Investigative Consumer Report Sample: Critical Insights

An Investigative Consumer Report provides detailed information about an individual’s background. It includes personal habits, character, and reputation.

Investigative Consumer Reports are essential tools for employers and landlords. These reports go beyond basic credit checks, offering a comprehensive view of an individual’s lifestyle, work ethic, and reliability. They gather information from personal interviews with associates, neighbors, and colleagues.

This thorough approach helps in making informed decisions about potential hires or tenants. Companies use these reports to ensure they bring trustworthy and dependable individuals into their organizations. Landlords rely on them to choose responsible tenants who will respect their property. Understanding the scope and accuracy of these reports is crucial for anyone involved in hiring or renting decisions.

Credit: www.onesourcebackground.com

Introduction To Investigative Consumer Reports

An Investigative Consumer Report gives in-depth details about someone’s background. It includes personal and professional life. Businesses use these reports for hiring or lending decisions.

Purpose And Importance

The main purpose of an investigative consumer report is to verify trustworthiness. Employers use these reports to ensure they hire reliable employees. Lenders use them to decide if someone is a good credit risk. These reports help in making informed decisions.

Investigative consumer reports are important because they protect businesses from fraud. They ensure a safe workplace by verifying employee backgrounds. They also help in maintaining a company’s reputation.

Key Elements

An investigative consumer report includes several key elements:

- Personal Information: Name, address, Social Security number

- Credit History: Credit scores, outstanding debts

- Employment History: Previous jobs, roles, and responsibilities

- Education Verification: Degrees, certifications

- Criminal Records: Any criminal history or pending cases

- References: Feedback from past employers or associates

The report can also include details like driving records. Each element helps build a complete picture of the person.

| Element | Description |

|---|---|

| Personal Information | Basic identifying details like name and address |

| Credit History | Details of credit scores and debts |

| Employment History | Past jobs and roles |

| Education Verification | Degrees and certifications earned |

| Criminal Records | Any criminal activities or pending cases |

| References | Feedback from past employers or associates |

Each key element adds value and completeness to the report. This makes decision-making easier and more reliable.

Credit: www.signnow.com

Components Of A Comprehensive Report

Understanding the components of a comprehensive report is crucial for anyone reviewing an investigative consumer report. These reports provide detailed insights into various aspects of an individual’s background. Below are the key components that make up a thorough investigative consumer report.

Personal Data

Personal data includes essential information about an individual. This typically covers:

- Full Name

- Date of Birth

- Social Security Number

- Current and Previous Addresses

- Contact Information (phone number, email address)

This data forms the foundation of the report, providing basic identification details.

Employment History

Employment history offers a detailed look at the individual’s work experience. Important elements include:

| Employer Name | Position | Dates of Employment | Responsibilities |

|---|---|---|---|

| ABC Corp | Software Engineer | 2015-2020 | Developing software applications |

| XYZ Inc | Project Manager | 2020-Present | Managing software projects |

Knowing the employment history helps assess an individual’s professional background and stability.

Financial Information

Financial information is a critical component. This includes:

- Credit Score

- Credit Reports

- Debt Obligations

- Bankruptcy Records

These details provide a snapshot of the individual’s financial health and responsibility.

A comprehensive report is essential for making informed decisions. Each component provides valuable insights into different aspects of an individual’s background.

Legal And Ethical Considerations

Investigative consumer reports offer valuable insights into a person’s background. However, they come with legal and ethical responsibilities. Companies must ensure compliance with laws and respect privacy concerns. Understanding these aspects is crucial for the responsible use of these reports.

