Credit Repair Contract: Secure Your Financial Health

A Credit Repair Contract is a legally binding agreement between a credit repair company and a client. It outlines services, fees, and terms.

A Credit Repair Contract is essential for individuals seeking professional help to improve their credit scores.

This document ensures transparency and sets clear expectations for both the credit repair company and the client. It typically includes details about the services offered, payment terms, and the duration of the contract.

Understanding the terms of this agreement helps clients make informed decisions and avoid potential scams.

Always review the contract thoroughly before signing to ensure it aligns with your financial goals. A well-drafted Credit Repair Contract can be a crucial step toward achieving a healthier credit profile and better financial stability.

Credit: www.fiverr.com

Understanding Credit Repair

Credit repair is essential for anyone with a low credit score. It involves fixing your poor credit standing. This can be through addressing errors on your credit report. Sometimes, it involves disputing inaccurate information. Knowing what credit repair is and common credit issues can help you immensely.

What Is Credit Repair?

Credit repair is the process of improving your credit score. This can be done by working on your credit report. It usually involves identifying and disputing errors. Credit repair can also involve negotiating with creditors. This helps to remove or correct inaccurate information.

Many people use credit repair services. These services assist in improving their credit score. Credit repair companies offer expertise in dealing with credit bureaus. They can help correct inaccuracies that affect your credit score.

Common Credit Issues

Many individuals face common credit issues. These issues often impact their credit score negatively. Here are some of the most frequent problems:

- Late payments: Paying bills late can drastically lower your credit score.

- High debt: Owing too much money affects your credit utilization ratio.

- Errors on credit report: Mistakes on your report can unfairly lower your score

- Identity theft: Fraudulent activities can damage your credit.

Addressing these issues is crucial. It helps in improving your credit score. Regularly checking your credit report is essential. It helps you stay aware of any inaccuracies or issues.

