Challenging Credit Inquiries: Strategies to Protect Scores

Challenging credit inquiries involves disputing inaccuracies with credit bureaus. Ensure documentation to support your claim for better results.

Credit inquiries can impact your credit score and financial health. Hard inquiries, such as loan applications, may lower your score temporarily. Disputing incorrect or unauthorized inquiries is crucial to maintaining a healthy credit profile. Start by obtaining your credit report and identifying any inaccuracies.

Contact the credit bureau and the creditor, providing evidence to support your dispute. This process can help remove erroneous inquiries, thus improving your credit score. Regularly monitoring your credit report can also prevent future inaccuracies. Taking these steps ensures your credit profile remains accurate, ultimately benefiting your financial stability. Remember, a clean credit report can enhance your chances of securing loans and favorable interest rates.

The Impact Of Credit Inquiries

Credit inquiries can significantly impact your credit score. Understanding their influence is crucial for maintaining healthy credit. Let’s explore the different types of credit inquiries and how they affect your credit scores.

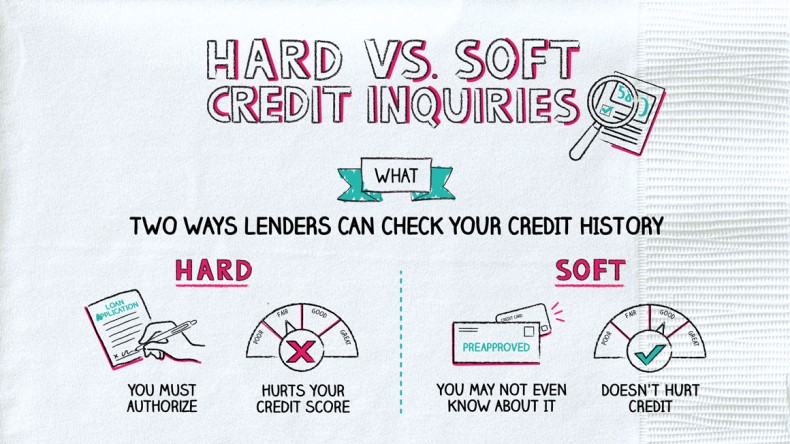

Hard Vs. Soft Inquiries

There are two types of credit inquiries: hard inquiries and soft inquiries.

Hard Inquiries | Soft Inquiries |

|---|---|

| It occurs when you apply for credit | It occurs when you apply for credit. |

Can lower your credit score. | Do not affect your credit score. |

Stay on your report for two years. | Do not stay on your report. |

How Inquiries Affect Credit Scores

Hard inquiries can lower your score by a few points. Multiple hard inquiries in a short period suggest risk to lenders.

Each hard inquiry can lower your score by 5-10 points.

Avoid multiple hard inquiries within a few months.

Soft inquiries do not impact your score. They are not visible to lenders and do not indicate risk.

Checking your credit score is a soft inquiry.

Background checks for employment are soft inquiries.

Identifying Unauthorized Credit Checks

Unauthorized credit checks can harm your credit score. They may appear on your report without your permission. Knowing how to spot these checks is vital. It helps in maintaining a healthy credit profile. Let’s dive into the details.

Signs Of Unwarranted Inquiries

Unauthorized credit checks show up as hard inquiries on your report. These inquiries lower your score by a few points. Look for any company names you don’t recognize. Unfamiliar names can be a red flag. Also, check the dates of the inquiries. Inquiries you did not authorize are suspicious.

Here are some common signs of unwarranted inquiries:

Company names you don’t recognize

Inquiries made on dates you don’t recall

Too many inquiries in a short period

Monitoring Your Credit Reports

Regularly checking your credit reports is essential. You can spot unauthorized checks early. You can get free reports from major credit bureaus. Review these reports at least once a year.

Here is a simple guide to monitor your credit reports:

Request your free credit report from credit bureaus.

Check the section listing credit inquiries.

Identify any unfamiliar or suspicious inquiries.

Report unauthorized inquiries to the credit bureau.

