How to Unfreeze Credit: Quick Steps for Financial Freedom

To unfreeze credit, contact each credit bureau and request a lift of the freeze. Provide necessary identification and PIN.

Unfreezing your credit is crucial when you need to apply for new credit or loans. Credit freezes help protect against identity theft, but they also restrict access to your credit report. This can hinder loan applications, credit card approvals, and other financial processes.

Contacting each of the three major credit bureaus—Equifax, Experian, and TransUnion—is essential to lift the freeze. Prepare to provide identification and a PIN or password set during the freeze. This process can usually be done online, by phone, or via mail. By understanding the steps involved, you can ensure timely access to your credit when needed.

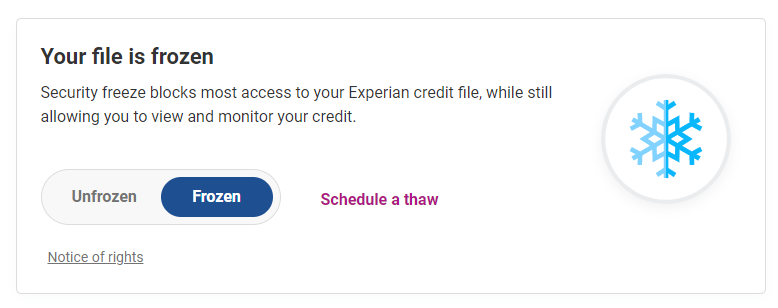

Credit: www.experian.com

Introduction To Credit Freezing

Credit freezing is a way to protect your credit. It stops lenders from accessing your credit reports. This can prevent identity theft. Freezing your credit is easy and free. But, you need to know how to unfreeze it too.

Why People Freeze Their Credit

People freeze their credit for many reasons. Here are some common reasons:

- To stop identity theft

- To prevent unauthorized loans

- To avoid fraud

Identity theft is when someone steals your info. They might use it to open new accounts. This can damage your credit score. A credit freeze helps keep your information safe.

Potential Consequences Of A Frozen Credit

Freezing your credit has some consequences. You need to be aware of these:

| Consequence | Impact |

|---|---|

| Loan Applications | Cannot apply for new loans easily |

| Credit Card Applications | Need to unfreeze credit first |

| Job Applications | Some jobs check credit reports |

To get a loan or credit card, you must unfreeze your credit. Even some job applications require a credit check. You can temporarily lift the freeze if needed.

Identifying The Need To Unfreeze

Knowing when to unfreeze your credit is crucial. There are times when you need access to your credit report. This is important for various financial decisions. Unfreezing credit allows creditors to check your credit history. Let’s explore common scenarios that require unfreezing your credit.

Applying For New Credit

Applying for new credit often requires a credit check. Creditors need to assess your creditworthiness. If your credit is frozen, they can’t access your report. This can delay or halt your application. Unfreeze your credit to ensure a smooth application process.

- Credit cards

- Personal loans

- Car loans

These are common types of credit applications. Make sure to unfreeze your credit before applying for any of these.

Renting An Apartment Or Buying A Home

Renting an apartment or buying a home also requires a credit check. Landlords and lenders need to see your credit history. A frozen credit report can delay your rental or mortgage approval. Ensure your credit is accessible to make these processes easier.

| Scenario | Reason for Credit Check |

|---|---|

| Renting an apartment | Landlord’s verification |

| Buying a home | Mortgage approval |

Unfreezing your credit in these situations is essential. It helps in getting approval without unnecessary delays.

Preparation Before Unfreezing

Unfreezing your credit can be a crucial step for your financial plans. Proper preparation ensures a smooth and quick process. The steps below will guide you through the necessary preparations before unfreezing your credit.

Gathering Necessary Documents

To unfreeze your credit, you need to gather essential documents. These documents verify your identity and protect your information. Here is a list of what you may need:

- Government-issued ID (e.g., driver’s license, passport)

- Social Security number

- Proof of address (e.g., utility bill, bank statement)

Make sure all documents are current and legible. Having them ready will speed up the process.

