Experian Freeze: Safeguard Your Credit in Simple Steps

To freeze your Experian credit report, visit their website or call their customer service. This will prevent unauthorized access to your credit information.

Freezing your Experian credit report is a crucial step to protect against identity theft and fraud. It restricts access to your credit information, making it difficult for identity thieves to open new accounts in your name. This security measure is essential if you suspect your personal information has been compromised.

The process is straightforward and can be done online or via phone. By freezing your credit report, you take control over who can access your financial data. This proactive step ensures that your credit remains intact and your financial future is secure. Always monitor your credit reports regularly for any unusual activity.

Credit: www.experian.com

The Perils Of Identity Theft

Identity theft is a rising concern in today’s digital age. It affects millions of people each year. The consequences can be devastating. From drained bank accounts to ruined credit scores, the impact is vast. Knowing the risks and how to protect yourself is crucial.

Rising Incidence Of Credit Fraud

Credit fraud is increasing at an alarming rate. Thieves use stolen information to open new accounts. They can also make unauthorized purchases. This can leave victims in financial ruin. Reports show that millions fall prey to these schemes annually.

Year | Reported Cases |

|---|---|

2018 | 3 million |

2019 | 4 million |

2020 | 5.7 million |

These numbers highlight the growing threat. Understanding the signs of identity theft is vital. Regularly check your credit reports for any unusual activity. Using services like Experian can help monitor your credit status.

Personal Stories Of Credit Sabotage

Many people have faced credit sabotage. Jane Doe, a victim, had her identity stolen. The thief opened multiple credit card accounts. Jane spent months fixing the damage. Her credit score dropped significantly. This impacted her ability to get loans.

Another victim, John Smith, experienced similar issues. John’s social security number was used. Fraudsters took out loans in his name. It took years for John to clear his name. His experience highlights the importance of vigilance.

Regularly check your credit reports.

Use credit monitoring services.

Be cautious with your personal information.

These personal stories emphasize the need for protection. Experian offers tools to help safeguard your identity. Take proactive steps to secure your financial future.

Credit: www.experian.com

Experian’s Role In Credit Protection

Experian plays a key role in protecting your credit. They provide vital services to ensure your financial security. This includes credit reporting and advanced security measures.

Credit Reporting And Security

Experian offers comprehensive credit reporting. They collect data from various sources to create a detailed report. This report helps lenders assess your creditworthiness.

Security is also a top priority for Experian. They use advanced technologies to keep your data safe. This includes encryption and regular security audits.

Services Provided By Experian

Experian provides a wide range of services for credit protection. Here are some of the key services:

Credit Monitoring: Alerts you to changes in your credit report.

Identity Theft Protection: Helps safeguard your identity against fraud.

Credit Freeze: Prevents new credit accounts from being opened in your name.

Fraud Resolution: Assists you in resolving any fraudulent activities.

Here’s a quick summary of these services in a table format:

Service | Description |

|---|---|

Credit Monitoring | Alerts to changes in your credit report. |

Identity Theft Protection | Safeguards your identity against fraud. |

Credit Freeze | Prevents new accounts in your name. |

Fraud Resolution | Helps resolve fraudulent activities. |

What Is A Credit Freeze?

A credit freeze is a tool to protect your credit. It restricts access to your credit report. New creditors can’t view your report, stopping new accounts.

It does not affect your current credit. You can still use your credit cards. Freezing your credit is free and easy to do.

Benefits Of Freezing Your Credit

Protects Against Identity Theft: Prevents fraudsters from opening new accounts.

No Impact on Current Credit: Your current accounts remain unaffected.

Free Service: No cost to freeze or unfreeze your credit.

Easy to Manage: You can unfreeze your credit anytime.