You can use tools to monitor your credit. These tools alert you to new inquiries. They help you act fast against unauthorized checks.

Credit Bureau | Website |

|---|---|

Equifax | |

Experian | |

TransUnion | transunion.com |

Legal Framework Surrounding Credit Inquiries

The legal framework governing credit inquiries is vital for consumers. It ensures fair treatment and transparency. Understanding these laws helps protect your credit score and personal information.

Fair Credit Reporting Act (FCRA) Basics

The Fair Credit Reporting Act (FCRA) is a cornerstone of consumer protection. Enacted in 1970, it regulates the collection, dissemination, and use of consumer information, including credit inquiries.

Key provisions of the FCRA include:

Accuracy: Credit reporting agencies must ensure the information they collect is accurate.

Access: Consumers have the right to access their credit reports at any time.

Privacy: Only authorized entities can access your credit information.

Consumer Rights Under The Fcra

Consumers have specific rights under the FCRA to protect their credit information.

Right | Description |

|---|---|

Right to Access | Consumers can request a free credit report every year from each major credit bureau. |

Right to Dispute | Errors in your credit report can be disputed. The agency must investigate. |

Right to Notification | Consumers must be informed if their credit information is used against them. |

These rights ensure that consumers are treated fairly and can maintain control over their personal credit information.

Preventive Measures For Protecting Credit

Taking preventive measures is essential to protect your credit score. Credit inquiries can affect your credit report. Learn how to safeguard your credit with these strategies.

Opting Out Of Prescreened Offers

Prescreened credit offers can be tempting but risky. Too many can harm your credit score. You can opt out of these offers.

To opt-out, visit the OptOutPrescreen website. You can choose to opt out for five years or permanently.

You will need to provide your personal information. This includes your name, address, Social Security number, and date of birth. Opting out can reduce unwanted credit inquiries.

Setting Up Fraud Alerts

Fraud alerts can protect your credit from identity theft. Setting up a fraud alert is simple.

Contact one of the three major credit bureaus:

Equifax

Experian

TransUnion

A fraud alert lasts for one year. It can be renewed if needed. This alert makes it harder for thieves to open accounts in your name.

The credit bureau will contact the other two bureaus. This ensures the alert is on all your credit reports.

Step | Action |

|---|---|

1 | Contact a credit bureau |

2 | Provide your information |

3 | Request the fraud alert |

Follow these measures to protect your credit. Preventive actions are key to maintaining a healthy credit score.

Disputing Inaccurate Credit Inquiries

Inaccurate credit inquiries can harm your credit score. It’s important to dispute them. Credit bureaus must correct any mistakes. Learn how to effectively dispute these inquiries.

Crafting An Effective Dispute Letter

A well-crafted dispute letter is crucial. Start by including your name, address, and contact information.

Clearly state the error you found. Provide supporting documents like credit reports. Mention the incorrect inquiry and explain why it’s wrong.

Include a copy of your credit report.

Highlight the inaccurate inquiry.

Attach any relevant documents.

Sample Dispute Letter:

Your Name

Your Address

City, State, ZIP Code

Your Phone Number

Date

Credit Bureau Name

Bureau Address

City, State, ZIP Code

To Whom It May Concern,

I am writing to dispute an inaccurate credit inquiry on my report. The inquiry from [Company Name] dated [Date] is incorrect. I have not authorized this inquiry.

Please investigate and remove this inquiry from my credit report. I have attached a copy of my report with the erroneous inquiry highlighted.

Thank you for your prompt attention to this matter.

Sincerely,

Your Name

Following Up With Credit Bureaus

After sending your letter, follow up with the credit bureaus. This ensures they received your dispute. It also shows you are serious.

Wait for a response for about 30 days. If you don’t get a reply, contact them again. You can call or send another letter.

Check your mail regularly.

Keep copies of all correspondence.

Note down dates of communication.

If they don’t correct the error, you can escalate. File a complaint with the Consumer Financial Protection Bureau (CFPB) or contact a lawyer.