Keeping Security Information Handy

Your credit bureau will ask for security information. This includes your PIN or password set during the initial freeze. Keep this information handy and secure.

Here is a quick checklist:

- PIN or password from each credit bureau

- Answers to security questions

Without this information, you may face delays. Ensure you have it ready before starting the unfreeze process.

Steps To Unfreeze Credit

Unfreezing your credit is easy if you know the steps. Learn how to unfreeze your credit by contacting the credit bureaus. Find out the best methods: online, by phone, or by mail. Follow these simple steps to regain control of your credit.

Contacting Credit Bureaus

To unfreeze your credit, contact the three main credit bureaus. These are Equifax, Experian, and TransUnion. Each bureau has its process. You must contact all three to unfreeze your credit completely.

Here are their contact details:

| Credit Bureau | Phone Number | Website |

|---|---|---|

| Equifax | 1-800-349-9960 | www.equifax.com |

| Experian | 1-888-397-3742 | www.experian.com |

| TransUnion | 1-888-909-8872 | www.transunion.com |

Online Vs. Phone Vs. Mail Methods

There are three ways to unfreeze your credit: online, by phone, and by mail. Each method has its pros and cons.

- Online: Fast and convenient. You need to log in to each bureau’s website.

- Phone: Quick but might involve wait times. Have your PIN ready.

- Mail: Secure but slower. Send a request with your details and PIN.

Choose the method that suits you best. Online is usually the fastest.

Temporary Vs. Permanent Unfreeze

Unfreezing your credit can be temporary or permanent. Each option has its benefits. Knowing which to choose depends on your needs. Let’s explore these options.

Deciding Which Option Suits Your Needs

A temporary unfreeze is ideal for short-term needs. It allows limited access to your credit report. This is useful if you plan to apply for a loan or credit card soon.

A permanent unfreeze is more flexible. It lifts all restrictions on your credit report. Choose this if you need long-term access or frequent credit checks.

| Option | Best For | Duration |

|---|---|---|

| Temporary Unfreeze | Short-term needs | Specified period |

| Permanent Unfreeze | Long-term needs | Indefinite |

How To Choose The Duration

Choosing the right duration is crucial. For a temporary unfreeze, decide how long you need access. Common periods are 1, 3, or 6 months.

Think about your upcoming financial activities. If you’re applying for a mortgage, a longer duration might be better. For a single credit check, a shorter period works.

Use the following steps:

- Identify your financial activities.

- Estimate how long they will take.

- Select a suitable unfreeze period.

Remember, a permanent unfreeze removes all restrictions. It is better for extended or ongoing financial activities.

What To Do After Unfreezing

Unfreezing your credit is a crucial step. Now, let’s understand what to do next. You need to stay vigilant and take advantage of new opportunities. Here are some essential steps to take after unfreezing your credit.

Monitoring Your Credit Report

It’s important to monitor your credit report regularly. Check for any errors or suspicious activities. You can use free services or paid subscriptions for this task.

- Review your report from all three credit bureaus.

- Look for any unfamiliar accounts or transactions.

- Contact the credit bureau if you find any mistakes.

Regular monitoring helps you spot issues early. It ensures your credit health remains intact.

Taking Advantage Of Credit Opportunities

Now that your credit is unfrozen, you can explore new credit opportunities. This could mean applying for new credit cards or loans.

- Research various credit card offers.

- Compare interest rates and benefits.

- Apply for cards that suit your needs.

Consider options like personal loans or home loans if needed. Make sure to understand the terms and conditions before signing up.

| Credit Opportunity | Benefits |

|---|---|

| Credit Cards | Rewards, cashback, and improved credit score |

| Personal Loans | Consolidate debt, lower interest rates |

| Home Loans | Better interest rates, long-term investment |

Taking advantage of these opportunities can boost your financial health. Be wise and make informed decisions.