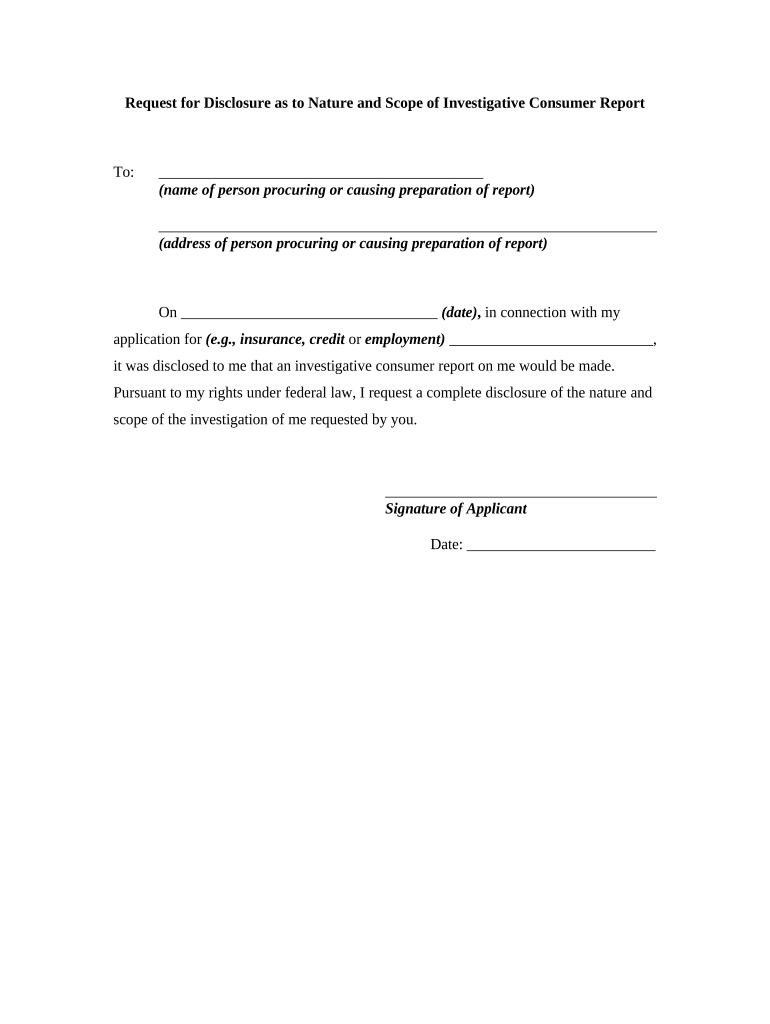

Compliance With Laws

Companies must follow strict laws when using investigative consumer reports. The Fair Credit Reporting Act (FCRA) is a key law in the United States. It sets rules for collecting, using, and sharing consumer information.

- Provide a clear disclosure to the consumer.

- Obtain written consent before conducting the report.

- Notify the consumer if the report affects their application.

Failure to comply with these laws can result in penalties. Companies must stay updated with any changes in regulations. This ensures they avoid legal issues and maintain ethical standards.

Privacy Concerns

Privacy is a major concern in investigative consumer reports. Consumers have a right to know how their information is used. Companies must handle data with care and respect.

| Privacy Aspect | Company Responsibility |

|---|---|

| Data Collection | Collect only necessary information. |

| Data Storage | Ensure secure storage of consumer data. |

| Data Sharing | Share data only with authorized parties. |

Consumers should be informed about data collection practices. They should know who has access to their information. Transparency builds trust and ensures the ethical use of consumer reports.

Data Collection Methods

Understanding how data is collected is crucial in an Investigative Consumer Report Sample. Different methods provide unique insights. Here are three key methods:

Interviews

Interviews gather firsthand information. They involve direct conversations. This method allows for detailed responses. Interviewers ask specific questions. They record the responses accurately. Interviews can be in person or over the phone. This method ensures high-quality data collection. It provides deep insights into consumer behavior.

Public Records

Public records offer valuable information. They include documents like court records and property deeds. These records are accessible to the public. Analysts review these documents carefully. They extract relevant data. Public records help verify the information. They also provide historical data. This method is reliable and verifiable.

Surveillance

Surveillance involves monitoring activities. It gathers data through observation. This method captures real-time information. Surveillance can be covert or overt. It uses tools like cameras and trackers. This method ensures accuracy. It records actual behavior, not self-reported data.

| Method | Key Features | Advantages |

|---|---|---|

| Interviews | Direct conversations, detailed responses | High-quality data, deep insights |

| Public Records | Accessible documents, historical data | Reliable, verifiable |

| Surveillance | Monitoring, real-time data | Accurate, captures actual behavior |

Analyzing And Interpreting Findings

Analyzing and interpreting findings in an investigative consumer report sample is crucial. This step helps businesses make informed decisions. Let’s explore how to recognize patterns and assess risks.

Pattern Recognition

Pattern recognition involves identifying recurring trends in the data. Look for consistent behaviors or anomalies.

- Purchase History: Check for frequent buys of specific products.

- Customer Feedback: Note repeated comments or complaints.

- Demographic Trends: Identify common traits among your customers.

Use tools to visualize these patterns. Charts and graphs can simplify the data. This helps in making sense of complex information quickly.

Risk Assessment

The risk assessment determines potential threats based on the findings. This step helps in mitigating risks early.

- Financial Risks: Assess financial stability based on spending patterns.

- Behavioral Risks: Look for unusual activities or red flags.

- Compliance Risks: Ensure adherence to legal standards.

Create a table to summarize these risks:

| Risk Type | Indicators | Action Plan |

|---|---|---|

| Financial | High spending in a short period | Review credit limits |

| Behavioral | Frequent complaints | Implement customer feedback |

| Compliance | Non-adherence to policies | Conduct internal audits |

Regularly update your risk assessment plans. This ensures your business stays ahead of potential issues.

Common Challenges And Solutions

Investigative consumer reports can be complex. They have various challenges that require effective solutions. Addressing these issues ensures accurate and fair reports. Let’s explore some common challenges and their solutions.

