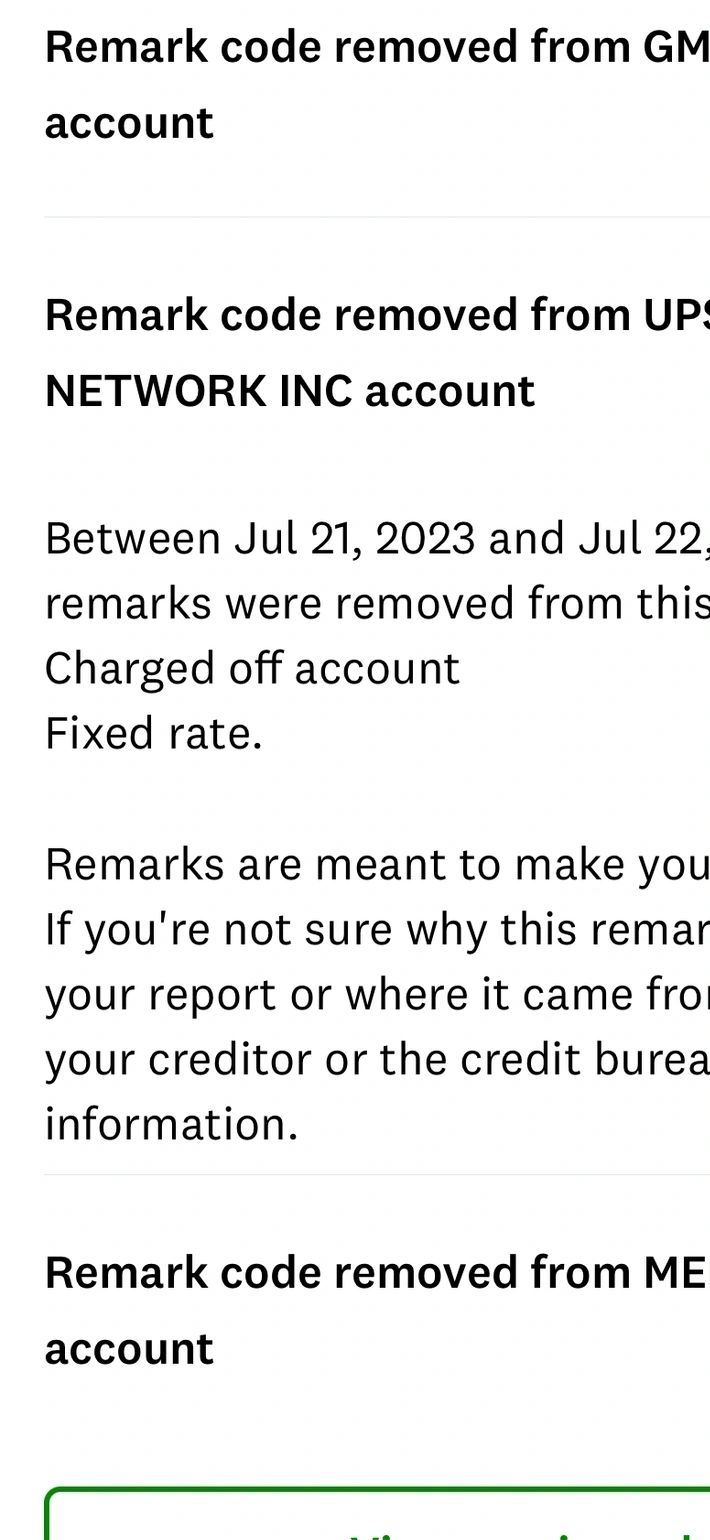

Remark Code Removed from Credit Report: Step-By-Step Guide

A remark code removed from your credit report means the specific note or comment has been deleted. This can improve your credit score.

Having a clean credit report is crucial for financial health. Negative remarks can impact your credit score and limit borrowing opportunities. Removing a remark code can be beneficial, potentially leading to a higher credit score and better loan terms. Regularly monitoring your credit report helps you identify and address any issues promptly.

Disputing inaccuracies and working to remove negative remarks are proactive steps. Maintaining a positive credit history includes timely payments and responsible credit use.

By understanding the impact of remark codes and taking corrective actions, you can improve your overall financial standing. A well-managed credit report reflects financial responsibility and can open doors to better financial opportunities.

