609 Letter Template Free: Unlock Your Credit Potential!

The 609 Letter Template is a powerful tool for disputing inaccuracies on your credit report. It leverages Section 609 of the Fair Credit Reporting Act.

The 609 Letter Template provides a structured format for consumers to request verification of information on their credit reports. This letter is used to challenge and potentially remove incorrect, outdated, or unverifiable items from credit reports. By citing Section 609 of the Fair Credit Reporting Act, consumers can demand that credit bureaus provide evidence of the account’s accuracy or remove it if they cannot.

This approach can significantly impact one’s credit score positively. Crafting a precise and well-documented 609 letter is crucial to ensure it meets legal standards and effectively addresses the inaccuracies in your credit report.

The Power Of A 609 Letter

Many people struggle with credit report errors. These errors can hurt your credit score. A 609 letter is a powerful tool. It helps you fix these mistakes. You can improve your credit score quickly. Let’s dive into what a 609 letter is and its legal basis.

What Is A 609 Letter?

A 609 letter is a formal request. You send it to credit bureaus. The letter asks for proof of information on your credit report. If the bureau can’t verify the information, they must remove it. This can help clean up your credit report.

People often use 609 letters to dispute errors. These errors can be late payments, wrong balances, or incorrect accounts. Using a 609 letter template can save you time. It ensures you include all necessary details.

The Legal Basis

The 609 letter gets its name from Section 609 of the Fair Credit Reporting Act (FCRA). The FCRA is a federal law. It gives you the right to request information from credit bureaus. Credit bureaus must provide this information within 30 days.

If they fail to verify the information, they must delete it. This law protects consumers. It ensures credit reports are accurate. Using a 609 letter leverages this legal right to your advantage.

Key Points of FCRA Section 609:

- You can request all information in your credit file.

- Bureaus must verify the accuracy of the data.

- If unverifiable, the information must be removed.

Understanding the power of a 609 letter is crucial. It helps maintain a clean and accurate credit report. This, in turn, boosts your credit score and financial health.