| Credit Issue | Impact |

|---|---|

| Late Payments | Significant decrease in credit score |

| High Debt | Increased credit utilization ratio |

| Errors on Report | Unfairly low credit score |

| Identity Theft | Fraudulent activity damaging credit |

Credit: credit-repair-contract-form.pdffiller.com

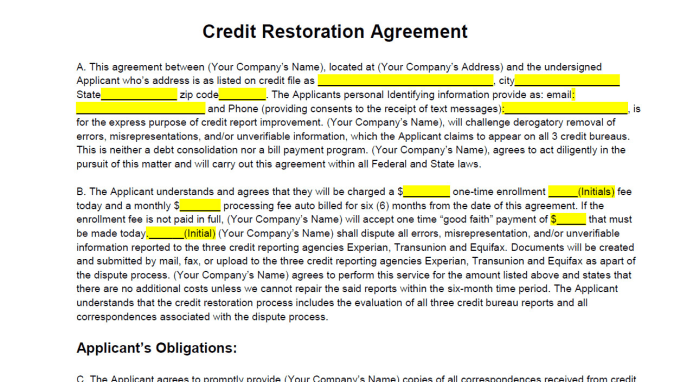

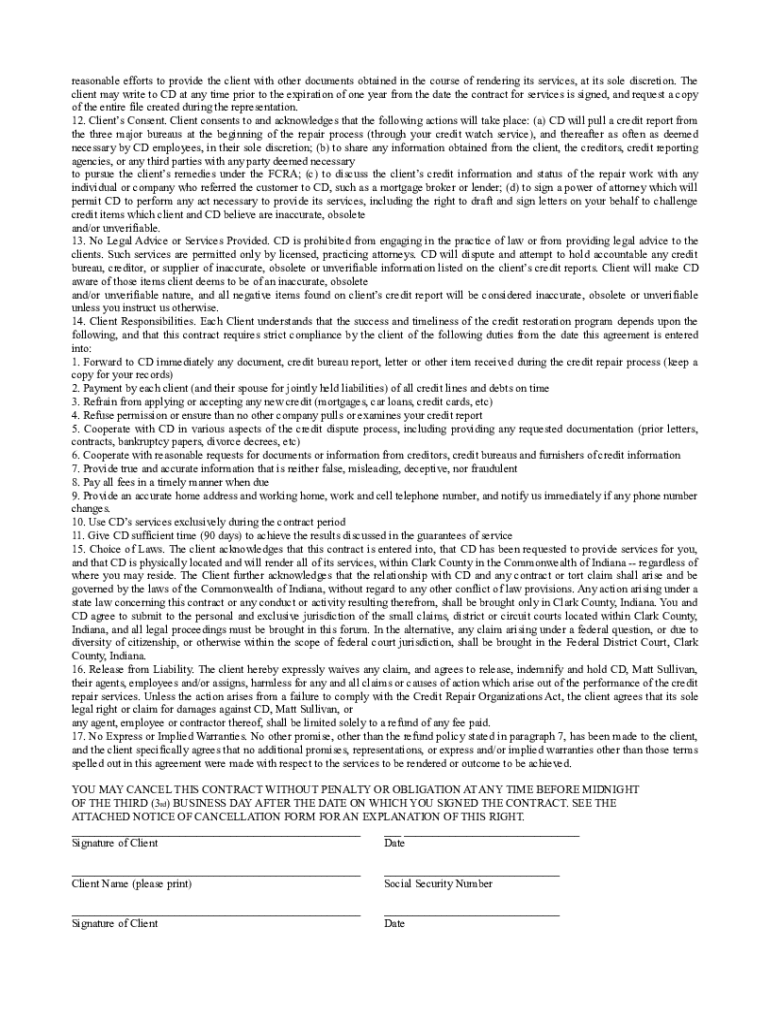

Essential Elements Of A Credit Repair Contract

A credit repair contract is a key document. It defines the relationship between you and the credit repair company. It ensures transparency and sets clear expectations.

Clear Terms And Conditions

Terms and conditions are crucial. They outline the agreement’s rules. Look for the following points:

- Start and end dates: When does the service begin and end?

- Payment details: How much do you pay and when?

- Cancellation policy: Can you cancel? If so, how?

- Liability clauses: Who is responsible for what?

These elements provide clarity. They protect both parties.

Services Offered

Know what services you are paying for. A good contract lists specific services. These may include:

- Credit report analysis: A detailed review of your credit report.

- Dispute letters: Sending letters to credit bureaus.

- Negotiations: Talking to creditors on your behalf.

- Financial advice: Tips to improve your credit score.

Understanding services offered helps you know what to expect. It ensures you get the help you need.

Legal Requirements

Understanding the legal requirements for a credit repair contract is essential. These requirements ensure transparency, fairness, and protection for consumers seeking credit repair services.

Consumer Protection Laws

Various consumer protection laws regulate credit repair services. These laws aim to prevent fraudulent activities and safeguard consumer rights. The Credit Repair Organizations Act (CROA) is a crucial federal law.

The CROA mandates that credit repair companies must:

- Provide a written contract detailing services and costs.

- Allow consumers to cancel the contract within three days without penalty.

- Refrain from making false claims about their services.

State-specific Regulations

Each state may have additional rules for credit repair contracts. These regulations vary widely and can include:

| State | Specific Regulation |

|---|---|

| California | Mandatory bond for credit repair companies. |

| Florida | Written disclosures about consumer rights. |

| New York | Strict advertising guidelines for credit repair services. |

It’s important to check your state’s specific requirements to ensure compliance.

Fee Structure

Understanding the fee structure in credit repair contracts is crucial. Knowing how fees are charged helps you make informed decisions. There are two main types of fees: upfront fees and performance-based fees.

Upfront Fees

Upfront fees are charged before any service is provided. These fees cover the initial setup and analysis of your credit report. They may include administrative costs and the creation of a personalized action plan.

Here is a breakdown of common upfront fees:

- Setup Fee: A one-time charge for account creation.

- Analysis Fee: Fee for reviewing your credit report.

- Consultation Fee: Fee for initial consultation and strategy planning.

Performance-based Fees

Performance-based fees depend on the results achieved. These fees are charged only after specific goals are met. They align the service provider’s incentives with your success.

Common performance-based fees include:

- Per Deletion Fee: Fee for each item removed from your credit report.

- Monthly Fee: Charged monthly based on the progress made.

- Score Improvement Fee: Charged if your credit score improves by a certain number of points.

Understanding these fee structures helps you choose the best credit repair service. Make sure to ask for a detailed breakdown before signing any contract.

Cancellation And Refund Policies

Understanding the cancellation and refund policies in a credit repair contract is crucial. These policies protect your rights as a consumer. Below, we delve into the specifics of these policies.

Cancellation Terms

Most credit repair contracts offer a three-day cancellation period. During this time, you can cancel without any penalty. This is often referred to as the “cooling-off period”.

To cancel your contract, you must send a written notice. Ensure you date and sign the notice. Keep a copy for your records.

Refund Conditions

Refund conditions vary by company. Generally, you are eligible for a refund if the company fails to deliver the promised services.

| Condition | Refund Eligibility |

|---|---|

| Service Not Provided | Full Refund |

| Partial Service Provided | Pro-rated Refund |

| Service Provided as Promised | No Refund |

Always read the fine print in your contract. Know your rights and the specific refund policies.

Credit: formspal.com

Client Responsibilities

Understanding Client Responsibilities is key in a Credit Repair Contract. Clients play a vital role in ensuring the success of their credit repair journey. Knowing and fulfilling these responsibilities can help achieve better and quicker results.