Introduction To Remark Codes

Understanding remark codes on your credit report is crucial. These codes provide insights into your credit history. They impact your credit score and financial health.

What Are Remark Codes?

Remark codes are notes added by creditors or credit bureaus. They explain certain actions or statuses on your credit report. Examples include late payments, disputes, or closed accounts.

These codes help lenders understand your credit behavior. They are usually short. Here are some common remark codes:

Code 001: Account in good standing

Code 002: Account 30 days past due

Code 003: Account in dispute

Impact On Credit Score

Remark codes can significantly affect your credit score. Positive codes can enhance your score. Negative codes can lower it.

Remark Code | Impact |

|---|---|

Code 001 | Positive |

Code 002 | Negative |

Code 003 | Neutral |

Removing negative remark codes can improve your credit score. It is essential to monitor your credit report regularly. This helps ensure accuracy and address any issues promptly.

Common Types Of Remark Codes

Understanding the common types of remark codes on your credit report can help you manage your credit health better. These codes provide specific information about the status of your accounts. Knowing what they mean can empower you to take the necessary actions to improve your credit score.

Late Payments

Late payments are one of the most common types of remark codes. They indicate that you have missed payments on your accounts. This can significantly impact your credit score. Credit bureaus usually report late payments if they are 30 days or more past due.

Here are some common remark codes for late payments:

30 days late: Indicates a payment was 30 days overdue.

60 days late: Indicates a payment was 60 days overdue.

90 days late: Indicates a payment was 90 days overdue.

Each missed payment can stay on your credit report for up to seven years. It’s crucial to make timely payments to avoid these negative remarks.

Collections

Collections occur when a creditor hands over an unpaid debt to a collection agency. This usually happens after several missed payments. A collection remark code can severely damage your credit score.

Common remark codes for collections include:

Account in collections: Indicates the account is with a collection agency.

Paid collection: Indicates the debt was paid after it went to collections.

Settled collection: Indicates the debt was settled for less than the full amount.

These codes can also remain on your credit report for up to seven years. Settling or paying off the debt can help improve your score over time.

How Remark Codes Affect Creditworthiness

Remark codes on your credit report can significantly impact your creditworthiness. These codes provide additional context about your credit history. They inform lenders about the specifics of your financial behavior. Understanding how these codes affect you is crucial for maintaining a good credit score.

Lender Perceptions

Lenders use remark codes to gauge your credit risk. A negative remark code can signal financial instability. This may include late payments or accounts sent to collections. Positive remark codes, on the other hand, reflect responsible credit use. They show timely payments and settled accounts.

Negative remark codes can make you appear as a high-risk borrower. Lenders may hesitate to approve your loan applications. In contrast, positive remark codes can boost your credibility. They give lenders confidence in your ability to manage credit.

Loan Approval Rates

Remark codes can directly impact loan approval rates. Loans are often granted based on your credit score and history. Remark codes offer insights that go beyond just numbers.

Remark Code | Impact on Loan Approval |

|---|---|

Late Payment | Decreases Approval Chances |

Account in Collections | Significantly Reduces Approval |

Timely Payments | Increases Approval Chances |

Settled Accounts | Improves Approval Rates |

Late payments and accounts in collections can drastically lower your loan approval chances. Timely payments and settled accounts can enhance your approval rates. Therefore, managing your credit responsibly is essential.

Make sure to regularly check your credit report. Address any negative remark codes promptly. This will help maintain your creditworthiness and improve loan approval chances.

Credit: crowncollective.online

Steps To Remove Remark Codes

Removing remark codes from your credit report can significantly improve your credit score. It’s a straightforward process, but it requires attention to detail. Follow these steps to ensure your credit report is accurate and free from unnecessary remark codes.

Requesting A Credit Report

Start by requesting your credit report from the major credit bureaus. You are entitled to one free report from each bureau annually. Get Credit Repair Cloud Free Trial to get a free Report.

Ensure you get reports from Equifax, Experian, and TransUnion. Each bureau may have different information. Review all three to get a complete picture of your credit status.

Once you receive your credit reports, save copies for your records. You will need these for the next steps.

Identifying Errors

Thoroughly review each credit report for errors. Look for any remark codes that seem incorrect or outdated. Compare information across all three reports.