Credit: napkinfinance.com

Negotiating With Creditors

Negotiating with creditors is a vital step in challenging credit inquiries. It can lead to significant improvements in your credit report. By negotiating, you might get the inquiry removed or marked as disputed.

When To Contact A Creditor

Contact creditors as soon as you identify an incorrect inquiry. Early action shows your seriousness and urgency. If you notice an inquiry you don’t recognize, reach out immediately. Quick communication can prevent further damage to your credit score.

Keep records of all communications. Document dates, names, and details of each conversation. This helps in tracking progress and serves as evidence if needed.

Negotiation Strategies

Effective negotiation starts with preparation. Understand your credit report and identify errors. Gather evidence to support your claim, such as bank statements or correspondence.

Be polite and respectful during negotiations. Approach the conversation calmly and professionally. State your case clearly and provide supporting documents.

Here are some strategies for negotiating with creditors:

Explain the error: Clearly describe the incorrect inquiry and why it’s wrong.

Provide evidence: Present any documents that support your claim.

Ask for removal: Request the creditor to remove the inquiry from your report.

Follow up: If no response, follow up regularly and keep records of each attempt.

Below is a table summarizing these strategies:

Strategy | Description |

|---|---|

Explain the error | Clearly describe the incorrect inquiry. |

Provide evidence | Present supporting documents. |

Ask for removal | Request deletion of the inquiry. |

Follow up | Regularly check and keep records. |

Credit Repair Services And Their Role

Credit repair services play a crucial role in managing and improving your credit score. They help identify and challenge inaccurate or outdated credit inquiries. Understanding how these services work can be the key to a better financial future.

Choosing A Credit Repair Company

Choosing the right credit repair company is essential for effective results. Look for companies with good reviews and a proven track record. A reputable company will have transparent pricing and no hidden fees.

Consider the following factors when selecting a credit repair company:

Experience: How long has the company been in business?

Reputation: What do past clients say about their services?

Accreditation: Is the company accredited by the Better Business Bureau (BBB)?

Services Offered: Does the company offer a range of credit repair services?

Customer Support: Is their customer service responsive and helpful?

Understanding The Services Offered

Credit repair services can vary widely from one company to another. Here are some common services you might expect:

Service | Description |

|---|---|

Credit Report Analysis | Reviewing your credit report for errors and inaccuracies. |

Dispute Letters | Sending letters to credit bureaus to challenge incorrect information. |

Debt Validation | Requesting creditors to verify the accuracy of the debt. |

Credit Counseling | Providing advice on managing debt and improving credit score. |

Monitoring Services | Regularly checking your credit report for new issues. |

By understanding these services, you can better assess which credit repair company will meet your needs. Always ensure you get a detailed breakdown of services before signing up.

Building And Maintaining Strong Credit

Building and maintaining strong credit is essential. Good credit opens doors to better financial opportunities. It helps secure loans, get better interest rates, and more. Let’s explore ways to keep your credit score high.

Responsible Credit Management

Responsible credit management is key. Always pay your bills on time. Late payments can damage your credit score. Keep your credit card balances low. High balances can hurt your credit utilization ratio.

Check your credit report regularly. Look for any errors or suspicious activities. Dispute any inaccuracies promptly. Be mindful of new credit inquiries. Too many inquiries can lower your score.

Strategies For Long-term Credit Health

Long-term credit health requires a plan. Use a mix of credit types. This includes credit cards, loans, and mortgages. A diverse credit mix can boost your score.

Keep old credit accounts open. The age of your accounts affects your credit history length. Avoid closing old accounts unless necessary.

Strategy | Description |

|---|---|

Pay on Time | Never miss a payment deadline |

Low Balances | Keep credit card balances below 30% of the limit |

Check Credit Report | Review your report for errors regularly |

Diverse Credit | Use different types of credit products |

Old Accounts | Keep older accounts open if possible |

Use these strategies to build and maintain strong credit. A healthy credit score can lead to better financial opportunities.

Navigating The Dispute Resolution Process

Challenging credit inquiries can be daunting. Understanding the dispute resolution process helps. This guide simplifies each step. It ensures a smoother experience for you.