Credit: templatelab.com

Crafting Your 609 Letter

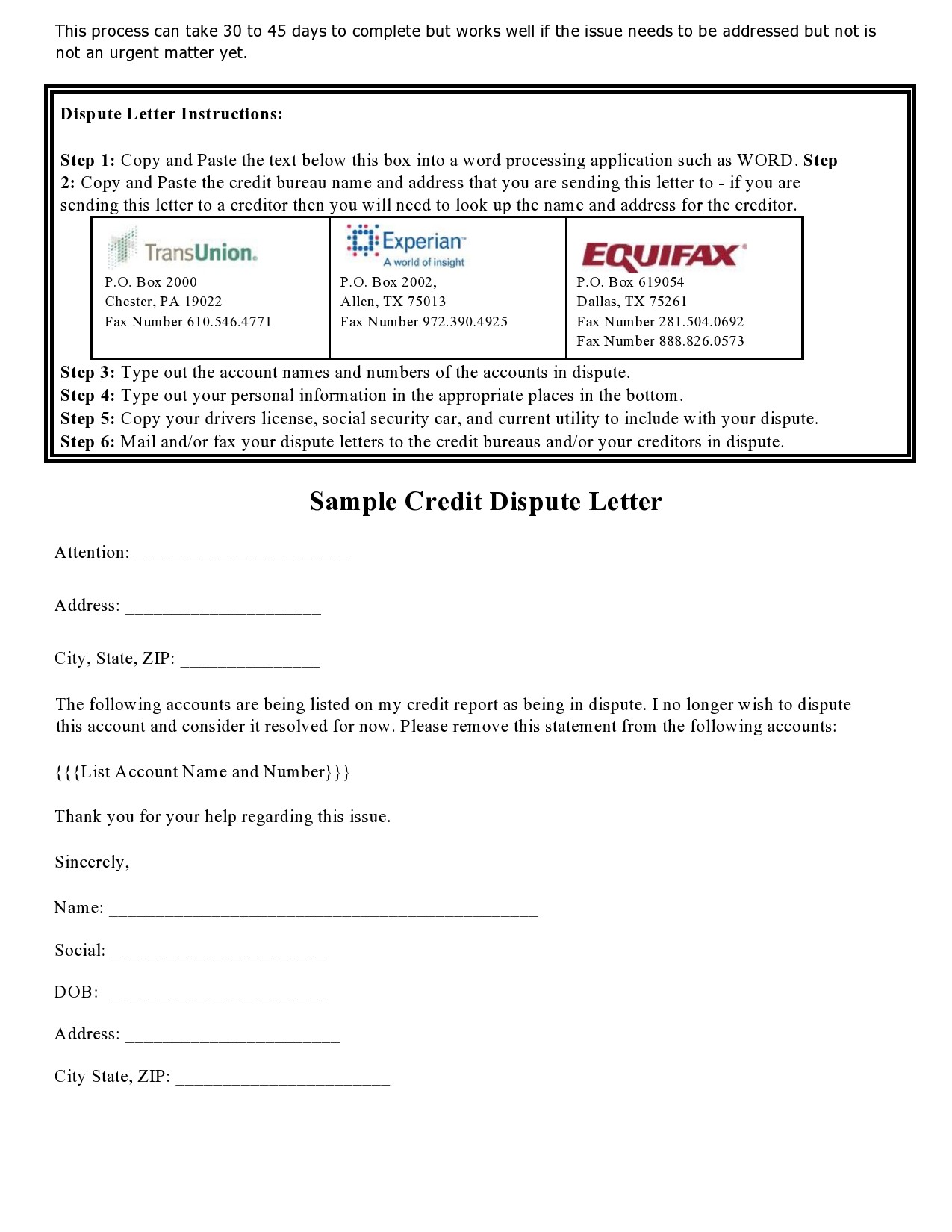

Creating a 609 letter can help you clean up your credit report. This letter demands the removal of inaccurate or unverified information. Let’s explore how to craft an effective 609 letter.

Essential Elements

Your 609 letter must include key details. These elements ensure your request is clear and valid.

| Element | Description |

|---|---|

| Personal Information | Your full name, address, and Social Security number. |

| Credit Report Details | The name of the credit bureau and the report number. |

| Disputed Items | A list of items you want to be removed or verified. |

| Proof of Identity | A copy of your ID and a utility bill. |

Personalizing Your Letter

Make your 609 letter unique and personal. This helps in showing authenticity.

- Use your own words. Avoid templates that may look generic.

- Explain your situation briefly. Provide context for your dispute.

- Include specific details. Reference dates, amounts, and creditor names.

Adding a personal touch can make your letter more effective. Show your commitment to resolving the issue.

Free 609 Letter Templates: A Gateway

Using free 609-letter templates can be a game-changer. These templates help dispute errors on your credit report. They are a powerful tool for improving your credit score. Before using these templates, it’s important to understand the process and the specific laws that protect consumers. One important document that can be used in this process is the section 604 dispute letter. This letter is used to dispute any inaccuracies in your credit report and can help to improve your overall credit standing. By utilizing these templates and understanding the section 604 dispute letter, individuals can take control of their credit and work towards a better financial future. If individuals encounter any difficulties or have questions about using the templates or the section 604 dispute letter, they can reach out to hasslefree customer support for assistance. This additional support can make the credit dispute process smoother and more manageable. With the right resources and guidance, consumers can confidently take steps towards resolving any credit report errors and improving their financial well-being.

Finding Reliable Sources

It’s crucial to find reliable sources for free 609 letter templates. Not all templates available online are accurate. Ensure the source is trustworthy and has good reviews.

- Check reputable financial websites.

- Look for user testimonials.

- Verify the template’s compliance with credit bureau guidelines.

Using a reliable source ensures your letter meets the necessary standards. This increases the chances of a successful dispute.

Template Vs. Customization

Using a template saves time. But customization makes your letter more effective. Let’s compare both options:

| Template | Customization |

|---|---|

| Quick and easy to use | Tailored to your specific situation |

| Provides a basic structure | Includes personal details and evidence |

| May lack specific details | Addresses unique issues directly |

Combining both methods can be powerful. Start with a free 609-letter template. Then, customize it with your details.

