Credit Repair Cloud Reviews: Unveiling the Truth

Credit Repair Cloud generally receives positive reviews for its user-friendly interface and effective tools. Users appreciate its comprehensive features and customer support.

Credit Repair Cloud is a popular choice for individuals and businesses aiming to improve their credit scores. This software provides an all-in-one solution for credit repair, offering features like automated dispute letters, client management, and financial education.

Many users find the interface intuitive, which makes navigating through the various tools straightforward.

The platform also offers excellent customer support, ensuring users receive the help they need. Positive reviews often highlight the effectiveness of the software in improving credit scores, making it a trusted resource in the credit repair industry. If you’re serious about credit repair, Credit Repair Cloud is worth considering.

Features Of Credit Repair Cloud

Credit Repair Cloud Reviews highlight the impressive features that make this software a top choice for credit repair businesses.

This tool offers a comprehensive suite of functionalities designed to streamline the credit repair process. Let’s dive into the key features that set Credit Repair Cloud apart.

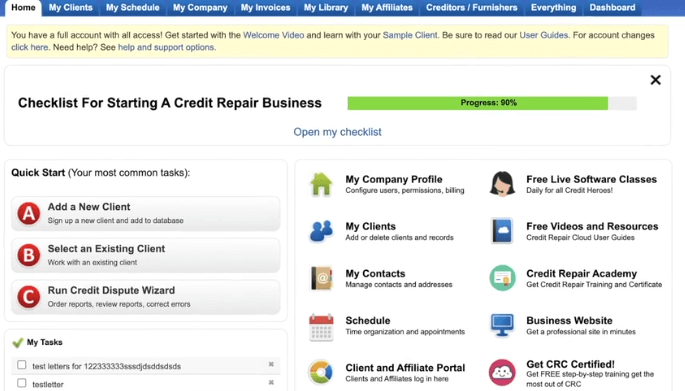

User-friendly Interface

The user-friendly interface of Credit Repair Cloud stands out in user reviews. The software is designed to be intuitive, making it easy for users with varying levels of tech-savviness to navigate. Key elements include:

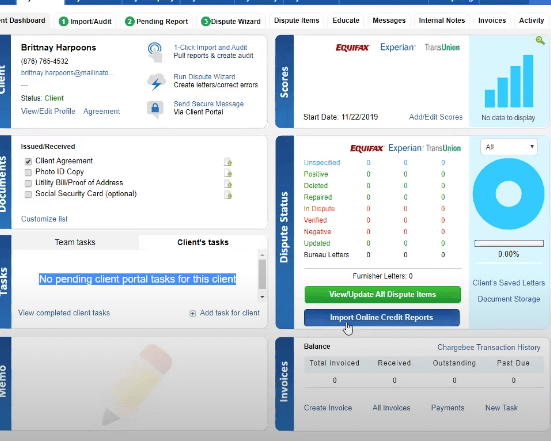

Dashboard: The dashboard provides a clear overview of client progress, upcoming tasks, and important notifications.

Navigation: Simple and logical navigation paths ensure users can find what they need quickly.

Customization: Users can customize their dashboard to display the most relevant information for their business.

Users appreciate the clean layout and the absence of clutter, which enhances efficiency. The interface also features drag-and-drop functionalities, allowing users to easily manage their workflows. Client management is streamlined, with easy access to client profiles, reports, and communication history.

To sum up, the user-friendly interface ensures that users can focus more on their clients and less on figuring out how to use the software.

Automated Dispute Management

Another standout feature is the automated dispute management system. This feature simplifies the process of handling disputes, saving users time and effort. Key components include:

Automated Letter Generation: The software generates dispute letters automatically based on the client’s credit report data.

Tracking: Users can track the status of disputes in real-time, ensuring they stay informed about progress.

Templates: Pre-built templates for various dispute scenarios are available, ensuring consistency and compliance.