Differences Between A Lock And A Freeze

Feature | Credit Lock | Credit Freeze |

|---|---|---|

Cost | May have a fee | Always free |

Legal Protection | Limited protection | Full legal protection |

Ease of Use | Instant access via app | Requires PIN or password |

Step-by-step Guide To Freezing Your Experian Credit

Freezing your Experian credit is a smart way to protect against identity theft. By freezing your credit, you prevent unauthorized access to your credit report. This guide will take you through the process step-by-step.

Initiating The Freeze Online

To initiate the freeze online, visit the Experian website. Follow these steps:

Go to the Experian Freeze Center.

Click on the “Add a security freeze” button.

Create an account or log in if you already have one.

Provide your personal information: name, address, Social Security number, and date of birth.

Verify your identity through security questions or documents.

Set a PIN or password for your freeze. Keep this secure for future use.

Submit your request and confirm the freeze.

Freezing Your Credit By Phone Or Mail

If you prefer to freeze your credit by phone or mail, follow these instructions:

By Phone:

Call Experian at 1-888-397-3742.

Listen to the prompts and select the option for freezing your credit.

Provide your personal information and answer security questions.

Set a PIN or password for your freeze. Keep this secure.

Confirm your request to freeze your credit.

By Mail:

Write a request to freeze your credit.

Include your personal information: full name, address, Social Security number, and date of birth.

Provide copies of documents to verify your identity: driver’s license, utility bill, etc.

Specify a PIN or password for your freeze.

Mail your request to:

Experian |

P.O. Box 9554 |

Allen, TX 75013 |

Following these steps ensures your credit is secure from unauthorized access. Whether you choose to freeze your credit online, by phone, or by mail, you protect your financial future.

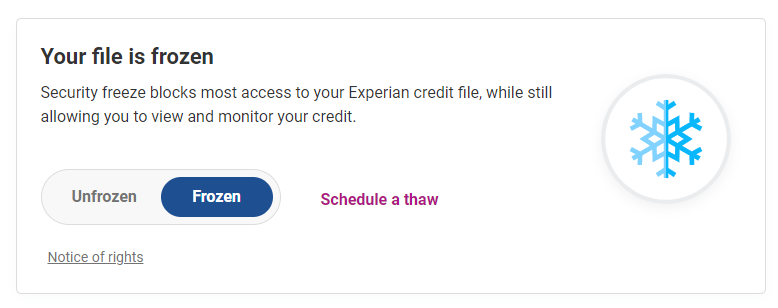

Managing Your Experian Freeze

Keeping your credit safe is important. An Experian freeze helps protect against identity theft. It blocks access to your credit report. But sometimes, you need to let others see your credit. Here’s how to manage your freeze.