Common errors include:

Outdated information

Incorrect balances

Duplicate accounts

Accounts that don’t belong to you

Make a note of any discrepancies you find. Highlight or list them separately for easy reference.

If you find errors, create a detailed list. Include account numbers, specific errors, and any supporting documentation you have.

Use this list to contact the credit bureaus and dispute the errors. You can usually do this online through the credit bureau’s website. Each bureau has a different process, so follow their specific instructions.

Keep a record of all your communication with the credit bureaus. Note dates, representatives’ names, and any reference numbers.

Removing remark codes from your credit report helps improve your financial health. Follow these steps diligently to ensure your report is accurate.

Disputing Inaccurate Remark Codes

Incorrect remark codes can affect your credit score. Disputing them is important for maintaining a healthy credit profile. Learn how to file a dispute and what documentation you need.

Filing A Dispute

To start, contact the credit bureau. Use their online dispute form or send a letter. Clearly state the inaccurate remark code. Include your full name and contact information.

Here is a simple table with important information:

Step | Action |

|---|---|

1 | Contact the credit bureau |

2 | State the inaccurate remark code |

3 | Include personal details |

Supporting Documentation

Gather all necessary documents. These can include:

Copy of your credit report

Proof of identity

Any supporting evidence

Attach these documents to your dispute. This helps prove your case and speed up the process. Send copies, not originals. Keep the originals safe.

Example Dispute Letter:

Your Name

Your Address

City, State, Zip Code

Date

Credit Bureau Name

Bureau Address

City, State, Zip Code

Subject: Dispute of Inaccurate Remark Code

Dear Sir/Madam,

I am writing to dispute an inaccurate remark code on my credit report. The code is [Remark Code]. Please see the attached documents for proof.

Thank you,

Your Name

Working With Credit Bureaus

Having a remark removed from your credit report can boost your credit score. To achieve this, you need to work directly with the credit bureaus. These bureaus manage your credit data and have the power to remove inaccurate remarks.

Equifax

Equifax is one of the major credit bureaus. Contact them to dispute any incorrect remarks. They offer several ways to reach them:

Online Dispute Portal

Mail

Phone

For mail disputes, send a letter to:

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30374-0256

Include your full name, current address, and a copy of your credit report with the incorrect remark highlighted.

Experian

Experian allows you to dispute remarks online, by mail, or by phone. Here are the contact details:

Online Dispute Center

Mail: P.O. Box 4500, Allen, TX 75013

Phone: 1-888-397-3742

Provide your personal information, a copy of your credit report, and a clear explanation of the dispute.

Transunion

TransUnion offers several options for disputing inaccurate remarks:

Online Dispute Form

Mail: P.O. Box 2000, Chester, PA 19016

Phone: 1-800-916-8800

Include all necessary documents to support your dispute.

Response Timeframes

Credit bureaus typically have 30 days to investigate your dispute. They will notify you of the results once the investigation is complete.

Credit Bureau | Response Time |

|---|---|

Equifax | 30 days |

Experian | 30 days |

TransUnion | 30 days |

If your dispute is successful, the credit bureau will remove the inaccurate remark from your report.

Alternative Solutions For Code Removal

Removing a remark code from your credit report can boost your score. Several alternative solutions exist to achieve this goal. Explore these options to find the best path for you.

Credit Repair Services

Credit repair services offer professional assistance in removing remark codes. They have expertise in dealing with credit bureaus. These services can identify errors and dispute them. Here’s how they can help:

Analyze your credit report

Identify incorrect remark codes

Dispute errors with credit bureaus

Provide ongoing monitoring

Using credit repair services can save you time. They have the knowledge to handle complex issues. Hiring professionals may be a wise investment.

Negotiating With Creditors

Another option is negotiating with creditors directly. This approach involves communicating with the companies who reported the remark. Steps to negotiate include:

Contact the creditor by phone or mail

Explain your situation and request removal

Provide supporting documents if needed

Follow up until the remark is removed

Be polite and persistent in your negotiations. Keep records of all communications. This approach can be effective if you present a strong case.

Both credit repair services and negotiating with creditors offer viable solutions. Choose the one that best fits your needs and resources.

Maintaining A Clean Credit Report

Keeping a clean credit report is crucial for financial health. Removing a remark code from your credit report can be a significant step. It’s essential to follow best practices to ensure your credit report remains spotless.