The automation of these tasks reduces the manual workload, allowing users to handle more clients efficiently. The system also includes reminders and alerts, ensuring no dispute is overlooked. Users can set up automatic follow-ups, ensuring timely communication with credit bureaus and clients.

Overall, the automated dispute management feature enhances productivity and ensures a systematic approach to credit repair.

Benefits Of Credit Repair Cloud

Credit Repair Cloud has garnered positive reviews from users who have experienced significant benefits. This powerful platform offers tools that help individuals and businesses improve their credit scores efficiently.

Understanding the benefits of Credit Repair Cloud can help you decide if it’s the right solution for your credit repair needs.

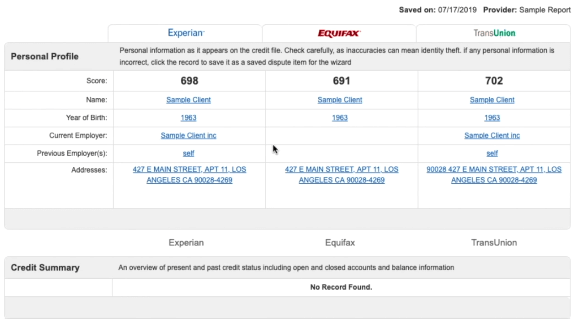

Improved Credit Scores

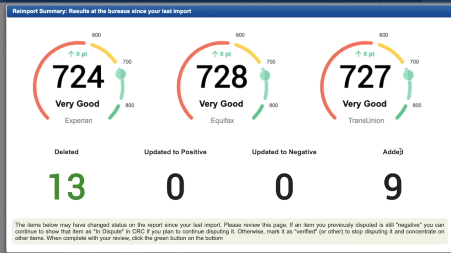

Credit Repair Cloud provides comprehensive tools to help users improve their credit scores. One key benefit is the ability to access accurate credit reports. The platform pulls data from all three major credit bureaus, ensuring you have a complete picture of your credit health.

Dispute Automation: The software automates the dispute process, making it easier to challenge incorrect items on your credit report.

Personalized Action Plans: Credit Repair Cloud offers customized action plans tailored to your unique credit situation.

Credit Monitoring: Continuous monitoring helps you stay on top of changes to your credit report.

Automating disputes saves time and increases the chances of removing negative items. Personalized action plans guide you step-by-step, making the process less overwhelming. The platform’s credit monitoring feature ensures you are always aware of your credit status, enabling quick responses to any changes.

Feature | Benefit |

|---|---|

Dispute Automation | Saves time, increases success rate |

Personalized Action Plans | Provides clear, tailored steps |

Credit Monitoring | Keeps you informed of changes |

Time And Cost Efficiency

Credit Repair Cloud is designed to save users both time and money. Automated processes reduce the manual work involved in credit repair. This allows you to focus on other important tasks while the software handles the heavy lifting.

Automated Letters: The platform generates and sends dispute letters automatically.

Client Management: Easy tracking and management of multiple clients for businesses.

Cost-Effective: Affordable pricing plans that fit various budgets.

Automated letters eliminate the need to draft disputes manually, speeding up the process. Businesses benefit from client management tools that streamline tracking and communication. Cost-effective pricing ensures that even small businesses can afford the service.

By leveraging automation, Credit Repair Cloud allows you to handle more cases in less time. This efficiency translates to lower operational costs and higher profits for businesses. For individuals, it means quicker improvements in credit scores without breaking the bank.

Overall, Credit Repair Cloud offers a combination of time-saving features and cost-effective solutions, making it an excellent choice for both individuals and businesses aiming to improve credit scores.

