Freezing Credit Pros And Cons: Is It Worth the Risk?

Freezing credit prevents new accounts from being opened in your name. It protects against identity theft but may cause inconvenience.

Freezing your credit is a powerful tool to safeguard your financial identity. This process restricts access to your credit report, making it harder for fraudsters to open new accounts in your name. While this added layer of security offers peace of mind, it also comes with certain drawbacks.

You may find it inconvenient when applying for new credit or services, as you’ll need to temporarily lift the freeze.

Understanding both the advantages and disadvantages of freezing your credit can help you make an informed decision. This proactive step can greatly enhance your financial security but requires careful management to avoid potential hassles.

Credit: lifelock.norton.com

Introduction To Credit Freezing

Credit freezing is a method to protect your credit from fraud. It helps keep your personal information safe. Freezing your credit can prevent unauthorized access.

What Is Credit Freezing?

A credit freeze restricts access to your credit report. Only companies you already do business with can see your credit report. New creditors cannot access your report without your permission.

Credit freezing is also called a security freeze. It does not affect your credit score. It is a free service offered by credit bureaus.

How Credit Freezing Works

To freeze your credit, contact the three main credit bureaus: Equifax, Experian, and TransUnion. You can do this online, by phone, or by mail. After your request, the bureaus will provide a PIN or password. Keep this information safe, as you will need it to lift the freeze.

Here is a simple table showing the steps:

| Steps | Action |

|---|---|

| Step 1 | Contact each credit bureau |

| Step 2 | Request a freeze |

| Step 3 | Receive a PIN or password |

| Step 4 | Keep your PIN safe |

Once frozen, your credit report is locked. No one can open new accounts using your information. To unfreeze your credit, use your PIN or password.

Benefits Of Freezing Credit

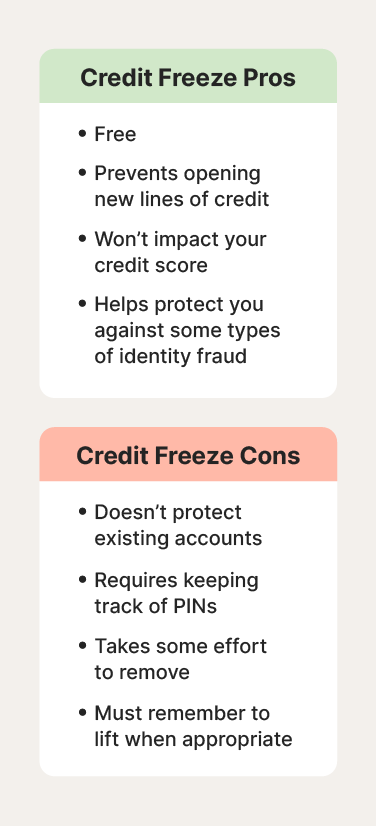

Freezing your credit can be a smart move. It helps protect against fraud and gives you control over who can access your credit. Let’s delve into the key benefits.

Protection Against Fraud

When you freeze your credit, no one can open new accounts. This stops identity thieves from opening accounts in your name. Your existing accounts remain safe and accessible. This step is essential after data breaches.

Freezing your credit can also prevent unauthorized credit checks. This is crucial for maintaining a healthy credit score. You can lift the freeze anytime if you need to apply for credit. This adds an extra layer of security.

Control Over Credit Access

Freezing your credit puts you in control. Only you can unlock your credit report. This means you decide who can see your credit history. It’s a powerful tool for managing your financial future.

With this control, you can avoid unwanted credit card offers. It also stops lenders from accessing your credit without permission. This makes your credit report more private and secure.

| Benefit | Description |

|---|---|

| Fraud Protection | Stops new accounts from being opened in your name. |

| Credit Control | You decide who can access your credit report. |

| Privacy | Avoid unwanted credit checks and offers. |

Drawbacks Of Freezing Credit

Freezing credit helps protect against identity theft. But it has drawbacks. Understanding these drawbacks is essential before deciding.