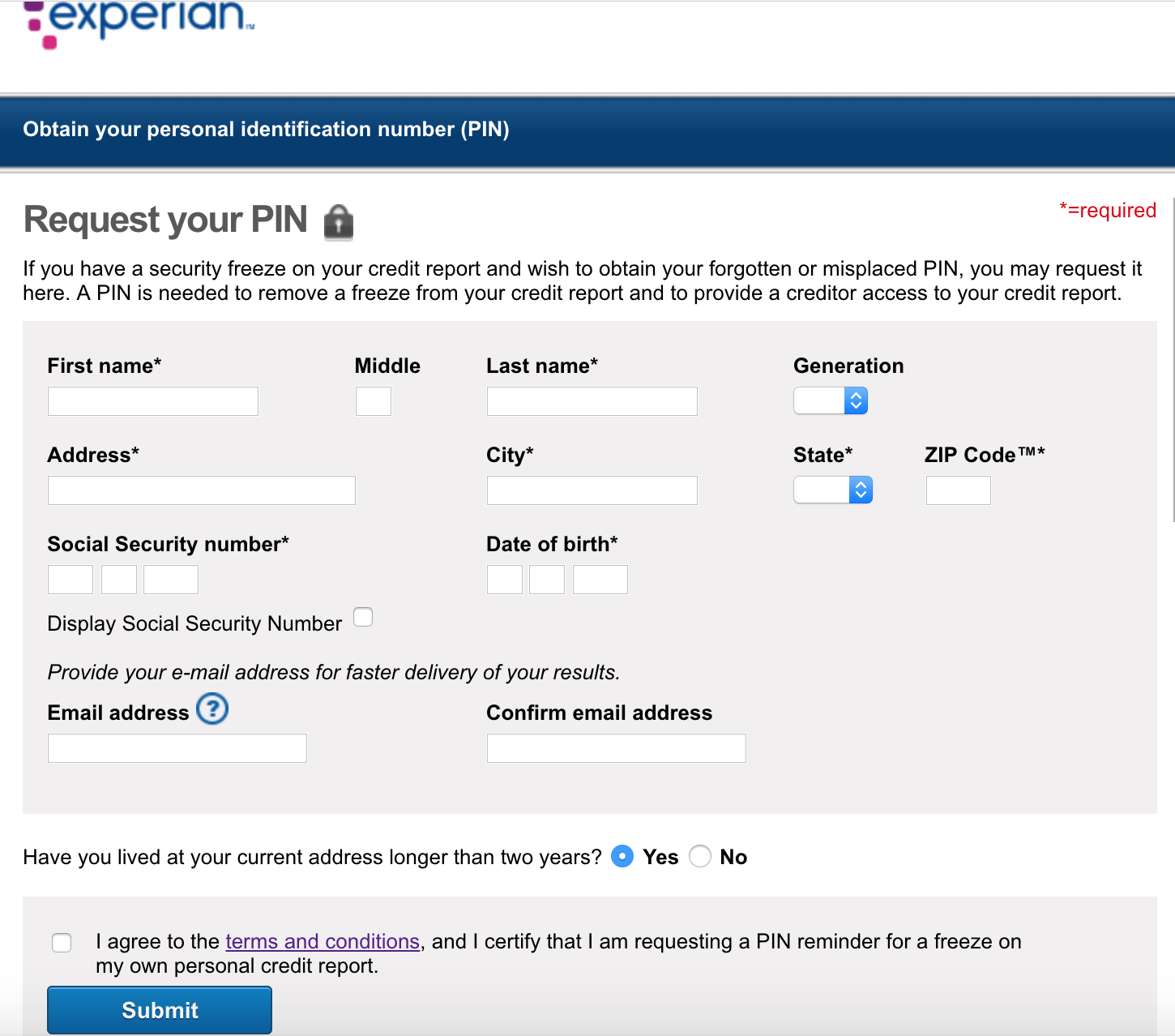

How To Temporarily Lift A Freeze

You can temporarily lift your Experian freeze. This is useful if you need to apply for a loan or a job. Follow these steps:

Visit the Experian Freeze Center.

Log in to your account using your PIN or password.

Select the option to temporarily lift the freeze.

Choose the dates you want the freeze to be lifted.

Confirm your request.

Your credit report will be accessible during the chosen dates. Afterward, the freeze will be active again.

Permanently Removing The Freeze

Sometimes, you may want to permanently remove the freeze. This makes your credit report always available. Here’s how to do it:

Go to the Experian Freeze Center.

Sign in with your PIN or password.

Select the option to remove the freeze permanently.

Follow the on-screen instructions to confirm.

Once done, your credit report will be open for access anytime. This is useful if you are planning to apply for several loans or credit cards.

Credit: krebsonsecurity.com

The Impact Of A Credit Freeze On Your Life

A credit freeze is a tool to protect against identity theft. It restricts access to your credit report. This can affect your financial activities.

Credit Access During A Freeze

During a credit freeze, lenders cannot access your credit report. This means you can’t open new lines of credit easily. Existing creditors can still access your report. This allows them to manage your accounts. Employers and landlords can also see your report. They might need it for background checks.

You can lift a freeze temporarily. This is useful for a credit check. You need a PIN or password for this action. The freeze can be lifted permanently if needed.