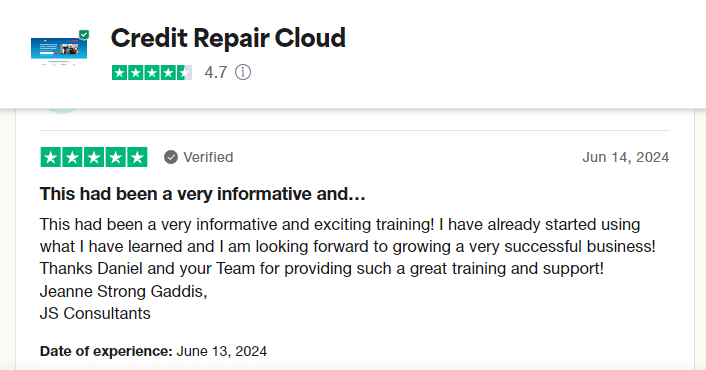

Customer Feedback

Credit Repair Cloud Reviews offer valuable insights into the platform’s performance. Customer feedback reveals the true user experience, highlighting both the positive outcomes and the challenges faced. This section delves into real stories from users who have tried Credit Repair Cloud.

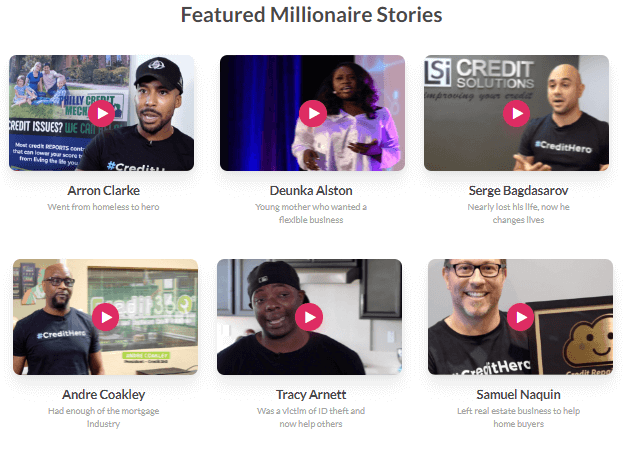

Success Stories

Many users have shared their success stories with Credit Repair Cloud. They have found the platform to be a game-changer for their credit repair businesses. Here are some of the key points:

Increased Efficiency: Users have reported a significant boost in their workflow efficiency.

Customer Growth: Many users have seen their client base grow rapidly after implementing the software.

Revenue Boost: Several customers mentioned a noticeable increase in their revenue.

Below is a table summarizing some of the success metrics shared by users:

Metric | Before Credit Repair Cloud | After Credit Repair Cloud |

|---|---|---|

Clients per Month | 10 | 25 |

Monthly Revenue | $2,000 | $5,000 |

Time Spent per Client | 3 hours | 1 hour |

These statistics show how Credit Repair Cloud has helped businesses grow and become more efficient.

Challenges Faced

Despite the success stories, some users have faced challenges while using Credit Repair Cloud. Understanding these challenges helps in setting realistic expectations:

Learning Curve: Some users found the platform complicated at first.

Technical Issues: Occasional bugs and glitches have been reported.

Customer Support: A few users mentioned delays in customer support response times.

Here is a table listing some of the common challenges and possible solutions:

Challenge | Description | Solution |

|---|---|---|

Learning Curve | Initial difficulty in understanding the platform | Comprehensive tutorials and webinars |

Technical Issues | Bugs and occasional glitches | Regular updates and bug fixes |

Customer Support | Slow response times | Enhanced support channels |

Addressing these challenges can lead to an even better user experience for Credit Repair Cloud customers.

Comparison With Competitors

Credit Repair Cloud is a popular choice for those aiming to fix their credit scores. But how does it stand against its competitors?

In this section, we will compare Credit Repair Cloud with other leading credit repair software, focusing on two key aspects: Performance Metrics and Pricing and Packages.

Performance Metrics

Performance is crucial for any credit repair software. Credit Repair Cloud consistently scores high on various metrics:

User-Friendly Interface: The dashboard is intuitive, making it easy for users to navigate.

Automation: Automates many tasks like sending dispute letters, which saves time.

Customer Support: Offers 24/7 support via chat, email, and phone.

Comparing these with competitors:

Software | User-Friendly Interface | Automation | Customer Support |

|---|---|---|---|

Credit Repair Cloud | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

DisputeBee | ⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ |

SkyBlue Credit | ⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐⭐ |

Credit Repair Cloud outshines in automation and customer support, making it a top choice for efficiency and reliability.