Data Accuracy

Data accuracy is a significant challenge in investigative consumer reports. Incorrect data can lead to unfair assessments. Ensuring accuracy involves several steps:

- Verify information from multiple sources.

- Use automated tools to cross-check data.

- Regularly update records.

Using a table can help in tracking data accuracy:

| Step | Action |

|---|---|

| 1 | Verify from multiple sources |

| 2 | Use automated tools |

| 3 | Regularly update records |

Bias And Objectivity

Bias and objectivity are critical in maintaining report integrity. Bias can distort findings. Objectivity ensures fairness. To achieve this:

- Train investigators on unbiased methods.

- Implement checks for impartiality.

- Use diverse teams to review reports.

Avoiding bias and ensuring objectivity involves continuous efforts. Regular training and diverse teams help maintain fairness.

Case Study: Sample Report Analysis

Investigative consumer reports offer deep insights into consumer behavior. Understanding these reports helps businesses make informed decisions. This case study dissects a sample investigative consumer report. It reveals the report’s structure and key findings.

Background Information

The sample report covers a six-month period. It analyzes consumer behavior in the electronics sector. Data sources include surveys, purchase histories, and social media analysis. The report aims to identify purchasing patterns and brand preferences.

| Data Source | Details |

|---|---|

| Surveys | Collected from 1,000 consumers |

| Purchase Histories | Analyzed transactions from major retailers |

| Social Media | Monitored brand mentions on Twitter and Facebook |

Key Insights

- Brand Loyalty: 60% of consumers stick to one brand.

- Purchase Drivers: Price and quality are top factors.

- Social Media Influence: 40% of purchases driven by social media.

Brand loyalty is strongest among older consumers. Younger consumers are more price-sensitive. Social media impacts younger consumers more significantly.

Impact And Conclusions

The insights guide marketing strategies. Companies can tailor campaigns to different age groups. Understanding purchase drivers helps improve product offerings. Businesses can leverage social media to boost sales.

This report emphasizes the value of investigative consumer reports. They provide actionable insights for businesses. Using these insights, companies can enhance customer satisfaction and loyalty.

Credit: www.uslegalforms.com

Future Trends In Consumer Reporting

The landscape of consumer reporting is rapidly evolving. Emerging trends are shaping the future of this industry. In this section, we will explore key future trends in consumer reporting.

Technological Advancements

Technology is transforming consumer reporting. Artificial Intelligence (AI) and Machine Learning (ML) are leading the charge. These technologies enhance data accuracy and speed.

AI can analyze vast amounts of data quickly. It identifies patterns and trends that humans might miss. ML improves over time, making predictions more accurate.

Blockchain is another game-changer. It ensures data security and transparency. This technology prevents tampering and fraud. Blockchain creates a trustworthy environment for consumer reports.

Automation is also on the rise. Automated systems streamline report generation. They reduce human error and save time. This makes consumer reports more reliable and efficient.

Regulatory Changes

Regulations are evolving to protect consumers. New laws are being introduced globally. These laws aim to ensure data privacy and accuracy.

The General Data Protection Regulation (GDPR) in Europe sets a high standard. It mandates strict data protection measures. Companies must comply to avoid hefty fines.

The California Consumer Privacy Act (CCPA) is another significant regulation. It gives consumers more control over their data. Businesses must be transparent about data usage.

Future regulations may include data portability. This allows consumers to transfer their data easily. It fosters competition and innovation in the industry.

| Technological Advancements | Regulatory Changes |

|---|---|

| AI and ML improve data accuracy | GDPR ensures strict data protection |

| Blockchain enhances security | CCPA gives control over data |

| Automation streamlines processes | Future laws may focus on data portability |

These trends are shaping the future of consumer reporting. Embracing these changes is crucial for staying competitive.

Frequently Asked Questions

1. What Is A Investigative Consumer Report Example?

An investigative consumer report example includes detailed background checks, employment history, criminal records, and personal references. It provides in-depth information about an individual’s character and lifestyle. These reports help employers make informed hiring decisions.

2. What Is An Example Of A Consumer Report?

A common example of a consumer report is a product review on Consumer Reports, detailing features, performance, and user feedback.

3. How To Get An Investigative Consumer Report?

To get an investigative consumer report, request it from a consumer reporting agency. Provide necessary identification details and consent.

4. What Is The Primary Difference Between A Consumer Report And An Investigative Report?

A consumer report provides information about an individual’s credit history. An investigative report includes interviews and detailed background checks.

Conclusion

Understanding investigative consumer reports is crucial for informed decisions. Use the sample provided to ensure accuracy and compliance. Empower your choices with knowledge and stay ahead. Always review and understand your reports thoroughly. This helps in safeguarding your interests and maintaining transparency in your transactions. Stay informed and proactive.