Myths About Credit Freezes Debunked

Many believe credit freezes damage credit scores. This is not true. A freeze does not affect your score at all. It only restricts access to your report.

Another myth is that a credit freeze is hard to reverse. Actually, it’s simple. You can lift a freeze online or by phone. You just need your PIN or password.

Some think a freeze stops all credit activities. This is false. Current creditors still have access. They can manage existing accounts. Employers and landlords can also view your report if needed.

Myth | Truth |

|---|---|

Damages credit scores | Does not affect scores |

Hard to reverse | Easy to lift |

Stops all credit activities | Current creditors still access |

Understanding these facts can help you make informed decisions. A credit freeze is a powerful tool. Use it wisely to protect your financial health.

Navigating Challenges With A Credit Freeze

A credit freeze can protect your credit. It stops fraudsters from opening new accounts in your name. But it can also bring challenges. Let’s explore how to navigate these challenges.

Troubleshooting Common Issues

Sometimes, you might face issues with your credit freeze. Here are some common problems and solutions:

Forgot PIN: Contact Experian to reset your PIN.

Access Denied: Ensure you’ve used the correct information.

Unfreeze Problems: Verify your identity again.

Keep your PIN and personal information safe. This reduces issues.

Customer Support For Freeze-related Concerns

Experian offers customer support for freeze-related concerns. Here’s how you can reach them:

Method | Details |

|---|---|

Phone | Call 1-888-EXPERIAN (1-888-397-3742) |

Use the contact form on their website | |

Send letters to Experian, P.O. Box 9554, Allen, TX 75013 |

Contact support if you face any issues. They can help resolve problems quickly.

Beyond Freezing: Additional Ways To Protect Your Credit

Freezing your credit is an effective way to prevent fraud. But it’s not the only step you can take to protect your financial health. Here are some additional measures to keep your credit safe.

Regular Credit Monitoring

Regular credit monitoring helps you keep an eye on your credit reports. It alerts you to any suspicious activities or changes. This allows you to address issues before they become serious problems.

Benefits | Details |

|---|---|

Early Detection | Catch errors and fraud early. |

Real-Time Alerts | Receive notifications of unusual activity. |

Peace of Mind | Know your credit is being watched. |

Many services offer credit monitoring. Some are free, while others charge a fee. Choose one that fits your needs and budget.

Identity Theft Protection Services

Identity theft protection services offer more than just credit monitoring. They include tools that help you protect your personal information. These services can also aid in recovering your identity if stolen.

Fraud Alerts: Warn you of potential scams.

Dark Web Monitoring: Scans for your information on dangerous sites.

Recovery Assistance: Guides you through restoring your identity.

Investing in identity theft protection can save you time and stress. These services provide a comprehensive approach to safeguarding your identity and credit.

Frequently Asked Questions

1. How Do I Unfreeze My Account With Experian?

Log in to your Experian account. Go to the “Security Freeze” section. Select “Remove or Lift Freeze. ” Follow the instructions provided.

2. How Do I Contact Experian About A Freeze?

Contact Experian by calling 1-888-397-3742. Visit their website for more options. You can also mail them at Experian, P. O. Box 9554, Allen, TX 75013.

3. Can I Freeze All Three Credit Bureaus At Once?

Yes, you can freeze all three credit bureaus at once. Contact Equifax, Experian, and TransUnion separately. Each bureau requires a request to freeze your credit. This helps protect against identity theft.

4. How Do I Speak To A Live Person At Experian?

Call Experian customer service at 1-888-397-3742. Follow the prompts to reach a live representative.

5. What Is An Experian Freeze?

An Experian Freeze restricts access to your credit report, preventing identity theft and unauthorized credit applications.

Conclusion

Freezing your Experian credit report offers essential protection against identity theft. It’s simple, effective, and grants peace of mind. Take control of your financial security today. A credit freeze can safeguard your personal information, providing a strong defense against potential fraud.

Ensure your financial health by utilizing this powerful tool.