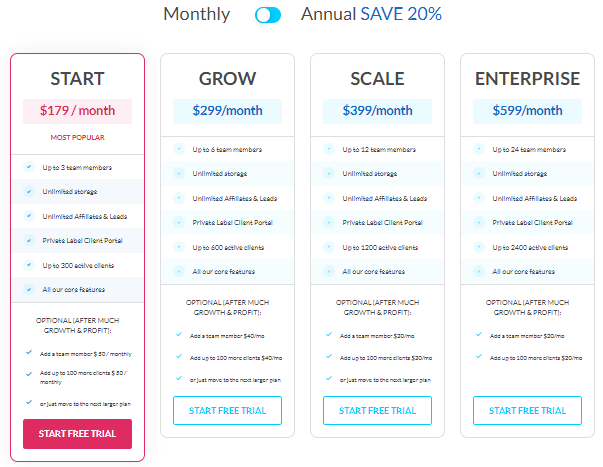

Pricing And Packages

Cost is another critical factor. Credit Repair Cloud offers various packages to suit different needs:

Starter Plan: $179/month, includes basic features.

Pro Plan: $299/month, includes advanced features and more users.

Enterprise Plan: $399/month, suitable for large businesses.

Comparing these with competitors:

Software | Starter Plan | Pro Plan | Enterprise Plan |

|---|---|---|---|

Credit Repair Cloud | $179/month | $299/month | $399/month |

DisputeBee | $199/month | $349/month | $449/month |

SkyBlue Credit | $159/month | $279/month | $379/month |

Credit Repair Cloud provides affordable plans with a wide range of features. This ensures businesses of all sizes can find a suitable option.

Regulatory Compliance

Credit Repair Cloud Reviews often highlight the importance of regulatory compliance. Ensuring that your credit repair business adheres to legal standards is crucial. This section delves into the key aspects of regulatory compliance, including Legal Considerations and Data Security Measures.

Legal Considerations

Legal considerations are critical in the credit repair industry. Compliance with laws not only protects your business but also builds trust with clients. Here are some key points to consider:

Credit Repair Organizations Act (CROA): This federal law governs credit repair businesses. It mandates transparent practices and prohibits misleading claims.

State Regulations: Each state may have its laws regulating credit repair services. Ensure your business complies with both federal and state laws.

Client Agreements: Contracts must be clear and fair. They should outline services provided, fees, and cancellation policies.

Adhering to these legal requirements can prevent lawsuits and penalties. It’s wise to consult a legal expert specializing in credit repair laws. This ensures your business practices are compliant and up-to-date.

Legal Aspect | Importance |

|---|---|

CROA | Prevents deceptive practices |

State Regulations | Ensures local compliance |

Client Agreements | Clarifies terms and conditions |

Data Security Measures

Data security is paramount in the credit repair industry. Protecting client information builds trust and prevents data breaches. Here are some essential data security measures:

Encryption: Encrypting data ensures that sensitive information is protected during transmission and storage.

Access Controls: Implementing strict access controls restricts data access to authorized personnel only.

Regular Audits: Conducting regular security audits helps identify and address vulnerabilities.

Investing in robust cybersecurity systems is crucial. This includes firewalls, anti-malware software, and secure servers. Regularly updating these systems helps protect against new threats.

Training staff on data security best practices is also essential. Educate employees on recognizing phishing attempts and using strong passwords. This reduces the risk of human error leading to data breaches.

By prioritizing data security, you safeguard client information and enhance your business’s reputation.

Credit: www.trustpilot.com

Future Outlook

Credit Repair Cloud has been a game-changer in the credit repair industry. It offers tools that help businesses streamline their operations and achieve better outcomes for their clients.

As technology continues to evolve, so does the landscape of credit repair. The future outlook for Credit Repair Cloud looks promising, with new trends and innovations shaping its path.