Regular Monitoring

Regularly checking your credit report helps you spot errors. You can catch and correct inaccuracies quickly. Check your report from all three major credit bureaus:

Equifax

Experian

TransUnion

Each bureau might have different information. Reviewing all three ensures you don’t miss any issues.

Best Practices For Credit Health

Follow these best practices to maintain a clean credit report:

Pay bills on time: Timely payments boost your credit score.

Keep credit card balances low: High balances can hurt your credit.

Avoid opening many new accounts: Too many inquiries can lower your score.

Review your credit report: Regularly check for and dispute errors.

Keep old accounts open: Longer credit history can improve your score.

Using these practices can help keep your credit report in top shape. A clean credit report opens doors to better financial opportunities.

Boosting Your Credit Score Post Removal

Removing a remark from your credit report is a big step. It can have a positive impact on your credit score. But what comes next? Here are some strategies to further boost your credit score after the removal.

Timely Payments

Timely payments are the backbone of a good credit score. Paying bills on time shows lenders you are reliable. Set reminders for your payment dates. This ensures you never miss a due date. Automatic payments are also a good idea. They help you avoid late payments.

Even one late payment can harm your credit score. So, stay consistent. You can use a calendar or an app to track your payments. This will keep you on top of your finances.

Low Credit Utilization

Low credit utilization is another key factor. This means using a small portion of your available credit. A good rule is to keep it below 30%. For example, if your credit limit is $1,000, aim to use less than $300.

Here is a simple table to illustrate this:

Credit Limit | Recommended Utilization |

|---|---|

$500 | Less than $150 |

$1,000 | Less than $300 |

$2,000 | Less than $600 |

Paying off balances regularly helps keep utilization low. Avoid maxing out your credit cards. This shows lenders you can manage your credit wisely.

Remember, both timely payments and low credit utilization are crucial. They can significantly boost your credit score after a remark is removed. Stay consistent and watch your score rise!

Real-life Success Stories

Learn from real-life success stories about people who had a remark code removed from their credit reports. These stories inspire and offer hope for improving your credit score.

Case Study 1

John’s Journey:

John had a remark code for a late payment on his credit report. He worked hard to get it removed. Here’s how he did it:

John gathered all his payment records.

He contacted the creditor and explained the situation.

John requested a goodwill adjustment.

The creditor agreed and removed the remark code.

John’s credit score improved by 50 points. His persistence paid off.

Case Study 2

Sarah’s Success:

Sarah discovered a discrepancy in her credit report. She noticed a remark code for a debt that wasn’t hers. This is her story:

Sarah disputed the remark code with the credit bureau.

She provided evidence that the debt was not hers.

The bureau investigated and found in her favor.

The remark code was removed within 30 days.

Sarah’s quick action saved her credit score from dropping. Her experience shows the importance of checking your credit report regularly.

Can the Same Steps Be Used to Remove Remark Codes from a Credit Report?

Yes, the same steps can be used to remove credit report disputes. First, review your credit report for any inaccuracies. Then, submit a dispute letter to the credit bureau and provide any supporting documentation. Finally, monitor your report for updates and follow up if necessary.

Frequently Asked Questions

1. Is It Good To Have Remarks Removed From Credit Report?

Yes, it’s beneficial to remove negative remarks from your credit report. It can improve your credit score and increase approval chances for loans.

2. Can A Remark Be Removed From A Credit Report?

Yes, you can remove a remark from a credit report. Contact the credit bureau or creditor, dispute inaccuracies, and provide supporting documentation.

3. What Is A Remark Code On A Credit Report?

A remark code on a credit report provides additional information about an account. It explains specific conditions or actions.

4. How Do I Get A Dispute Remarks Removed From My Credit Report?

Contact the credit bureau and request the removal of dispute remarks. Provide documentation showing the issue is resolved. Follow up diligently.

5. What Is A Remark On A Credit Report?

A remark is a note added by a creditor indicating specific information about your account.

Conclusion

Removing a remark code from your credit report can significantly improve your credit score. It opens doors to better financial opportunities.

Stay proactive by regularly checking your credit report. Address any inaccuracies promptly. This ensures your credit profile remains healthy and accurate. Achieving a clean credit report is crucial for financial success.