Providing Accurate Information

Clients must provide accurate information about their credit history. This includes:

- Full name and current address

- Social security number

- Details of credit accounts

- Copies of credit reports

Providing correct information helps avoid delays and ensures the process runs smoothly. Always double-check the details before submission.

Timely Communication

Timely communication is crucial in a credit repair process. Clients should:

- Respond promptly to emails or calls

- Notify about any changes in contact details

- Provide required documents on time

Staying in touch with the credit repair service ensures that any issues can be addressed quickly. This helps in maintaining momentum and achieving results faster.

Monitoring Progress

Monitoring progress is essential in any credit repair contract. This ensures you’re on the right path. Keeping track helps adjust strategies if needed. Here’s how you can effectively monitor your progress.

Regular Updates

Receiving regular updates is crucial. It helps you understand the changes in your credit score. Regular updates should be frequent. Most services provide updates monthly. This helps you stay informed. You can see improvements or setbacks.

Regular updates also serve as a motivational tool. Seeing positive changes encourages you to stay committed. It’s like having a personal coach. They guide you step-by-step.

Access To Credit Reports

Having access to credit reports is vital. Credit reports show the details of your credit history. You can see what’s affecting your score. This includes late payments, debts, and inquiries.

| Report Element | Details |

|---|---|

| Late Payments | Shows history of missed payments. |

| Debts | Lists all outstanding debts. |

| Inquiries | Shows who has checked your credit. |

Reviewing credit reports helps you identify errors. Errors can negatively impact your score. Correcting these errors is part of the process. With access, you can monitor these corrections.

- Identify errors

- Track corrections

- Understand score influences

Access to credit reports keeps you informed. It empowers you to take control of your credit repair journey.

Choosing The Right Credit Repair Service

Choosing the right credit repair service can be overwhelming. With many options available, it’s essential to make an informed decision. A reliable service can improve your credit score and financial health.

Research And Reviews

Start by researching different credit repair services. Use search engines to find reviews. Look for customer feedback on platforms like Yelp and Google. Pay attention to both positive and negative reviews. Customer experiences can provide valuable insights.

Check if the service has resolved similar issues to yours. Look for any red flags or consistent complaints. A company with many negative reviews may not be trustworthy.

Join online forums and ask for recommendations. Community opinions often highlight reliable services. Compare different services based on overall customer satisfaction.

Accreditation And Certifications

Verify if the credit repair service has proper accreditation. The National Association of Credit Services Organizations (NACSO) is a reputable accrediting body. Membership in NACSO indicates a commitment to ethical practices.

Check for certifications from organizations like the Credit Repair Organizations Act (CROA). CROA certification ensures compliance with federal laws. Certified companies are more likely to follow ethical guidelines.

Look for services endorsed by financial experts. Endorsements can be a sign of credibility. Accredited and certified services are generally more reliable.

| Criteria | Importance |

|---|---|

| Customer Reviews | High |

| Accreditation | Very High |

| Certifications | High |

| Endorsements | Medium |

How Does a Credit Repair Law Firm Help in Securing a Strong Credit Repair Contract?

A credit repair law firm helps individuals negotiate errors and discrepancies on their credit reports, ensuring accuracy and fairness. With expert guidance, clients gain credit repair legal process insights to navigate disputes effectively. These firms also assist in drafting a strong credit repair contract that complies with regulations, protecting client interests.

Frequently Asked Questions

1. Can I Pay Someone To Fix My Credit?

Yes, you can pay someone to fix your credit. Credit repair companies can help dispute errors. Be cautious of scams.

2. Is Credit Repair Illegal In Texas?

Credit repair is legal in Texas. Companies must comply with the Texas Credit Services Organizations Act. Always choose a reputable service.

3. Can Credit Repair Hurt Your Credit?

Yes, credit repair can hurt your credit if done incorrectly. Disputing accurate information or using fraudulent tactics can lower your score. Always use reputable services.

4. How Does Credit Repair Make Money?

Credit repair companies make money by charging fees for services. They dispute errors, negotiate with creditors, and offer financial advice.

5. What Is A Credit Repair Contract?

A credit repair contract is a legal agreement between a credit repair company and a client to improve credit scores.

Conclusion

A credit repair contract is crucial for rebuilding your financial health. Ensure you read and understand every clause. Seek professional advice if needed. This contract can be the first step toward a brighter financial future. Take control and make informed decisions for lasting credit improvement. Take the time to carefully review your credit repair contract and make sure it reflects your specific needs and goals. Remember that effective credit repair takes time and dedication, so stick with the program and stay committed to making positive changes. With the right support and a solid contract in place, you can confidently navigate the path to improved credit and financial stability. For those in need of affordable credit repair solutions, a well-crafted credit repair contract can provide the necessary structure and guidance. Look for a contract that offers clear pricing and a detailed outline of the services provided. With the right credit repair contract, you can take the first step towards improving your financial health without breaking the bank.