Credit: 609-letter-template.pdffiller.com

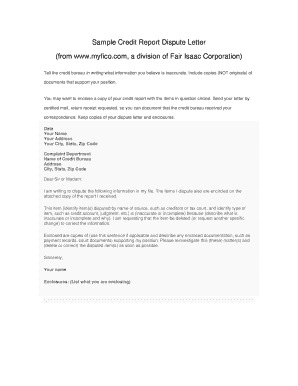

Step-by-step Guide To Using The 609 Letter

The 609 Letter is a powerful tool for credit repair. This guide will help you use it effectively to dispute errors on your credit report.

Preparing Your Documentation

Before you send your 609 Letter, gather all necessary documents. These documents support your dispute and help verify your identity.

- Credit Reports: Get copies from all three bureaus: Experian, TransUnion, and Equifax.

- Proof of Identity: Include a copy of your driver’s license or passport.

- Proof of Address: Attach a recent utility bill or bank statement.

- Social Security Number: Provide a copy of your Social Security card.

Organize these documents in a neat folder. Ensure all copies are clear and readable.

Sending Your Letter

Now, it’s time to send your 609 Letter. Follow these steps to ensure it reaches the right place.

- Write the Letter: Use a clear and concise template. State your dispute and include all relevant information.

- Attach Documentation: Include all prepared documents. These support your claims.

- Address the Envelope: Send it to the correct credit bureau. Use certified mail for tracking.

Here are the addresses for the three main credit bureaus:

| Credit Bureau | Address |

|---|---|

| Experian | P.O. Box 4500, Allen, TX 75013 |

| TransUnion | P.O. Box 2000, Chester, PA 19016 |

| Equifax | P.O. Box 740256, Atlanta, GA 30374 |

Track your letter to ensure it is delivered. Keep a copy of everything you send for your records.

Common Pitfalls And How To Avoid Them

Creating a 609-letter template can be a powerful tool for credit repair. But, there are common pitfalls that can diminish its effectiveness. Knowing these pitfalls and how to avoid them ensures your letter achieves its purpose.

Mistakes In The Letter

Many people make errors while drafting the letter. These mistakes can weaken your case. Here are the common mistakes and how to avoid them:

- Incorrect Information: Ensure all personal and account details are accurate. Double-check your name, address, and account numbers.

- Generic Language: Personalize the letter. Use specific details about your dispute. Avoid using a template verbatim.

- Incomplete Documentation: Attach all necessary documents. Include copies of your ID, and the disputed credit report.

Follow-up Mistakes

Follow-up is crucial after sending your 609 letter. Missing this step can lead to delays or no action at all. Here are common follow-up mistakes:

- Not Tracking Delivery: Use certified mail. Get a return receipt to confirm delivery.

- Ignoring Timelines: Credit bureaus have 30 days to respond. Mark your calendar and follow up if needed.

- Not Keeping Records: Maintain copies of all correspondence. Keep a log of dates and responses.

Avoiding these pitfalls increases the chance of success with your 609 letter. Be diligent, detailed, and proactive.

Credit: www.pinterest.com

Success Stories: The 609 Letter In Action

The 609 Letter is a powerful tool for credit repair. Many people have used it to transform their financial lives. Here are some success stories to inspire you. These real-life examples show the effectiveness of the 609 Letter.

Real-life Impact

Many have shared their experiences with the 609 Letter. Let’s look at some of their stories:

| Name | Before | After |

|---|---|---|

| Jane Doe | Credit score: 550 | Credit score: 720 |

| John Smith | 3 Negative Items | All Negative Items Removed |

| Alice Johnson | Denied Loan | Approved Loan |

Jane Doe started with a credit score of 550. After using the 609 Letter, her score jumped to 720. John Smith had three negative items on his report. He sent the 609 Letter and got them all removed. Alice Johnson was denied a loan. She used the 609 Letter and later got approved.