Engaging With Dispute Departments

First, contact the credit bureau’s dispute department. Communicate clearly and concisely. Provide all necessary information upfront.

Identify the inquiry you wish to challenge.

Gather supporting documents.

Prepare a clear explanation of the issue.

Use the bureau’s online dispute form. Alternatively, send a written letter. Make sure to keep copies of all correspondence.

Credit Bureau | Contact Method | Response Time |

|---|---|---|

Experian | Online, Mail | 30 Days |

Equifax | Online, Mail | 30 Days |

TransUnion | Online, Mail | 30 Days |

What To Do If Disputes Are Unresolved

If disputes remain unresolved, don’t panic. You have options. You can escalate your case.

Contact the creditor directly.

File a complaint with the Consumer Financial Protection Bureau (CFPB).

Consider seeking legal advice.

Keep a record of all actions. This ensures you can track progress. Resolving credit disputes takes time. Stay persistent and patient. Your efforts will pay off.

Future Credit Inquiries And Your Score

Credit inquiries can impact your credit score. They occur when lenders check your credit report. Multiple inquiries in a short period can lower your score. It’s essential to manage these inquiries to maintain a healthy credit score.

Minimizing Future Inquiries

To protect your credit score, minimize future inquiries. Here are some practical steps:

Apply for credit only when necessary.

Avoid multiple applications in a short period.

Check your credit report regularly.

Use pre-qualification tools to see if you qualify without a hard inquiry.

How To Apply For Credit Wisely

Applying for credit wisely can help maintain your credit score. Follow these tips:

Research lenders: Look for lenders with favorable terms and conditions.

Understand your needs: Know exactly why you need the credit.

Check eligibility: Ensure you meet the lender’s requirements before applying.

Limit applications: Apply for one credit product at a time.

Use pre-qualification: This helps avoid unnecessary hard inquiries.

Being mindful of credit applications helps maintain a good score. Keep these tips in mind to minimize the impact of future credit inquiries.

What Strategies Can I Use to Protect My Credit Scores from Fraudulent Inquiries?

Protect your finances today by monitoring your credit report regularly. Set up fraud alerts with the major credit bureaus. Consider a credit freeze to prevent unauthorized access. Be cautious when providing personal information online. Keep an eye on your bank and credit card statements for any unauthorized activity.

Frequently Asked Questions

1. How Do I Challenge A Credit Inquiry?

To challenge a credit inquiry, contact the credit bureau. Submit a dispute letter with relevant documents. Include details of the inquiry. Request removal. Monitor your credit report for updates.

2. Is It Worth Disputing A Hard Inquiry?

Yes, disputing a hard inquiry can be worth it if it’s unauthorized. It might improve your credit score. Ensure the inquiry is indeed incorrect before disputing.

3. Is It Illegal To Dispute Hard Inquiries?

Disputing hard inquiries is not illegal. You can challenge unauthorized or inaccurate inquiries on your credit report. Ensure to provide valid reasons and evidence when disputing.

4. How Bad Is 3 Hard Inquiries?

Three hard inquiries may lower your credit score by a few points. Their impact lessens over time. Minimize future inquiries to improve your score.

5. What Are Credit Inquiries?

Credit inquiries are requests to view your credit report. They can impact your credit score.

Conclusion

Challenging credit inquiries can improve your credit score. By addressing inaccuracies, you protect your financial health. Stay proactive and informed. Regularly monitor your credit report for any discrepancies. Take control of your credit journey today. Remember, every small step counts towards better financial stability and opportunities. Consider enrolling in credit card protection services to further safeguard your personal and financial information. These services can provide additional layers of security and offer assistance in the event of identity theft or fraudulent activity. By taking advantage of these resources, you can actively protect your credit and minimize the risk of potential harm to your overall financial well-being. Here are some credit protection tips to keep in mind: always be cautious of sharing your personal and financial information, regularly change your online account passwords, and be mindful of unsolicited requests for your credit card details. Additionally, consider freezing your credit if you suspect unauthorized access or fraudulent activity. These proactive measures can help ensure your credit remains secure and your financial future remains strong.