Inconvenience In Credit Applications

Freezing credit makes applying for credit cumbersome. Each time you apply, you must unfreeze your credit. This can delay your application process.

Unfreezing and refreezing often involve multiple steps. This process can be time-consuming and frustrating. Instant credit approvals become almost impossible.

Potential Fees Involved

Some states charge fees for freezing and unfreezing credit. These fees can add up, making the process costly. Check with your state for specific charges.

Even small fees can deter you from freezing credit. Fees may vary based on the credit bureau and the state.

Impact On Credit Score

Freezing your credit can have a significant impact on your credit score. Many people wonder how this action influences their credit stability and overall financial health. Below, we explore the nuances of how freezing your credit can affect your score.

Credit Score Stability

Freezing your credit provides a layer of protection against identity theft. It does not directly affect your credit score. Your credit score remains stable, as the freeze only restricts new credit inquiries. This means potential creditors cannot access your credit report.

Existing accounts remain unaffected. You can still use your credit cards, pay bills, and monitor your credit score. The stability in your credit score ensures you don’t face any unexpected dips due to fraudulent activities.

Misconceptions About Credit Freezing

Many people have misconceptions about credit freezing. Some believe it will harm their credit score. This is not true. Freezing your credit does not lower your score. It simply prevents new credit accounts from being opened in your name.

Another common myth is that you can’t apply for new credit while your credit is frozen. You can temporarily lift the freeze if you need to apply for a loan or credit card. This flexibility ensures you can manage your credit needs without permanently unfreezing your credit.

Freezing your credit is free and reversible. You can freeze and unfreeze your credit as often as needed. This makes it a practical tool for protecting your financial health.

Process Of Freezing Credit

The process of freezing credit involves taking steps to protect your financial identity. This method prevents unauthorized access to your credit report. Freezing your credit can be a smart move for many. Below, we break down the steps and required documentation.

Steps To Freeze Credit

To freeze your credit, follow these simple steps:

- Contact each of the three credit bureaus: Equifax, Experian, and TransUnion.

- Request a credit freeze on your report.

- Provide necessary documentation and information.

- Receive a confirmation of your credit freeze.

- Keep your freeze PIN or password safe.

Necessary Documentation

When freezing your credit, you will need certain documents:

- A copy of your government-issued ID (e.g., driver’s license).

- Proof of address (e.g., utility bill, bank statement).

- Social Security number.

- Personal information such as full name, date of birth, and address.

Having these documents ready will make the process faster. You might also need to answer security questions. This helps verify your identity.

Once your credit is frozen, it remains protected until you decide to unfreeze it. This extra layer of security can be crucial for safeguarding your financial well-being.

Credit: www.forbes.com

Unfreezing Credit

Unfreezing your credit is an important step after a freeze. This allows you to apply for loans, credit cards, or other financial services. There are two main ways to unfreeze credit: temporary lifts and permanent unfreezing.

Temporary Lifts

A temporary lift allows you to unfreeze your credit for a specific period. This is useful if you need to apply for credit but don’t want to permanently unfreeze your account.

- Flexibility: You can choose the exact dates for the lift.

- Security: Your credit will automatically refreeze after the period ends.

- Control: You can specify which creditors can access your credit.

Here’s a simple table to compare the pros and cons:

| Pros | Cons |

|---|---|

| Flexible duration | Temporary access only |

| Automatic refreeze | Requires planning |

| Specific creditor access | Limited time |

Permanent Unfreezing

Permanent unfreezing removes the freeze from your credit report indefinitely. This is useful if you need ongoing access to your credit.

- Convenience: No need to manage lift periods.

- Access: Creditors can access your credit anytime.

- Time-saving: No repeated requests to unfreeze and refreeze.

Yet, there are some drawbacks:

- Security risk: Your credit is always accessible.

- Less control: All creditors can see your credit report.

- Potential misuse: Easier for unauthorized access.

Choose the method that suits your needs best.