Trends In Credit Repair Industry

The credit repair industry is undergoing significant changes. Here are some key trends:

Increased Automation: Automation is becoming a staple. It helps reduce errors and speeds up processes, making credit repair more efficient.

Data Security: With rising cyber threats, data security is paramount. Companies invest in advanced security measures to protect sensitive client information.

Client Education: More companies focus on educating their clients. They provide resources and tools to help clients understand credit management.

Integration with Financial Tools: Credit repair services are integrated with other financial tools. This offers clients a more holistic approach to managing their finances.

The table below summarizes these trends:

Trend | Impact |

|---|---|

Increased Automation | Efficiency and accuracy |

Data Security | Protection of client information |

Client Education | Better client understanding |

Integration with Financial Tools | Holistic financial management |

Innovations In Credit Repair Cloud

Credit Repair Cloud is at the forefront of innovation in the credit repair industry. Some notable innovations include:

AI-Powered Analytics: AI tools analyze credit reports and identify issues faster. This leads to quicker resolutions and happier clients.

Customizable Client Portals: Clients can access personalized portals. These portals offer real-time updates and resources tailored to their needs.

Mobile App Integration: The mobile app allows clients to track their progress on the go. This enhances user convenience and engagement.

Advanced Reporting Features: New reporting features help businesses track their performance. They can generate detailed reports that highlight key metrics.

These innovations contribute to a brighter future for Credit Repair Cloud:

Innovation | Benefit |

|---|---|

AI-Powered Analytics | Faster issue identification |

Customizable Client Portals | Personalized client experience |

Mobile App Integration | Convenient progress tracking |

Advanced Reporting Features | Improved performance tracking |

Read Also:

How Important Is a Solid Credit Repair Contract When Using Credit Repair Cloud?

A well-structured credit repair contract for financial security is crucial when using Credit Repair Cloud. It outlines clear responsibilities, legal protections, and transparent terms for both businesses and clients. A strong contract ensures compliance with regulations, builds trust, and safeguards financial interests, making it an essential component of a successful credit repair business.

Frequently Asked Questions

1. How Much Is Credit Repair Cloud?

Credit Repair Cloud pricing starts at $179 per month. They offer various plans to suit different business needs.

2. What Is The Credit Repair Cloud?

Credit Repair Cloud is software for starting and running a credit repair business. It helps manage clients, disputes, and workflows.

3. Is Paying Someone To Fix Your Credit Worth It?

Paying someone to fix your credit can be worth it if you lack time or expertise. Research thoroughly before hiring.

4. Is Credit Repair Cloud An Mlm?

No, Credit Repair Cloud is not an MLM. It provides software for starting and running a credit repair business.

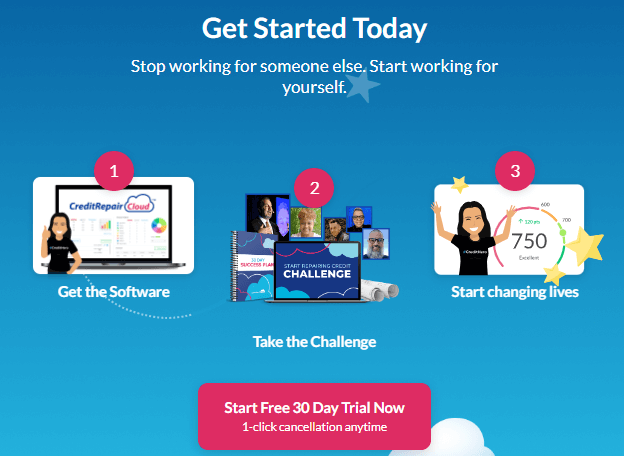

Conclusion

Choosing the right credit repair software is crucial. Credit Repair Cloud offers robust tools and excellent support. It’s ideal for businesses and individuals.

Positive user reviews highlight its effectiveness. If you’re serious about improving your credit repair process, give Credit Repair Cloud a try. It could be the solution you need.