Dealing With Challenges

Unfreezing your credit can be challenging. Sometimes, things don’t go as planned. It’s essential to know how to handle these obstacles. Below are some common challenges and their solutions. One common challenge when unfreezing your credit is dealing with long wait times and bureaucracy when contacting the credit bureaus. To overcome this, it’s helpful to stay persistent and follow up regularly. Another challenge can arise when freezing your child’s credit, as the process can be more complex and may require additional documentation. In these cases, it’s important to gather all necessary information and be prepared for potential delays.

If Your Unfreeze Request Is Denied

Sometimes, credit bureaus may deny your unfreeze request. This can be stressful. Here’s what you can do:

- Double-check your information: Ensure all details are correct.

- Contact the credit bureau: Ask why your request was denied.

- Provide additional documents: They might need more proof of identity.

If your request is still denied, consider seeking legal advice. Sometimes, errors can cause denials. Make sure all your information is accurate.

Troubleshooting Common Issues

Encountering issues is normal. Here are some common problems and their solutions:

| Issue | Solution |

|---|---|

| Incorrect PIN | Request a new PIN from the credit bureau. |

| Document mismatch | Ensure documents match your current details. |

| Website errors | Try again or use a different browser. |

For continued issues, contact the credit bureau directly. They can provide more specific guidance.

Maintaining Financial Freedom

Unfreezing your credit is an important step toward maintaining financial freedom. It allows you to access loans, credit cards, and other financial services. After unfreezing, it’s vital to practice good credit habits to keep your financial life healthy. Understanding new credit legislation is also crucial to ensure that you are aware of any changes that may impact your financial freedom. Keeping up-to-date with the latest laws and regulations can help you make informed decisions about your credit management. By staying informed and responsible, you can continue to enjoy the benefits of financial freedom while minimizing the risks associated with credit.

Practices For Healthy Credit

To ensure your credit remains strong, follow these practices:

- Pay Bills on Time: Late payments can hurt your credit score.

- Keep Balances Low: High balances can negatively impact your credit.

- Avoid New Debt: Opening many new accounts quickly can lower your score.

- Check Credit Reports: Regularly review your credit reports for errors.

Monitoring your credit is crucial. It helps you spot any suspicious activities early. Use free services to receive alerts on any changes. This proactive approach ensures you stay on top of your credit health.

When To Consider Refreezing

Sometimes, refreezing your credit might be necessary. Consider these situations:

| Situation | Reason to Refreeze |

|---|---|

| Suspicious Activity | To prevent identity theft and fraud. |

| No Immediate Credit Needs | To protect your credit from unauthorized access. |

| Major Life Changes | To safeguard your credit during transitions. |

Refreezing your credit adds an extra layer of protection. It ensures that only you can access your credit. This is especially important after major life events or if you suspect fraudulent activity.

Frequently Asked Questions

1. How Can I Quickly Unfreeze My Credit?

To unfreeze your credit quickly, contact each credit bureau online or by phone. Provide your PIN or password.

2. How Long Does It Take To Undo A Credit Freeze?

It usually takes about one hour to lift a credit freeze online. By phone, it may take up to three business days.

3. What Number Do I Call To Unfreeze My Credit?

Call the credit bureaus to unfreeze your credit. Experian: 1-888-397-3742, Equifax: 1-800-349-9960, TransUnion: 1-888-909-8872.

4. How Do I Call Experian To Unfreeze My Credit?

Call Experian at 1-888-397-3742 to unfreeze your credit. Follow the automated instructions to proceed.

5. What Is Credit Freeze?

A credit freeze restricts access to your credit report.

Conclusion

Unfreezing your credit is a straightforward process that ensures your financial security. Follow the steps outlined in this guide. Always keep your PIN or password secure. Regularly monitor your credit reports for any suspicious activity. By staying vigilant, you can protect your financial health effectively.