Alternatives To Credit Freezing

Freezing credit is a strong way to protect your identity. Yet, it is not the only option. There are other ways to safeguard your financial information. These alternatives can be more flexible and easier to manage.

Credit Monitoring Services

Credit monitoring services keep an eye on your credit reports. They alert you to suspicious activity. This helps you act quickly if something looks wrong.

Here are some benefits of credit monitoring services:

- Immediate Alerts: You get notifications about new accounts or credit inquiries.

- Comprehensive Monitoring: Some services monitor all three major credit bureaus.

- Identity Theft Insurance: Many services offer insurance for identity theft cases.

Popular credit monitoring services include:

| Service Name | Key Features |

|---|---|

| Experian CreditWorks | Daily FICO scores, identity theft insurance |

| Identity Guard | Dark web monitoring, risk management reports |

| Credit Karma | Free credit scores, financial advice |

Fraud Alerts

Fraud alerts warn creditors to take extra steps to verify your identity. This makes it harder for thieves to open accounts in your name.

There are three types of fraud alerts:

- Initial Fraud Alert: This lasts for one year and is free.

- Extended Fraud Alert: Lasts for seven years. Available if you are a proven identity theft victim.

- Active Duty Alert: Lasts for one year. Designed for military personnel on duty.

Setting up a fraud alert is simple. You can contact any of the three major credit bureaus:

- Equifax

- Experian

- TransUnion

They will notify the other two bureaus for you.

Credit: www.forbes.com

Personal Considerations

Freezing your credit is a big decision. It affects your financial life. Before you act, consider your situation. This involves assessing your risk and evaluating your financial habits. These steps will help you make an informed choice.

Assessing Personal Risk

Start by assessing your risk. Are you a target for identity theft? Have you faced identity theft before? If yes, freezing your credit might be a good idea. This step can protect your financial future.

Consider your online activity. Do you shop online often? Do you share personal information on social media? High online activity can increase your risk. Freezing your credit can provide peace of mind.

Also, think about your current security measures. Do you use strong passwords? Do you monitor your credit reports? If your security measures are weak, freezing your credit offers an extra layer of protection.

Evaluating Financial Habits

Next, evaluate your financial habits. How often do you apply for new credit? If you apply for credit often, freezing your credit might be inconvenient. You will need to unfreeze your credit each time.

Think about your spending habits. Do you make big purchases often? Do you finance purchases with new credit? If yes, consider how freezing your credit will impact this.

Consider your financial goals. Are you planning to buy a house or a car soon? You will need to unfreeze your credit for these transactions. Make sure you understand the process.

Check your credit report regularly. Are there any unusual activities? Regular monitoring can alert you to potential issues. This can reduce the need for freezing your credit.

| Personal Risk Factors | Financial Habits |

|---|---|

| High online activity | Frequent credit applications |

| Previous identity theft | Big purchases |

| Weak security measures | Planned major transactions |

Frequently Asked Questions

1. What Is The Downside Of Freezing Your Credit?

Freezing your credit can slow down loan approvals. It may also require fees and effort to temporarily unfreeze.

2. How Long Does Credit Freeze Last?

A credit freeze lasts until you lift it. You can remove it temporarily or permanently anytime.

3. What Is The Difference Between A Lock And A Freeze On Credit?

A credit lock is quicker and easier to manage, often through an app. A credit freeze offers stronger legal protection.

4. Can You Build Credit If Your Credit Is Frozen?

Yes, you can build credit even if your credit is frozen. Continue paying bills on time and maintain low balances.

5. What Is A Credit Freeze?

A credit freeze restricts access to your credit report, making it harder for identity thieves to open accounts in your name.

Conclusion

Freezing your credit has both advantages and drawbacks. It offers strong protection against identity theft. Yet, it can complicate accessing new credit quickly.

Weigh these factors before deciding. Understand your financial needs and security concerns. Make an informed choice that best suits your situation. Your credit safety is worth the effort.