What You Can Learn

These success stories teach us valuable lessons:

- Persistence pays off.

- Accuracy in your letter is crucial.

- Follow-up is key.

Persistence is important. Jane did not give up after one letter. Accuracy matters. John’s letters were detailed and precise. Follow-up is vital. Alice sent multiple letters and got results.

Using these tips can help you succeed with your 609 Letter. Be persistent, accurate, and consistent in your efforts.

Dealing With Responses From Credit Bureaus

Once you send a 609 letter to a credit bureau, you will receive a response. Understanding and analyzing these responses is crucial. This helps you take appropriate action and improve your credit score.

Analyzing The Response

Credit bureaus might send various types of responses. Common responses include:

- Validation of the debt

- Request for more information

- Notification of account removal

Validation of the debt means the bureau found evidence supporting the debt. You should review this evidence carefully. Look for errors or inconsistencies.

Request for more information indicates the bureau needs additional details to process your request. Provide the necessary information quickly to avoid delays.

Notification of account removal is the best outcome. It means the bureau removed the disputed account from your report. This helps improve your credit score.

Next Steps After A Response

Depending on the response, you need to take different actions. Here are the steps for each scenario:

| Response Type | Action Required |

|---|---|

| Validation of the debt | Review evidence, identify errors, and dispute if necessary |

| Request for more information | Gather and submit the requested information |

| Notification of account removal | Monitor your credit report for updates |

If the debt is validated, use these steps to dispute:

- Identify errors in the validation documents.

- Gather supporting documents to counter the validation.

- Send a follow-up 609 letter with the new evidence.

If the bureau requests more information, ensure you:

- Collect all necessary documents.

- Send them promptly.

After receiving a notification of account removal, keep an eye on your credit report. Ensure the account does not reappear.

Beyond The 609 Letter: Maintaining Your Credit Health

The 609 letter is a great tool for fixing credit errors. But, maintaining good credit requires more than just one letter. Let’s explore how to keep your credit healthy long-term.

Ongoing Credit Monitoring

Regularly check your credit report to spot errors. Use free services to monitor changes. Consider paid services for more detailed reports. These services can alert you to suspicious activities.

- Check reports from all three bureaus.

- Look for incorrect accounts or late payments.

- Dispute errors right away.

Regular monitoring helps you catch problems early. This way, you can act before they hurt your score.

Building Credit Post-609

After fixing errors with a 609 letter, focus on building strong credit. Start by making all payments on time. Payment history is the biggest factor in your credit score.

- Pay all bills by their due date.

- Keep credit card balances low.

- Avoid opening too many new accounts.

- Use different types of credit.

Keep old accounts open as they show a long credit history. Long credit history can boost your score. Diversify your credit by using credit cards and loans responsibly.

| Action | Impact |

|---|---|

| Pay on time | Positive |

| Keep balances low | Positive |

| Open new accounts sparingly | Positive |

| Use different credit types | Positive |

These steps help you build a strong credit history. This helps you get better interest rates and loan approvals.

Frequently Asked Questions

1. How Do I Write A Section 609 Letter?

Write a section 609 letter by including your personal information, a request for investigation, disputed items, and supporting documentation. Address the letter to the credit bureaus. Be concise and clear. Sign and date the letter before sending it.

2. Do 609 Letters Still Work?

Yes, 609 letters can still work. They request credit bureaus to verify and validate information on your credit report.

3. Does the 609 Letter Have To Be Notarized?

No, a 609 letter does not have to be notarized. Notarization is optional but can add credibility.

4. How To Write A Letter To Remove Negative Credit?

To write a letter to remove negative credit, state your case clearly. Include your personal information, account details, and evidence. Request the removal of the negative item. Be polite and concise.

5. What Is A 609 Letter?

A 609 letter disputes errors on your credit report using the Fair Credit Reporting Act (FCRA).

Conclusion

A 609 letter can greatly impact your credit repair journey. Use the free template to take control. Customize it to fit your needs. Boost your credit score efficiently and confidently. Start improving your financial health today. Empower yourself with this valuable tool and see positive results.