the need for concrete harm. |

| Ramirez v. TransUnion | TransUnion inaccurately labeled individuals as terrorists. | Supreme Court awarded damages to plaintiffs. |

| Wells Fargo | Wells Fargo failed to provide accurate credit reporting. | Settled for millions in penalties. |

Lessons Learned

Each case offers valuable lessons for businesses and individuals.

- Accurate Reporting: Always ensure data accuracy. Errors can lead to significant penalties.

- Consumer Rights: Respect consumer rights to avoid legal issues.

- Compliance: Adhere to FCRA guidelines to maintain trust.

Businesses must prioritize compliance and accuracy. These steps help avoid costly violations and maintain consumer trust.

Future Outlook

The future of FCRA violations is changing. Organizations must stay updated. The new rules will impact many areas. Let’s explore what’s coming next.

Regulatory Changes

Regulatory changes are on the horizon. New laws aim to tighten controls. These laws will enforce stricter compliance. Organizations must adapt quickly. Compliance costs may rise. Here are some key points:

- Stricter data protection rules

- More frequent audits

- Higher penalties for violations

Impact On Organizations

The impact on organizations will be significant. They need to invest in better compliance tools. Training staff becomes essential. Failing to comply can lead to hefty fines. Here are some potential impacts:

| Area | Impact |

|---|---|

| Financial | Higher compliance costs and penalties |

| Operational | Need for advanced compliance tools |

| Human Resources | Increased training requirements |

Organizations must act now. Prepare for these changes. Stay compliant to avoid penalties.

Frequently Asked Questions

1. What Is A Violation Of FCRA?

A violation of the FCRA occurs when a company improperly accesses or uses your credit information. It includes errors in reporting, not providing required disclosures, or failing to obtain your consent.

2. What Are My Rights Under The FCRA?

You have the right to access your credit report, dispute inaccuracies, and be informed if information in your file has been used against you.

3. What Is Considered A Liability For Violations Of The FCRA?

Liabilities for FCRA violations include actual damages, statutory damages, and punitive damages. Legal fees and court costs may also apply.

4. How Much Can I Sue For A FCRA Violation?

You can sue for FCRA violations and recover between $100 to $1,000 per violation. Legal fees and actual damages may also be awarded.

Conclusion

Understanding FCRA violations is crucial for compliance and legal safety. Stay informed to avoid penalties and legal issues. Regular audits and proper documentation can help maintain compliance. Always consult with legal experts to ensure your organization adheres to all FCRA regulations. Stay proactive to protect your organization’s reputation and financial health.